Smartphones still sliding but upsurge in sightSmartphones still sliding but upsurge in sight

The global smartphone market continued to decline in the second quarter of the year, according to new data, but analysts are optimistic that it may soon turn a corner.

July 20, 2023

The global smartphone market continued to decline in the second quarter of the year, according to new data, but analysts are optimistic that it may soon turn a corner.

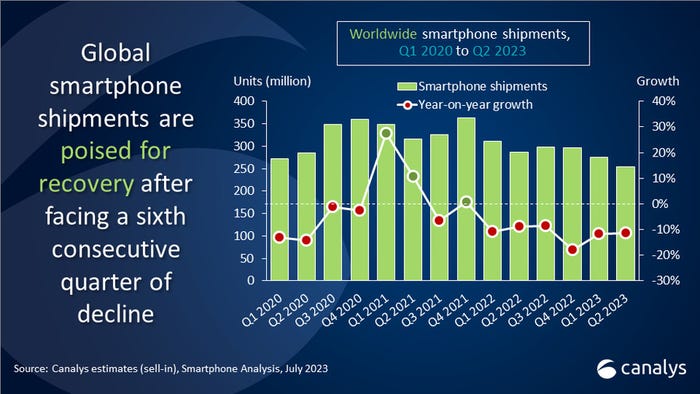

Shipments fell by 11% year-on-year in the three months to the end of June, Canalys estimates. We’re still talking not far off a quarter of a billion devices being sold into the channel during the quarter (see chart), but this is the sixth quarter in a row in which growth has been negative, according to the analyst firm’s estimates.

However, much as it did last quarter, the company is looking towards an upturn, although it is not making any firm predictions on that score.

“The smartphone market is sending early signals of recovery after six consecutive quarters of decline since 2022,” said Canalys analyst Le Xuan Chiew. “Smartphone inventory has begun to clear up as smartphone vendors prioritized cutting inventory of old models to make room for new launches.”

Market leaders Samsung and Apple – they claimed shares of 21% and 17% respectively, just as they did in the year-earlier quarter – had to reduce their sell-in in Q2, which naturally had an impact on the growth, or lack thereof, of the whole market. “Outside of the top two, the decline in smartphone shipments reveals signs of improvement as most vendors’ inventory returns to healthier levels while macroeconomic conditions stabilize,” Canalys said. Places three to five in the vendor ranking still belong to Xiaomi, Oppo and Vivo.

“There are indications that vendors are preparing for market recovery in the further future. They are looking to hedge key component prices to combat potential prices hike, given the present inflationary conditions, leading to the recent increase in component orders,” Le Xuan Chiew added.

He also noted that vendors have not stopped investing in manufacturing and have established direct presences in emerging markets like Southeast Asia and India, something he describes as “a strong driving force for sustainable growth.”

Indeed, India has picked up after something of a blip in Q1, when it witnessed its first ever year-on-year quarterly smartphone shipment decline.

A separate report from Canalys shows that the Indian smartphone market fell by 1% in the quarter to the end of June, essentially stabilising after that poor first quarter showing with shipments coming in at 36.1 million. The market grew by 18% sequentially on the back of improved inventory levels thanks to a “moderately favourable business environment,” the analyst firm said.

“With a troubled few quarters behind us, the market has finally gained momentum heading into the second half,” said Canalys analyst Sanyam Chaurasia. “During Q2, there was a slight improvement in macro indicators, with increased manufacturing output and reduced inflation rates. However, uncertainties related to the monsoon season will continue to pose risks to consumer demand.”

He noted that the government is looking to boost consumer confidence ahead of next year’s elections.

“Canalys predicts a more favourable demand environment in the second half of 2023 due to improved consumer spending during the festive season,” he said, adding that with India hosting the Cricket World Cup in October this year, operators will focus on promoting their 5G services and smartphone makers will use the event to push their affordable 5G devices.

All in all, while consumer spending remains under pressure in most markets, there are encouraging signs for handset makers going forward. And, of course, it’s not just in India that operators are keen to incentivise customers to move to 5G.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)