Western European smartphone market nosedives – CanalysWestern European smartphone market nosedives – Canalys

Market researcher Canalys has published its Q1 2018 smartphone numbers for Europe and they indicate a severe contraction in its richest markets.

May 10, 2018

Market researcher Canalys has published its Q1 2018 smartphone numbers for Europe and they indicate a severe contraction in its richest markets.

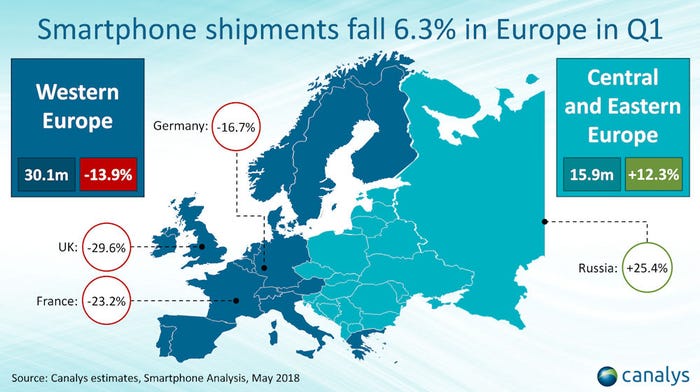

Overall European smartphone shipments fell 6.3% year-on-year according to Canalys’ research, but it was very much a game of two halves, with Eastern Europe growing by 12.3%, driven largely by Russia, while Western Europe fell off a cliff, down 13.9% annually. The overall drop for the continent was the biggest ever for a single quarter.

“This is a new era for smartphones in Europe,” said Ben Stanton of Canalys. “The few remaining growth markets are not enough to offset the saturated ones. We are moving from a growth era to a cyclical era. This presents a brand-new challenge to the incumbents, and we expect several smaller brands to leave the market in the coming years.”

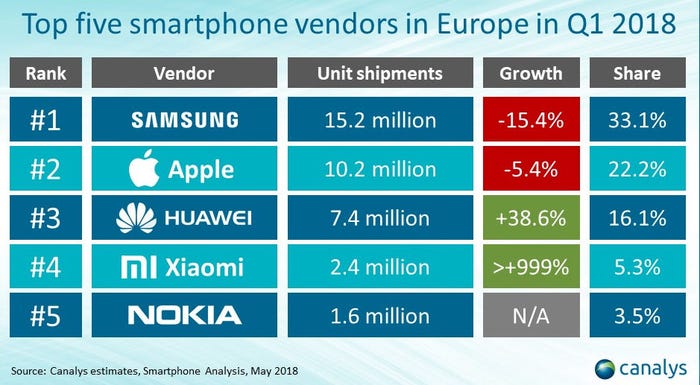

This would appear to mirror the broader global trend of consolidation in the smartphone market, with the top vendors gaining market share at the expense of the long tail. Samsung is the number one vendor but is having its own long tail attacked by Huawei and Xiaomi as cheaper phones increasingly offer much of the performance as flagship ones.

“It is not all gloom for the smaller players,” said Lucio Chen of Canalys. “Xiaomi and Nokia, under HMD Global, are both relatively new entrants to the European market, but have stormed to fourth and fifth place.

“Xiaomi is working closely with distributors, such as Ingram Micro and ABC Data, to drive products into retail stores. HMD has taken a different approach, using its operator relationships on the feature phone side to get its new smartphones ranged across Europe. But both Xiaomi and HMD Global have the benefit of being privately owned.

“As Xiaomi has shown, private companies have an incentive to operate at a substantial net loss to drive smartphone shipments, boosting market capitalization before IPO. But this is not sustainable in the long term, and both Xiaomi and HMD Global will eventually have to shift their revenue and cost structures, as the top three have now done, toward profitability.”

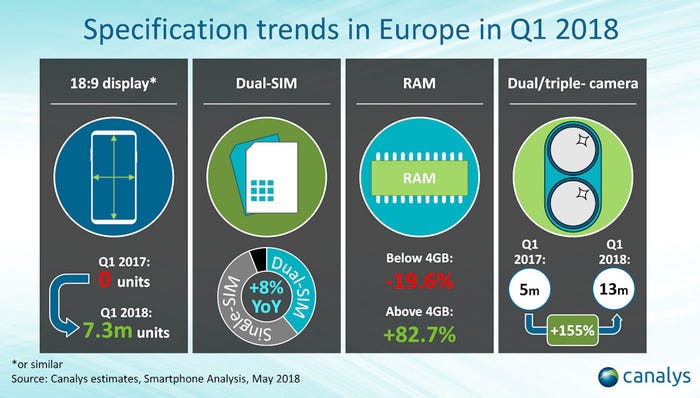

The nature of the component manufacturing business means that what used to be premium specs have become commoditised, which is the main reason for the shift towards cheaper phones even in rich countries. Now you can get a phone with a quality screen, camera, processor, etc for far less than the price of an iPhone X or whatever.

“Dual-SIM is also a growing specification trend in Europe,” said Vincent Thielke of Canalys. “It has taken longer to take hold than elsewhere in the world, because operators are paranoid about ranging dual-SIM phones, as it opens up the opportunity for competitors to sell lines into their installed base. But due to the growth of dual-SIM through retail channels, especially through brands such as Huawei and Wiko, operators are being forced to re-evaluate their portfolios and consider dual-SIM. Vendors are reacting too, and Samsung has made an explicit push to bring dual-SIM to more of its devices in more of its channels in 2018.”

The one vendor that seems to be impervious to the eddies and currents of smartphone fashion is Apple. While its brand is peerless, the fact that Apple has its own platform is probably the main reason it’s so much more resistant to commoditisation. When comparing Android devices specs are likely to be a more significant consideration then when choosing between Apple and Android. This is probably the main reason why Apple’s margins are so much higher too.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)