Sony puts smartphones on the back burner as it doubles down on music

Japanese technology and media conglomerate Sony has announced its latest cunning plan and it involved focusing on content and content creators.

May 22, 2018

Japanese technology and media conglomerate Sony has announced its latest cunning plan and it involved focusing on content and content creators.

At the same time Sony announced it is acquiring 60% of EMI Music Publishing from Mubadala for $2.85 billion, which means it now owns 90% of EMI and, when combined with its own music publishing business, makes Sony the world’s biggest music publisher.

“The music business has enjoyed a resurgence over the past couple of years, driven largely by the rise of paid subscription-based streaming services,” said Sony CEO Kenichiro Yoshida. “In the entertainment space, we are focusing on building a strong IP portfolio, and I believe this acquisition will be a particularly significant milestone for our long-term growth.”

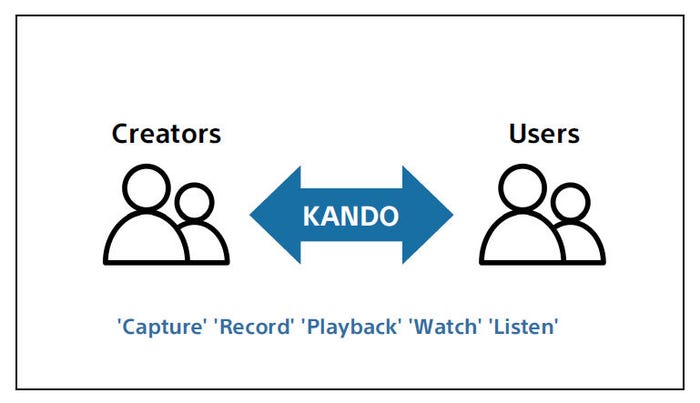

Sony’s new strategy focuses on investing in content and content creation, while making sure the hardware business doesn’t go down the toilet. This is an extension of the Kando philosophy Sony has been banging on about for a few years now – a Japanese word that seems to mean the excitement you get when you encounter something exceptional.

It’s all about getting closer to people, apparently, and appealing to their emotional side. This seems to be a desire to restore the Sony brand to its former highs, perhaps last experienced in the 1980s through products such as the Walkman. This would be difficult to achieve through just hardware as Apple has that crown and seems unlikely to relinquish it anytime soon, so Sony is focusing on providing people with content and helping them create their own.

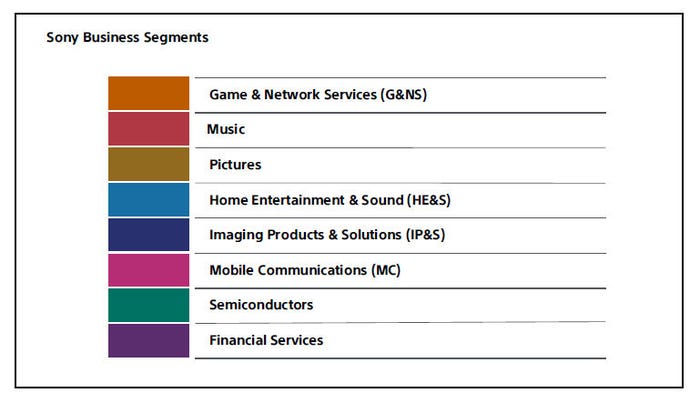

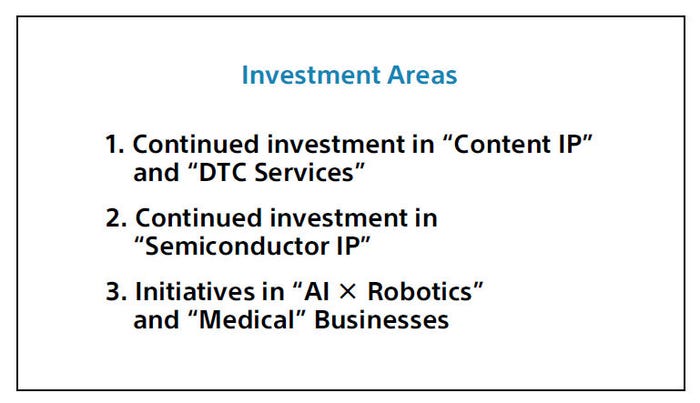

So you can effectively divide Sony into three main silos now: content IP (video, music, games), branded hardware (smartphones, consumer electronics) and consumer enablers (CMOS sensors and financial services). The emphasis is on investing in the content side and keeping the CE cash cow stable, which probably means continued managed decline for the smartphone segment. You can see how this all plays out in the Sony slides below.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)