Study highlights increasing dependence of operators on hyperscalers

A new report from analyst firm Omdia suggests operators’ best chance of growth in the consumer market comes from partnering with Big Tech.

April 12, 2023

A new report from analyst firm Omdia suggests operators’ best chance of growth in the consumer market comes from partnering with Big Tech.

Apart from their core fixed-line and mobile data services, pretty much all of the potential growth for service providers from the consumer sector over the next few years will come from ‘non-traditional categories, asserts Omdia’s Quantifying the Consumer Telco Opportunity – 2023 report. Those include streaming video, digital gaming and music, and smart home stuff.

“Service providers must look beyond data and diversify into adjacent digital markets to enable continued growth of their telco consumer businesses,” said Omdia’s Jonathan Doran. “Many have already invested in TV and online video entertainment, but there are other fast-growing markets telcos can also explore. Adopting the right go-to-market strategy and business model for each individual service area will be critical to striking the balance between achieving market success and mitigating financial risk.”

The thing is, Big Tech is already there and doing a decent job of selling all these digital goodies direct to consumers without the help of operators. Every time telcos have tried to compete directly in adjacent markets is has all gone horribly wrong so, as well as picking their fights more carefully, they are advised to consider an ‘if you can’t beat em, join em’ approach.

“In many areas, telcos will need to accept that competing head-on is unrealistic and developing partnerships with such players is not only more pragmatic but will also serve to strengthen their own products and brands,” said Doran. “Omdia’s Digital Consumer Operator Strategy Benchmark shows that the more service providers actively invest in a given service area – including through partnerships – the bigger market impact they have, which in turn better positions them to take a bigger slice of overall market revenue.”

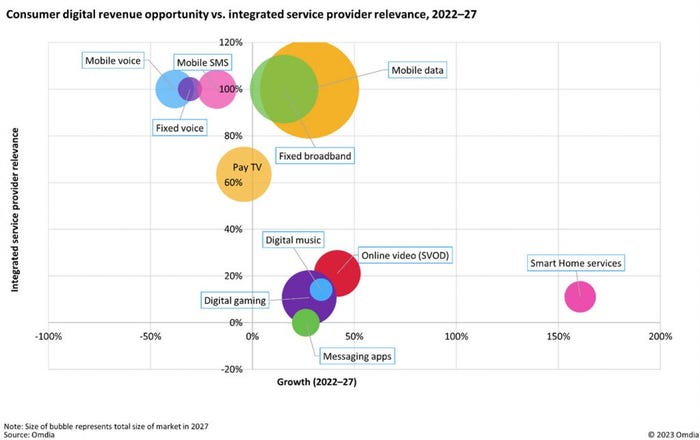

The Omdia chart below illustrates product types by growth potential (horizontal axis), relevance to the CSP core proposition (vertical axis) and forecasted relative 2027 market size. As you can see, most consumer digital products are pretty far from the CSP core proposition, but Omdia reckons they will collectively amount to a $500 billion market by 2027. How much of that will find its way into the pockets of telcos as a result of partnering with Big Tech remains to be seen, but even a small fraction is better than nothing.

Another question concerns the willingness of CSPs to become even more reliant on these hyperscalers than they already are. Amazon, Microsoft and Google are not only three of the biggest players in the digital consumer space, they also dominate the public cloud market, which operators are constantly urged to turn to for its efficiencies and flexibility. It’s possible to imagine a time most of what we get from and operator is actually supplied, and monetized, by one of a small number of hyperscalers. It’s not clear whether that represents a positive development for the telecoms industry.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

Read more about:

OmdiaAbout the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)