Smartphone growth returns after Covid blipSmartphone growth returns after Covid blip

Global smartphone shipments are set to increase by 7.4% this year, marking a return to growth after the Covid-19 pandemic hit the industry in 2020, according to new analyst figures.

August 31, 2021

Global smartphone shipments are set to increase by 7.4% this year, marking a return to growth after the Covid-19 pandemic hit the industry in 2020, according to new analyst figures.

And interestingly, consumers are showing an increased willingness to part with big bucks for new phones.

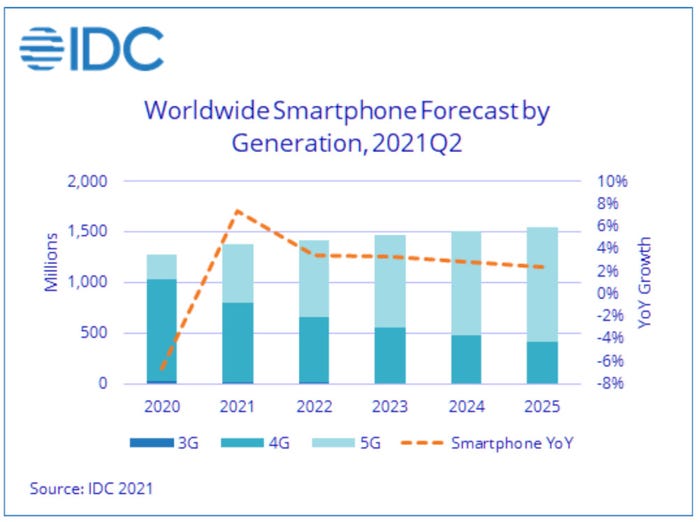

IDC puts smartphone shipments worldwide at 1.37 billion units in 2021, which represents “minimal growth” compared with pre-pandemic 2019. Its data for 2019 shows shipments of 1.372 billion, then a 5.9% decline to 1.29 billion the following year. Making comparisons with 2019 gives a more accurate picture of the state of the market.

This year’s growth will be driven by emerging and high-growth markets though, with the likes of India, Japan, the Middle East, and Africa fuelling the recovery, the analyst firm said. The big global markets of China, the US and Western Europe will still record smartphone shipment declines compared with 2019.

“The smartphone market was better prepared from a supply chain perspective heading into 2020 given almost all regions were expecting to grow and vendors were preparing accordingly,” said Ryan Reith, group vice president with IDC’s Mobility and Consumer Device Trackers. “2020 was a bust due to the pandemic but all of the top brands continued forward with their production plans with the main difference that the timeline was pushed out. Therefore, we are at a point where inventory levels are much healthier than PCs and some other adjacent markets and we are seeing the resilience of consumer demand in recent quarterly results,” Reith said.

And that consumer demand is evident in the growing interest in high-end – and high-cost – devices, despite the fact that the world is still grappling with the new variants of Covid-19 and the economic and human cost of the pandemic. Consumers are still keen to upgrade their handsets.

“Premium smartphones (priced at $1000+) continued to grow in the second quarter as the segment displayed 116% growth from last year,” noted Anthony Scarsella, research director, Mobile Phones at IDC. “Moreover, ASPs across the entire market climbed 9% as buyer preferences trend towards more costly 5G models than entry-level devices.”

The average selling price of a 5G smartphone will come in at $634 in 2021, an increase of just $2 on last year, but significantly higher than the $206 ASP commanded by 4G devices.

Those more costly 5G models will continue to be a big growth driver in the second half of this year, resulting in full-year 5G phone shipments of 570 million, up by 123.4% on last year. By the end of 2022, 5G phones will make up 54% of smartphone unit shipments.

Things are looking rosy for Apple, with iOS devices set to record 13.8% shipment growth this year compared with 6.2% for Android models. As such, you would expect Apple to improve on the 15.9% market share it clocked up last year on the back of 206 million iPhone shipments.

Growth patterns for the market as a whole are fairly staid after 2021, with IDC predicting global shipment growth of 3.4% in both 2022 and 2023 (see chart). The firm did not specifically refer to the ongoing semiconductor shortage, but it’s safe to say that will play its part going forward too.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)