T-Mobile US clocks Q1 customer wins and makes $950 million swoop for Lumos

US operator T-Mobile and Investment firm EQT have entered into a joint venture to acquire fibre-to-the-home platform Lumos, as the former scoops up 532,000 postpaid net customer additions in Q1.

April 26, 2024

The plan is the firms will acquire Lumos’ fibre network, which currently reaches 320,000 households over 7,500 route miles with fibre optic internet and home wi-fi service in the Mid-Atlantic, and then transition to a wholesale model with T-Mobile as the anchor tenant.

The transaction is expected to close in late 2024 or early 2025, subject to all the usual regulatory processes. T-Mobile is expected to invest approximately $950 million in the JV to acquire a 50% equity stake and all existing fibre customers, with the funds invested by T-Mobile being used by Lumos for future fibre builds.

The next capital contribution by T-Mobile out of an additional commitment of approximately $500 million is anticipated between 2027 and 2028. Al in all, the investments are expected to allow Lumos to reach 3.5 million homes passed by the end of 2028.

“As the demand for reliable, low-latency connectivity rapidly increases, this deal is a scalable strategy for T-Mobile to take a significant step forward in expanding on our broadband success and continue shaking up competition in this space to bring even more value and choice to consumers,” said Mike Sievert, CEO of T-Mobile. “Together with EQT and Lumos, T-Mobile is building on our position as the fastest growing broadband provider in the country in a value-accretive way that complements our sustained growth leadership in wireless. Customers – homes and businesses – who get the fast, affordable, and reliable internet they need will be the real winners.”

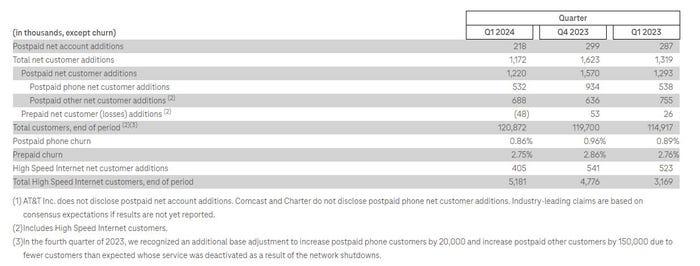

The news came alongside the operators Q1 financials, which showed postpaid phone net customer additions of 532,000, and postpaid net account additions of 218,000 – both of which it flags up as ‘best in industry’.

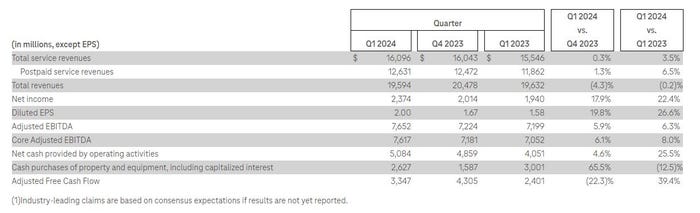

Total service revenues came in at $16.1 billion (a 4% YoY bump), and net income of $2.4 billion (a 22% YoY increase). Diluted earnings per share of $2.00 grew 27%, while the Core Adjusted EBITDA of $7.6 billion grew 8%.

$4.3 billion was returned to stockholders in the quarter, and the firm has raised its full year guidance slightly. It now expects postpaid net customer additions to land between 5.2 million and 5.6 million, an increase from prior guidance of 5.0 million to 5.5 million, and Core Adjusted EBITDA to be between $31.4 billion and $31.9 billion, an increase from prior guidance of $31.3 billion to $31.9 billion.

“T-Mobile had a great start to 2024 with industry-leading growth in service revenues and profitability,” said Mike Sievert, CEO of T-Mobile. “Even as the rest of wireless saw moderated customer growth, our momentum continued thanks to our increasingly differentiated combination of the best value, best network, and best experiences that customers love. We’re excited about our path forward and our raised guidance for 2024 reflects our confidence in what’s to come.”

Meanwhile, the FCC has approved T-Mobile’s deal to buy Mint Mobile for up to $1.35 billion, according to Reuters. The deal completed in March last year, and also includes wireless service Ultra Mobile and wholesaler Plum.

Elsewhere in the US operator space, AT&T this week posted its Q1 figures which showed strong mobile customer additions and some positive metrics on earnings, cash and spending, while its headline figures dropped off slightly.

Meanwhile Verizon posted a solid set of first quarter results as well, highlighting in particular growth in wireless service revenue, buoyed by continued adoption of FWA.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)