Global RAN market experiences major declineGlobal RAN market experiences major decline

A new report from Dell’Oro Group says RAN sales declined at their fastest pace in nearly seven years during Q2 of this year.

August 23, 2023

A new report from Dell’Oro Group says RAN sales declined at their fastest pace in nearly seven years during Q2 of this year.

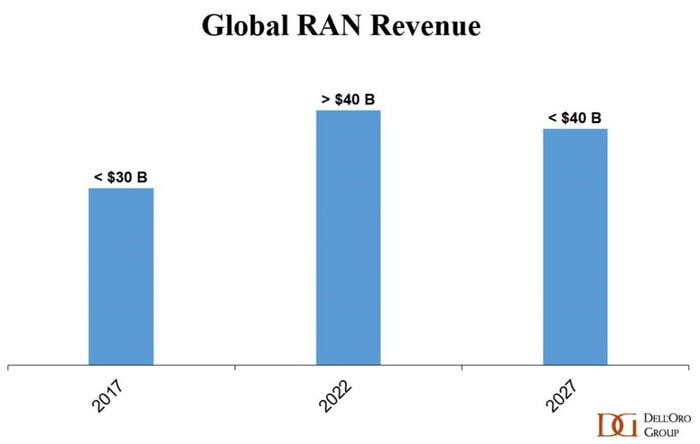

According to preliminary findings from the analyst firm, which tracks the telecoms, security, networks, and data centre sectors, following the ‘intense ramp-up’ from 2017 through 2021, RAN revenues stabilized in 2022 and the first quarter of 2023, however market conditions worsened in Q2 resulting in the year-on-year decline.

While this was not unexpected, we’re told the ’magnitude of the reversal was much steeper than anticipated.’ This has prompted the firm to declare the expansion phase of the RAN ‘has now faded’ and adjust its outlook accordingly.

Dell’Oro’s 2Q 2023 RAN report threw up some additional stats on the global RAN market. The top five suppliers for the first half of 2023 were Huawei, Ericsson, Nokia, ZTE, and Samsung, and of them Nokia recorded the largest RAN revenue share gains between 2022 and this period.

Huawei also clocked a win, with its quarterly RAN share reaching the highest level in three years in Q2, while its RAN revenue share outside of North America was apparently as large as Ericsson and Nokia combined. Ericsson and Samsung’s RAN revenue shares meanwhile declined between 2022 and 1H23.

Regional projections are mostly unchanged we’re told, however, the short-term outlook has been revised upward in APAC excluding China and downward in the North American region. Overall, global RAN revenues are expected to decline in 2023.

“It is tempting to point the finger at data traffic patterns, 5G monetization challenges, and the odds stacked against an economy struggling with persistent levels of elevated inflation,” said Stefan Pongratz, Vice President at Dell’Oro Group.

“Although these are, of course, important factors, we attribute the poor performance in the quarter to the clouds forming in North America. Alongside challenging 5G comparisons, the decline was amplified by the extra inventory accumulated over the past couple of years to mitigate supply chain risks.”

On a brighter note, another Dell’Oro report from earlier in the month said the market for private cellular networking equipment saw revenues in the second quarter jump 60% year-on-year. The firm expects total private wireless RAN revenues to grow at a 24% CAGR between 2022 and 2027 – though it also highlighted that private networking remains a small part of the overall RAN market.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)