Smartphone production forecast to drop by 16.5% in Q2

Taiwanese analyst firm TrendForce has been having a look at the effect of the COVID-19 pandemic on the smartphone supply chain and concludes it has had a significant impact.

April 30, 2020

Taiwanese analyst firm TrendForce has been having a look at the effect of the COVID-19 pandemic on the smartphone supply chain and concludes it has had a significant impact.

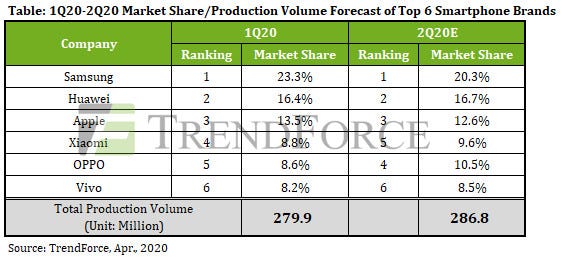

It found global smartphone production (most of which takes place in China and the Far East) fell by 10% in Q1 2020 to 280 million units. Despite China claiming to have largely shaken the virus off by April, Trendforce reckons Q2 will see an even bigger drop-off in smartphone production – down 16.5% to 287 million units. For the full year it’s forecasting an 11.3% decrease to 1.24 billion units.

While Samsung is the global market leader, it doesn’t have much of a presence in China and, we’re told, does most of its smartphone production in Vietnam and India. So while its supply wasn’t constrained by the factory closures in China, it has chosen to dial down supply in response to anticipated softening of demand in its biggest markets.

Conversely Huawei is increasingly reliant on the Chinese market as US sanctions hit its ability to make smartphones anyone would want elsewhere, so its smartphone production could also be affected by demand. Apple production was apparently hit to the tune of 9% in Q1 but is expected to recover this quarter, depending on demand in the US and Western Europe. Of the other big Chinese vendors Vivo somehow managed to increase its production in Q1 somehow.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)