Wearables and tablets experience another sucker punchWearables and tablets experience another sucker punch

Research firm Strategy Analytics has released its findings on the performance of smartwatches and tablets over Q4 2016, and it’s not the most flattering.

February 2, 2017

Research firm Strategy Analytics has released its findings on the performance of smartwatches and tablets over Q4 2016, and it’s not the most flattering.

On the smartwatch front, SA says the segment grew just 1% year-on-year, with shipments hitting 8.2 million units in the fourth quarter of 2016. The growth is a positive sign, but this is hardly setting the world on fire. Apple dominated the market share rankings, collecting 63% of total sales, with Samsung coming in second.

“The fourth quarter marked a return to growth for the smartwatch industry after two consecutive quarters of declining volumes,” said Neil Mawston of Strategy Analytics. “Smartwatch growth is recovering slightly due to new product launches from giant Apple and stronger seasonal demand in major developed markets like the US and UK. Global smartwatch shipments grew 1 percent annually from 20.8 million in full-year 2015 to a record 21.1 million in 2016.”

Apple was estimated to have shipped 5.2 million units during the quarter, a 2% boost from 2015, whereas Samsung only accounted for 800,000, a year-on-year decline of 38%. The Samsung performance has partially been blamed on a late entry to the market.

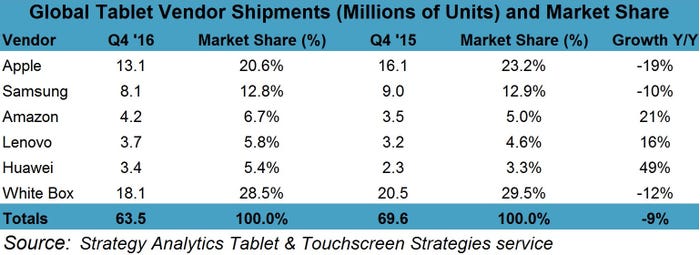

On a slightly more negative note, the global tablets segment is estimated to have declined by 9% during the fourth quarter, with Apple and Samsung both experiencing double-digit falls. The challenge here would appear to be the price-conscious consumer, as vendors are yet to justify the increased price for 2-in-1 tablet devices, such as the iPad Pro or Surface Pro 4. Cheaper brands like Lenovo however had a much more positive go.

“2-in-1 Tablets are a hot market segment but price remains a key factor in consumer behaviors around PC and Tablet replacement devices, which is evident in lower shipments of iPad Pro and Surface Pro 4 devices in the quarter,” said Eric Smith, Senior Analyst at Strategy Analytics.

“Apple cut prices on its iPad Air 2 and iPad mini 4 models but introduced no new iPad Pro models or pricing during the quarter, leading to 4% ASP decline year-on-year. Microsoft has not released a major refresh of its Surface Pro or Surface Book devices in over a year, which has given its OEM partners and other mobile-first companies a chance to catch up with high-performing, lower cost Surface clones.”

The winners here were clear, and it demonstrates a very clear message from the consumers to the vendors in the wearables space. Amazon launched its Fire HD Tablet for $89, and grew 49% year-on-year, while Huawei and Lenovo, also players in the lower price range game, grew 16% and 21% respectively.

In both segments, the cash-conscious consumer has seemingly made up its mind. Unless a device can prove itself to be more than a nice-to-have, the consumer will not spend big. While this will hurt vendors such as Apple and Samsung, who like to play in the premium market space, there are plenty of opportunities for more bank account-friendly brands to make a move.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)