AI hype fuels 21 percent jump in Q3 cloud spendingAI hype fuels 21 percent jump in Q3 cloud spending

Hyperscalers enjoyed another bumper quarter, as global spending on cloud infrastructure reached $82 billion in the three months to 30 September.

November 19, 2024

This is according to Canalys, which said that figure represents a 21 percent increase on the same period last year, and that Amazon Web Services (AWS), Google and Microsoft accounted for 64 percent of the total.

Combined spending with the big three grew 26 percent year-on-year. At 36 percent, Google saw the largest increase, followed by Microsoft and AWS with 33 percent and 19 percent respectively.

The growth was driven by continued excitement for all things AI-related. Enterprises – convinced that artificial intelligence will deliver an unprecedented boost in efficiency and productivity – are pouring money into hyperscalers' AI solutions.

This in turn is putting pressure on them to expand by investing in high-performance compute and storage infrastructure, said Canalys.

Hyperscalers need to tread carefully though – spend too little and there won't be enough capacity, but spend too much and that excess capacity will go unused, not earning a return.

"Continued substantial expenditure will present new challenges, requiring cloud vendors to carefully balance their investments in AI with the cost discipline needed to fund these initiatives," said Rachel Brindley, senior director at Canalys. "While companies should invest sufficiently in AI to capitalise on technological growth, they must also exercise caution to avoid overspending or inefficient resource allocation.

"Ensuring the sustainability of these investments over time will be vital to maintaining long-term financial health and competitive advantage," she said.

However, Canalys analyst Yi Zhang pointed out that hyeprscalers are also working on updates to their AI models and services, which offer the promise of more revenue.

"As these AI foundational models mature, cloud providers are focused on leveraging their enhanced capabilities to empower a broader range of core products and services," she said. "By integrating these advanced models into their existing offerings, they aim to enhance functionality, improve performance and increase user engagement across their platforms, thereby unlocking new revenue streams."

Separate stats from Gartner offer yet more cause for hyperscale optimism.

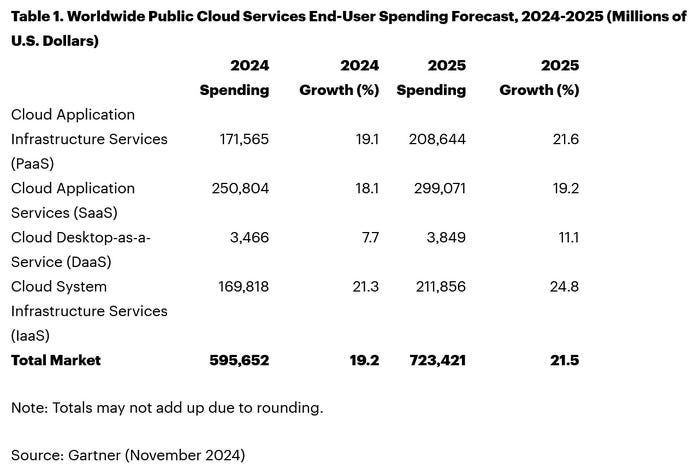

Gartner predicts that worldwide end-user spending on public cloud services is on course to reach $723.4 billion next year, up from a projected $595.7 billion in 2024.

All segments of the cloud market – platform-as-a-service (PaaS), software-as-a-service (SaaS), desktop-as-a-service (DaaS), and infrastructure-as-a-service (IaaS) – are expected to achieve double-digit growth.

While SaaS will be the biggest single segment, accounting for $299.1 billion, IaaS will grow the fastest, jumping 24.8 percent to $211.9 million (see chart).

Just like Canalys, Gartner also singles out AI for special attention.

"The use of AI technologies in IT and business operations is unabatedly accelerating the role of cloud computing in supporting business operations and outcomes," said Sid Nag, vice president analyst at Gartner. "Cloud use cases continue to expand with increasing focus on distributed, hybrid, cloud-native, and multicloud environments supported by a cross-cloud framework, making the public cloud services market achieve a 21.5 percent growth in 2025."

While hyperscalers and their smaller rivals will be buoyed by these figures, it's becoming increasingly apparent that a lot is riding on AI to deliver. If its promises of improved efficiency and productivity are not fulfilled, then there is a risk this could all come crashing down.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)