IBM revenues fall for 17th straight quarter despite 30% cloud growth

IBM revenues continued to fall for a 17th consecutive quarter despite beating analyst expectations and demonstrating healthy growth in its cloud and data business units.

July 19, 2016

IBM revenues continued to fall for a 17th consecutive quarter despite beating analyst expectations and demonstrating healthy growth in its cloud and data business units.

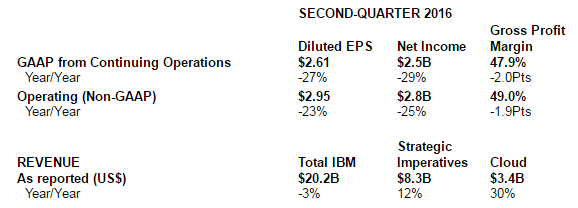

The company reported a drop in revenues for Q2 of 2.8% to $20.24 billion, though this was an improvement on analyst expectations of $20.03 billion, encouraging shares to rise 2.6% to $164 after hours. The business units which the company deems strategic imperatives, cloud, analytics and engagement, gained 12% year-on-year, though this wasn’t enough to counter the impact of legacy technologies on reported earnings which fell to $2.5 billion from $3.45 billion in 2015. Overall, revenues are now roughly 25% lower than the numbers reported in 2011.

“We continued to deliver double-digit revenue growth in our strategic imperatives,” said CFO Martin Schroeter on the company’s earnings call this week. “Over the last 12 months, strategic imperatives delivered $31 billion in revenue, and now represent 38% of IBM.

“Growth was led by cloud, where our revenue was up 30% to $3.4 billion in the quarter, and over $11.5 billion over the last year so good progress in cloud. Looking at revenue from a segment perspective, the strongest growth came from cognitive solutions led by our analytics and cognitive capabilities and security.”

Schroeter was keen to emphasise the impact Watson is having on the business, as the team continue its journey to redefine Big Blue in the age of cloud computing. Numerous customers were listed as wins for IBM in the cognitive computing sector, as IBM continues to champion Watson as a platform to bring together the digital business with digital intelligence to improve decision-making and add intelligence to products and processes. Watson will continue to be the jewel in the crown of Big Blue as the company moves towards the new digital era.

Despite revenues continuing to fall the team has made a number of positive launches throughout the quarter. Quantum computing is now available on the IBM cloud, the team launched a new partnership with Box to counter the impact of EU-US Privacy Shield on its international business, and an expanded partnership with VMWare expanded the reach of its security portfolio.

In terms of the specific segments, revenues in the cognitive team rose 4%, though this is down from 9% growth in the previous quarter, solutions software revenue was up 6% for the quarter, SAS was another area which recorded triple digit growth and Schroeter claims IBM’s security business outperformed the market by three times. The IBM interactive experience unit also demonstrated healthy growth, as the team continue its journey into an entirely new market for Big Blue.

“We have opened over 30 digital studios around the globe including new studios in Singapore and Seoul,” said Schroeter. “We also completed the acquisition of Aperto, a digital agency in Berlin with over 300 employees and a roster of enterprise clients such as Airbus and Siemens.”

One area which has caught the headlines in recent weeks is the impact of Brexit on the fortunes of the technology sector. Despite concerns from various corners of the industry, it would not have appeared to have a significant impact on the long-term vision of IBM.

“I don’t think that Brexit coming at the end of the quarter helped us at all, but we obviously finished kind of right where we expected to finish,” said Schroeter. “And when we look at our full view of the year, we don’t see an impact, if you will, that has any real materiality on us.

“What I typically observe in these kinds of instances is that our discussions with our clients have to go through a process of reprioritization. So as they reprioritize, the length of time that takes depends a lot on how much uncertainty they’re faced with. And obviously, the political leadership in Europe and the UK can help reduce that uncertainty, but we didn’t see – again, we don’t think it helped but it didn’t cause us to change our guidance.”

While revenues have continued to fall for the tech giant, it would appear to be heading in the right direction. The strategic imperatives business units are now accounting for a larger proportion of the overall figures, now 38%, indicating the tide may be turning for IBM. Schroeter also highlighted the team are not happy relying solely on the progress of Watson, as IBM has acquired 20 companies in the last twelve months, which are now beginning to contribute in a more significant manner.

Although progress is starting to be seen, it would be worth noting it has not been an entirely smooth ride for IBM. There have been numerous new product launches and advances into new market segments, though this has come at a cost of more than 70,000 redundancies over recent months. While there has been a slight increase in share price following the announcement, it would be worth noting previous performance has had an impact on IBM. Shares in Big Blue have dropped 17% since CEO Virginia Rometty took over in January 2012 while the S&P 500 index rose 70% during the same period.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)