Smartphone market still struggling and India's not helpingSmartphone market still struggling and India's not helping

The global smartphone market is showing signs of stabilising, but it continued to shrink in the first quarter of this year, according to new analyst data.

April 19, 2023

The global smartphone market is showing signs of stabilising, but it continued to shrink in the first quarter of this year, according to new analyst data.

And even newer analyst figures suggest that India was likely a contributor to the decline.

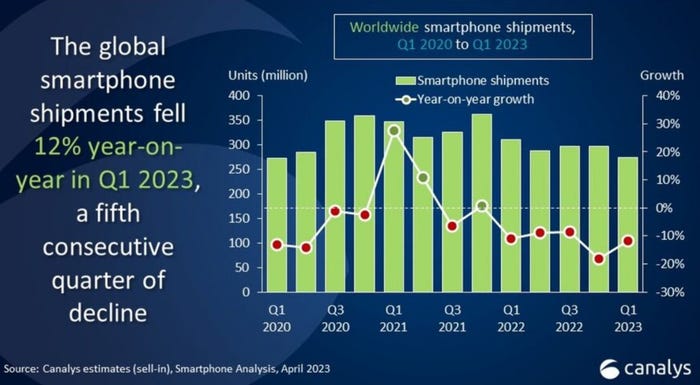

The number of smartphones shipped worldwide fell by 12% year-on-year in Q1 2023 with unit shipments coming in at well under 300 million, representing the fifth consecutive quarter of decline, Canalys reported on Tuesday.

Limited improvements in a massively unfavourable macroeconomic climate mean the market has yet to recover, the analyst firm noted, hitting vendors’ investments and operations in several markets.

It did not name those markets. Interestingly though, it followed up its global smartphones data with an announcement from India, a market that has had a pretty bumpy start to the year.

Its figures show the first ever Q1 year-over-year decline in smartphone shipments in India to 30.6 million, a drop of 20%. The economic situation means demand there is slow too. However, Canalys insists that investments from major brands “are pouring in,” with companies focusing optimising retail, manufacturing, local sourcing, and R&D to secure their long-term position in what looks to be a promising market.

Indeed, while the mass market in India is moving slowly and is expected to continue to do so throughout 2023, Canalys analyst Sanyam Chaurasia predicts that “the premium segment is poised for growth,” boosting the average selling price of the overall market. “As disposable income gradually rises, consumers are willing to spend more on premium devices,” he said.

So while the decline in India in Q1 doubtless had an impact on worldwide smartphone shipment figures, the market is arguably in a stronger position than many, with customer demand looking more positive.

On a global level, “despite price cuts and heavy promotions from vendors, consumer demand remained sluggish, particularly in the low-end segment due to high inflation affecting consumer confidence and spending,” said Chaurasia. In turn, that means low levels of sell-in from the vendors, and cautious production.

However, there are some green shoots emerging.

“We have noticed some signs of moderation in the continued decline,” noted Canalys analyst Toby Zhu, highlighting improvements in demand for some smartphones and price brackets, and some vendors becoming more active in production planning and component ordering.

The analyst firm believes that smartphone industry inventories can reach a relatively healthy level by the end of Q2.

“It is still too early to predict the recovery of overall consumer demand,” Zhu said. “However, the sell-in volume of the global smartphone market is expected to improve due to the reduction in inventories in the next few quarters.”

The analyst names the growing popularity of 5G and foldable phones as “the new driving forces in the industry.”

On the vendor side, Samsung was on the only big name to achieve a quarter-on-quarter recovery, Canalys pointed out, putting it back in the number one spot ahead of Apple, with a market share of 22 percent to the iPhone maker’s 21 percent. The latter experienced “solid demand” for its iPhone 14 Pro series in Q1, the analyst firm said. Similarly, new product launches towards the end of the quarter helped Xiaomi retain the number three position with an 11 percent share, followed by Oppo and Vivo. In India, Oppo squeezed past Vivo to take the number spot for the first time, incidentally, while Samsung continued to lead the market.

Overall, the numbers for the smartphone space in Q1 don’t look great, but they are not at all unexpected, and there are signs of growth to look for from here on in.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)