Growth slows in cloud services market but AI looms

The global market for cloud infrastructure services continued to show significant growth in the second quarter of the year, albeit at a lower rate than it did in Q1, according to new analyst data.

August 10, 2023

The global market for cloud infrastructure services continued to show significant growth in the second quarter of the year, albeit at a lower rate than it did in Q1, according to new analyst data.

And with artificial intelligence (AI) front-of-mind for cloud services providers, but yet to have a meaningful impact on revenues, there is plenty of cause for optimism. But cloud providers will have to be selective when deciding who to partner with in this market.

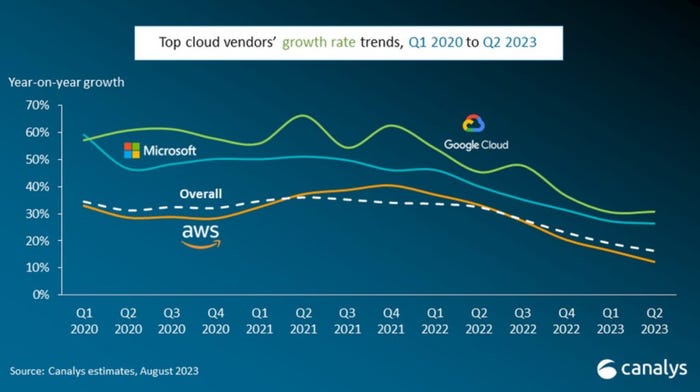

Worldwide cloud infrastructure services spending grew by 16% to US$72.4 billion in Q2, Canalys reported on Thursday. That’s a decline compared with the previous quarter’s 19% growth rate, but is nonetheless a healthy increase. The market is feeling the impact of pressure on customer spending, the analyst firm noted, but pointed out that the slower growth is also a result of the increased size of the market.

The big three cloud vendors – Amazon Web Services (AWS), Microsoft Azure and Google Cloud – still account for almost two-thirds of the market. To be precise, they accounted for 65% of total spending in Q2, together growing faster than the market; their collective 20% growth rate was down two percentage points on the first quarter though.

The third-largest of the three, Google, saw flat growth of around 31%, while the other two declined slightly, the figures show (see chart).

Canalys’ focus for this quarter is on AI and its impact on the cloud services market. Thus far, AI technologies and their integration into existing cloud products have yet to see widespread commercialisation, and therefore have not moved the revenue needle much. However, AI will be a major driver of cloud investment in future, and all the major cloud providers continue to invest heavily in AI technologies, it notes.

Cloud providers need to sign up new customers and new workloads to drive revenue growth and AI will be a big part of that. The technology will bring with it new cloud workloads and will fuel big demand for computing capacity. Naturally, the big guns are all keen to capture as much of that growth opportunity as they can.

In the quarter in question both AWS and Microsoft launched new AI-oriented partner programmes, the analyst firm pointed out.

AWS leads the overall cloud infrastructure services market with a share of 30%, but its growth has more than halved since Q2 last year.

“In the face of subdued revenue growth, AWS is actively increasing its investments in AI,” Canalys said, pointing out that the firm has ploughed $100 million in a new generative AI programme that it launched in June, which includes the establishment of an AWS Generative AI Innovation Center.

Microsoft, meanwhile, has won a raft of high-profile clients for its Azure OpenAI Service, and with demand for AI set to increase, it introduced the Microsoft AI Cloud Partner Program earlier this year.

Microsoft Azure is the number two player in the market with a 26% share. “Business performance is expected to remain steady, given the 19% increase in its cloud order backlog, which reached US$224 billion in Q2 2023,” Canalys noted. Google, meanwhile, is some way behind the top two, commanding 9% of the market, but – understandably – its growth rate is stronger.

While working with partners to drive customer use of their AI products will be crucial for the cloud providers, they must choose their buddies carefully.

“Vendors need to separate the wheat from the chaff when it comes to driving their AI strategies through partners,” said Alex Smith, VP at Canalys, in a statement.

“That means focusing on partners that are building service practices around AI, engaging in sales and marketing initiatives that focus on AI, producing original thought leadership and compelling case studies around AI applications, and selling solutions that are embedded with AI capabilities,” Smith advised. “It’s these partners that will assume a leading role in steering companies toward being leaders in this field.”

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)