Smartphone market plunges to lowest Q3 shipment level since 2014Smartphone market plunges to lowest Q3 shipment level since 2014

Analyst estimates agree that the global smartphone market is at a historical low as macroeconomic headwinds hit consumer sentiment.

October 28, 2022

Analyst estimates agree that the global smartphone market is at a historical low as macroeconomic headwinds hit consumer sentiment.

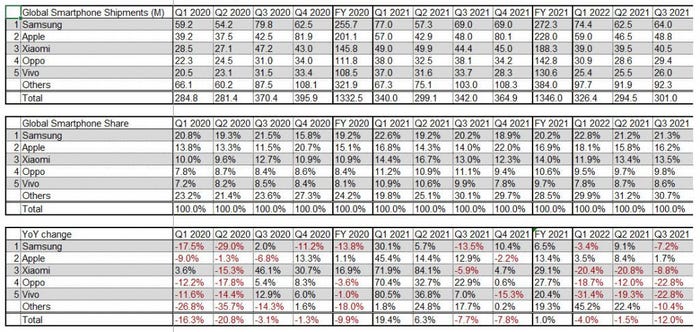

Most analyst firms tend to wait until Apple and Samsung issue their quarterly numbers before publishing their smartphone shipment estimates. We usually use numbers from Counterpoint in our table, but plenty of others also offer plausible data and it’s probably best to factor them all in to get the most accurate snapshot.

One thing they all seem to be agreed on is that the global smartphone market is at a historical low. It has been flat for several years now, meaning any macroeconomic shocks have tended to push it into the red. That was the case when the Covid pandemic happened in 2020 and, after a year of moderate recovery, the global inflation that is a direct result of the money printing required to compensate people for the widespread lockdowns is hitting discretionary spending hard.

“Most major vendors continued experiencing annual shipment declines in the third quarter of 2022,” said Harmeet Singh Walia of Counterpoint. “Russia’s escalating war in Ukraine, ongoing China-US political distrust and tensions, growing inflationary pressures across regions, a growing fear of recession, and weakening national currencies all caused a further dent in consumer sentiment, hitting already weakened demand.

“This is also adding to a slow but sustained lengthening of smartphone replacement cycles with smartphones becoming more durable and as technology advancement slows. This is accompanying, and to a smaller degree advancing, a fall in the shipments of mid- and lower-end smartphones, even as the premium segment weathers the economic storm better. Consequently, and thanks to an earlier launch of the latest iPhone series this year, Apple emerged as the only top-five smartphone vendor to manage annual shipment growth in the quarter.”

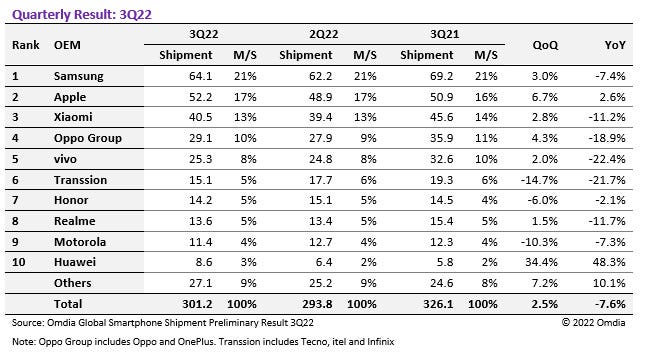

As you can see from the table below, Apple shipments barely grew, while those vendors most reliant on the Chinese market seem to be having a nightmare, presumably due to its continued ‘zero Covid’ policy, at least in part. This quarter’s 12% decline comes after a weak year-ago quarter, resulting in the broader historical low. “Looking further ahead into 2023, we expect sluggish demand with lengthening replacement rates, especially in the first half of the year,” said Jan Stryjak of Counterpoint.

Omdia now publishes a relatively comprehensive set of quarterly smartphone numbers too. It reckons the market declined by 7.6% but otherwise has fairly similar numbers to Counterpoint. Ten days ago Canalys had an early guess that seems to have been fairly on the money, opining a 9% decline that also marked the lowest Q3 level since 2014, so there’s a fair bit of consensus among the analysts.

“The biggest contributing factors to this continued slump is a decline in the Chinese domestic smartphone market, pandemic-related lockdown of major Chinese cities, the Russia-Ukraine war, political conflict in India and the subsequent economic downturn, and increasingly intense competition with Honor and Huawei, who are experiencing rapid growth in the domestic market,” said Zaker Li of Omdia.

“Adding fuel to fire, Xiaomi and Oppo experienced a shortage of components last year and as a result significantly increased their purchases in order to secure parts. An unintended consequence of this is a significant increase in inventory, meaning OEMs must continue to downgrade their shipment target for this year and reduce component purchases.”

With double-digit inflation hitting many economies, perfectly rational belt-tightening from consumers and businesses alike risks stagflation and a major global recession. The smartphone market offers some insight into broader consumer sentiment but we expect nearly all macroeconomic indicators to be negative for the next few quarters. Having said that, any signs that the global economy has bottomed-out and may be set to recover will be gratefully received.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

Read more about:

OmdiaAbout the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)