OpenRAN is unlocking innovation but also raises several challengesOpenRAN is unlocking innovation but also raises several challenges

According to telecoms market research firm Omdia, Open RAN currently makes up less than 1% of the market – although the analysts expect it to account for around 9% by 2024.

July 21, 2021

Telecoms.com periodically invites expert third parties to share their views on the industry’s most pressing issues. In this piece Steve Douglas, Head of 5G Strategy at Spirent Communications, takes a look at the pros and cons of OpenRAN technology.

The last few years has seen a slew of new vendors enter the largely closed mobile network infrastructure sector. The promise of a low-cost, vendor-neutral telecoms future is tantalising but there are still questions over reliability and robustness. Although the potential for Open Radio Access Network (Open RAN) is clearly growing, adoption is still relatively sparse. According to telecoms market research firm Omdia, Open RAN currently makes up less than 1% of the market – although the analysts expect it to account for around 9% by 2024.

The situation is shifting rapidly. Earlier this year, Deutsche Telekom AG, Orange S.A., Telefónica S.A., TIM and Vodafone Group Plc publicly stated via a Memorandum of Understanding (MoU) the five operators commitment to the implementation and deployment of Open RAN solutions that take advantage of new open virtualized architectures, software, and hardware to build more agile and flexible mobile networks in the 5G era.

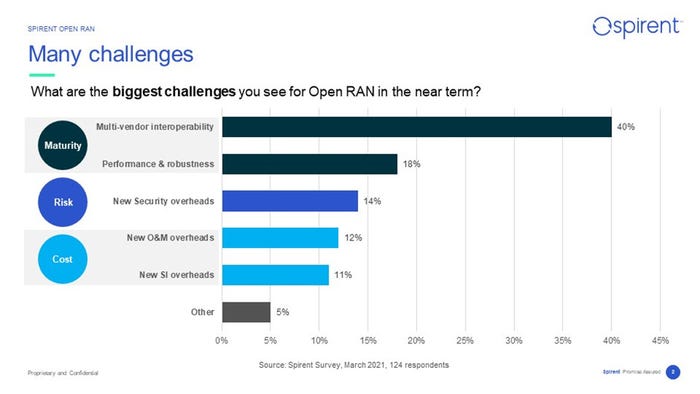

To understand the current Open RAN landscape, Spirent ran a survey in March of 2021 with 124 respondents initially asked, “What are the biggest challenges you see for Open RAN in the near term?” The survey responses broadly fell into 3 main groupings relating to maturity, risk and potential new costs.

Maturity and robustness

The highest priority for 40% of respondents was multi-vendor interoperability and open interface compliance to guarantee interworking and provide flexible choice. This was followed in second place by the need to prove system performance and robustness compared to traditional RAN offerings. In supplemental interviews, it becomes clear that parity with traditional RAN was seen as table stakes by many leading Service Providers.

The third highest response was the new security overheads with operational teams voicing concerns of needing to better understand the additional security risks on both the network architecture and on the supply chain.

Surprisingly, cost related challenges was the third ranked concern and centred around potential new overheads which could offset the potential cost benefit optimizations. This related to operational overheads to manage the new and smaller vendors (12%) who may be higher risk and higher maintenance. And how to solve the challenge and cost implication of installation and commissioning where service providers may need to invest in becoming the System Integrator or must outsource to a 3rd party (11%).

The survey also asked Service Providers their current view on Open RAN maturity and took the pulse on how they were likely to start commercial implementation. The key consensus was that mainstream maturity is still a few years away with 45% expecting a 2-year window till it becomes viable for supporting Massive MIMO technology. However, there is certainly an opportunity for early deployments around specific use cases such as Rural and indoor Private networks where bandwidth demand and complexity would be lower. In fact, 15% of service providers think it is mature for use today, with the caveat that it comes from a single vendor.

Implementation partnerships

An even larger follow-up survey conducted in May with 260 service respondents asked the question: “Who do you see as the prime integrator for your Open RAN network?” and the clear desire of nearly 1 in 3 respondents was with a System Integrator – with the larger Service Provider respondents being the highest percentage of this cohort. However, smaller service providers favoured the traditional RAN vendors (1 in 5) to take this role mostly due to the fact many still prefer the simplicity of an engagement with a single vendor even if the RAN is open. There was also a reasonable mix of responses supporting both New Open RAN vendors and the new Open eco-systems offering pre-integrated and packaged solutions of which Rakuten was mentioned.

Perhaps most surprisingly was that in-house teams accounted for just 8% and while this may seem small it does reflect the fact that many leading network operators are opting to perform that role themselves, at least for now.

So, the synthesis of these survey results shows that Open RAN is still in the maturing phase and alongside the survey, candid conversation with many service providers – both large and small – highlights that to achieve its potential and deal with the many stakeholder requirements and challenges that testing is going to be critical.

Testing evolved.

With 5G and Open RAN, the testing cycle is shifting towards a continuous approach as the increased frequency of releases and configuration changes from the multiple vendors within an Open RAN environment stretch Service Providers’ operations teams. In single vendor, traditional RAN environments a cycle of 3 releases over an 18-month period would be considered normal. However, an Open RAN environment with 5-6 vendors across Radio, Control, Data, Cloud, and operating systems might equate to 20+ updates.

This has led to many leading Service Providers looking towards implementing Continuous Testing environments that establish an automated pipeline process to handle the velocity and volume of releases coming from the vendors. Another theme that came through during the interview phase was a desire to have this delivered as a vendor neutral Managed Solution or Testing as a Service to keep costs down and gain best of breed expertise. This requirement also overcomes the issue of vendor “politicking” over root cause issues that can arise where multiple participants are involved.

Automated future

The survey and the supplementary interview all express a desire to utilize Open RAN – and the MoU from five of the world’s largest telecoms operators underscores the focus that the industry has on getting 5G to market, but there can be no compromises. The role of testing is pivotal to ensure that Open RAN is robust, interoperable, performant and scalable. It is critical to provide technical parity with traditional RAN, but to ensure its also efficient to deploy, operate and manage.

However, with Open RAN extending the stakeholder ecosystems, co-operation is vital to ensure that there is confidence that supply chains are secure, regulatory requirements for emergency services are met and new cost overheads are counteracted.

To meet this challenge, there is a deep focus on using more automation for continuous testing to help improve the process. In similar multi-vendor projects with several 5G Core network suppliers, the use of continuous testing automation has driven down error rates, time to test and underlying costs by between 65% to 90%. Although at an early stage, the 5G revolution will fundamentally change how service providers manage their networks and the role testing will need to play.

Steve Douglas is Head of 5G Strategy at Spirent Communications, the leading global provider of automated test and assurance solutions for networks, cybersecurity, and positioning. Steve helps to define technical direction, new innovative solutions, and market leading disruptive technologies which make a real difference. With over 20 years’ experience in telecommunications, Steve has been at the cutting edge of next generation technologies and has worked across the industry with multiple service providers, start-ups and Tier 1 OEMs, helping them drive innovation and transformation. An ardent believer in connected technology, Steve strives to challenge, blur, and break down the silos which prevent innovation and business success.

Steve Douglas is Head of 5G Strategy at Spirent Communications, the leading global provider of automated test and assurance solutions for networks, cybersecurity, and positioning. Steve helps to define technical direction, new innovative solutions, and market leading disruptive technologies which make a real difference. With over 20 years’ experience in telecommunications, Steve has been at the cutting edge of next generation technologies and has worked across the industry with multiple service providers, start-ups and Tier 1 OEMs, helping them drive innovation and transformation. An ardent believer in connected technology, Steve strives to challenge, blur, and break down the silos which prevent innovation and business success.

Read more about:

DiscussionAbout the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)