East Asian telcos ahead on digital transformationEast Asian telcos ahead on digital transformation

Telecoms operators the world over are embracing digital transformation and developing services in new sectors, and players from East Asia are ahead of the pack, new research published this week shows.

June 12, 2023

Telecoms operators the world over are embracing digital transformation and developing services in new sectors, and players from East Asia are ahead of the pack, new research published this week shows.

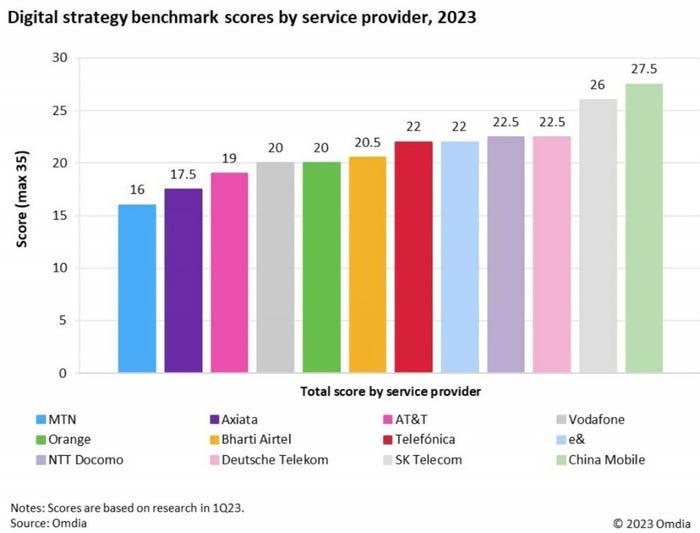

Three of the top four telecoms operators in the latest iteration of Omdia’s service provider digital strategy benchmark hail from that part of the world, led by global mobile market leader China Mobile. SK Telecom ranks second and NTT DoCoMo comes in in joint fourth with Deutsche Telekom (see chart below).

China Mobile scored 27.5 points out of a maximum of 35. It scored so highly due to the scale at which it has deployed high-speed broadband and subsequently used that infrastructure as platform to develop new services, Omdia explained.

“China Mobile is showing a particularly impressive speed of change, with digital transformation services now accounting for more than 25% of service revenues,” said Dario Talmesio, Research Director, Service Provider Strategy & Regulation, at Omdia. “China Mobile is rapidly turning itself into a TechCo operator with an array of digital services beyond connectivity.”

Indeed, China Mobile reported a 30% year-on-year increase in digital transformation revenue for full-year 2022 to 207.6 billion yuan (US$29 billion), while overall telecommunications services revenues came in at CNY812.1 billion ($114 billion), up by 8.1%.

The telco itself attributed the growth in digital transformation revenue to “the rapid expansion of 5G applications, mobile cloud, digital content, smart home and other businesses,” and talked up its “remarkable results” in that area. “These services have become a key growth driver contributing to a more balanced, stable and healthy overall revenue structure,” it said in its annual results announcement.

SK Telecom’s position at number two in the ranking is based on its drive to reinvest itself as an AI company and its work to develop services in areas including the metaverse and urban air mobility, Omdia said.

When SK Telecom chief executive took the reins just over 18 months ago, he outlined plans to drive a 20% revenue hike between 2020 and 2025 essentially by transforming the telco into an AI and digital infrastructure company. Amongst other things, that meant turning the firm’s ifland metaverse into an open platform, and a year later the telco was able to announce that its metaverse platform had gone global.

It is working with a number of other operators on metaverse content and technology, including Singtel and NTT DoCoMo, the latter also performing well on digital transformation. Fairly generally, Omdia talks up DoCoMo’s strength in technology and digital services.

Omdia also picks out e& – the operator formerly known as Etisalat – for particular mention. The United Arab Emirates-based telco group ranks fifth in the benchmark.

“e&’s strong showing is based on its new strategy, unveiled in early 2022, of transforming itself into a global technology and investment group—a strategy that it is pursuing vigorously,” said Matthew Reed, Chief Analyst, Service Provider Markets, at Omdia.

The telco reorganised itself under four pillars. The first covers its existing telecoms operations, but the second and third, E& life and e& enterprise, are responsible for new digital services and experiences in the consumer and business markets respectively. The fourth is about investment. The firm made many headlines with its decision to adopt e& as its new brand; the rebrand arguably overshadowed the strategic shift. But with that ampersand essentially standing for all the new sectors in addition to telecoms – next-gen technologies, digital experiences, financial services, the cloud, IoT, AI and so forth – it does make sense, and clearly e& is doing something right to find itself scoring 22 in the Omdia benchmark.

With telecoms operators all making a fair amount of noise about digital transformation, it’s handy to have a way of ranking their efforts and cutting through the marketing speak.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

Read more about:

OmdiaAbout the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)