Amazon’s weak outlook adds to cloud pessimism

US internet giant Amazon was the last of the ‘hyperscalers’ to deliver their quarterly numbers and they did little to lift the general gloom.

October 28, 2022

US internet giant Amazon was the last of the ‘hyperscalers’ to deliver their quarterly numbers and they did little to lift the general gloom.

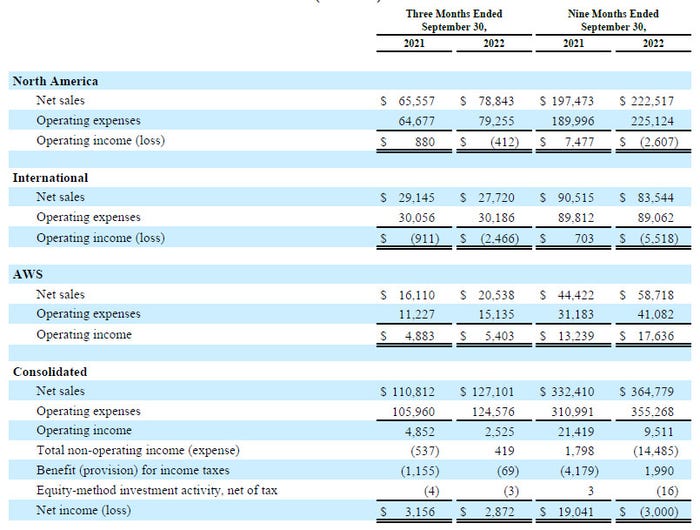

Q3 itself was fairly healthy, with sales up 15% to $127.1 billion. Having said that, operating income almost halved and net income was flattered by some one-off stuff. As you can see from the table extracted from its earnings announcement below, Amazon owes its profitability entirely to the AWS cloud division, but growth there is also slowing and margin is narrowing.

“There is obviously a lot happening in the macroeconomic environment, and we’ll balance our investments to be more streamlined without compromising our key long-term, strategic bets,” said Andy Jassy, Amazon CEO. “What won’t change is our maniacal focus on the customer experience, and we feel confident that we’re ready to deliver a great experience for customers this holiday shopping season.”

Amazon’s guidance for the next quarter listed a litany of dicey circumstances beyond its control before forecasting net sales of around £144 billion, which was well short of expectations. Operating income is expected to be in the range of zero to $4 billion, likely half of what it managed in the year-ago quarter. All this led to yet another investor panic, with Amazon shares down 14% at time of writing.

Since Amazon’s share price had already suffered collateral damage from weak earnings announced by other hyperscalers and internet giants earlier this week, and was already down a third this year, this further hit is noteworthy. Amazon is directly exposed to consumer sentiment via its ecommerce operations and business sentiment via AWS. You can see why it is considered a general economic bellwether and we expect its performance over the next few quarters to provide a good insight into the state of the global economy.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)