TIM admits debt will rise after NetCo sale

TIM on Monday revealed that its net debt will increase by well over €1 billion following the sale of its networks business, sending an already battered share price still lower.

March 11, 2024

The publication of the Italian incumbent's so-called Free to Run plan last week sent its shares into freefall. Although the telco did not share a projected net debt figure, financial analysts did some calculations based on its earnings and leverage targets and concluded that debt will be significantly higher in three years' time than it is now. Given the debt-reduction is a key tenet of the networks sale plan, that news did not land well.

And while TIM's announcement before the markets opened on Monday provided some clarity, it did nothing to stem the share price slide. TIM's stock lost almost a quarter of its value in the wake of the strategic plan last week and at the time of writing on Monday morning was still tracking downward, trading at around €0.20, a price it hasn't seen since autumn 2022.

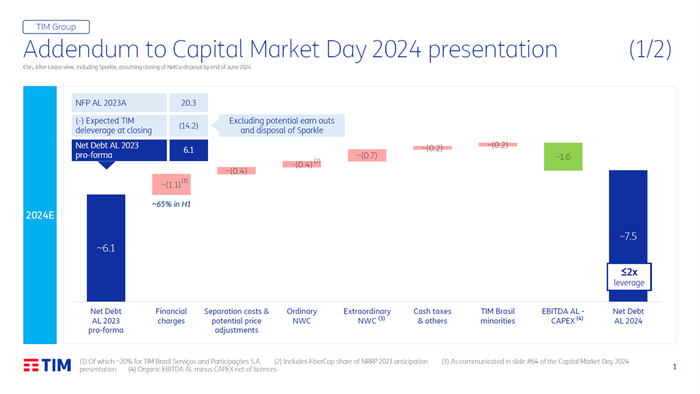

In an addendum to last week's business plan, TIM disclosed that its net debt at the end of this year – assuming the NetCo transaction closes – will be around €7.5 billion, compared with a pro forma figure of €6.1 billion for the same assets at the end of 2023. It did not share figures for 2025 or 2026.

The debt increase will come as a result of both ordinary and extraordinary operations, the latter being the effects of the NetCo transaction itself, such as separation costs, the impact of potential price adjustments and additional items related to net working capital, TIM said (see chart below).

The new information also includes the fact that net cash flow will be zero in 2025, rising to half a billion euros in 2026. However, TIM also listed a number of normalisation factors that could increase those figures.

"It should also be noted that potential upside to guidance could result from earn-outs related to the Netco transaction and the potential disposal of Sparkle, the process of which is still ongoing," TIM said.

The strength of reaction to the projected EBITDAaL figures and 2026 leverage target of 1.6x-1.7x TIM shared last week – the figures analysts used to calculate its likely debt pile going forward – clearly took it by surprise. Reuters reports that finance chief Adrian Calaza offered to resign at a special board meeting held over the weekend, but had his resignation turned down, electing to seek to reassure investors by providing more information.

TIM did not immediately stem its share price slide by being more open about its debt trajectory, so now it needs to wait for the dust to settle to see how the market feels about its networks-free future.

In the meantime, the NetCo sale is marching forward.

Late last week the Canada Pension Plan Investment Board (CPP Investments) announced that it is buying into NetCo, committing €2 billion for a 17.5% stake in the company. The deal values NetCo at €18.8 billion, CPP Investments said; there's clearly more going on behind the scenes than a bit of simple maths can resolve.

The transaction will see CPP Investments buy into Optics BidCo, the investor group that will acquire NetCo. It joins lead investor KKR and the Italian government, as well as the Abu Dhabi Investment Authority's Azure Vista subsidiary and Italian infrastructure fund F2i.

TIM aims to complete the networks sale in a matter of months. While actually doing the deal will bring some stability to the telco, the consternation over its financial position post-NetCo sale is likely to remain for some time.

About the Author

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)