Networking giants thunder into cloud infrastructure game

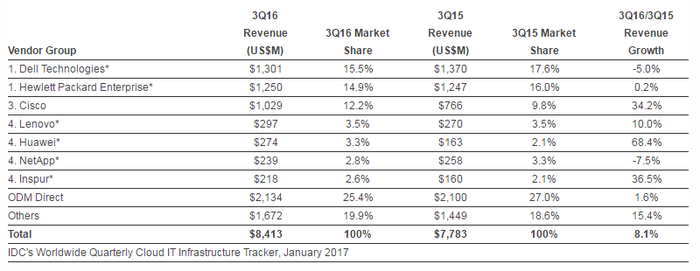

IDC has estimated sales of infrastructure products grew 8.1% year-on-year to $8.4 billion in Q3 of 2016, with companies traditionally from networking segment upsetting the status quo.

January 13, 2017

IDC has estimated sales of infrastructure products grew 8.1% year-on-year to $8.4 billion in Q3 of 2016, with companies traditionally from networking segment upsetting the status quo.

IDC’s Worldwide Quarterly Cloud IT Infrastructure Tracker, which accounts for all products relating to cloud IT, including public and private cloud, states cloud IT infrastructure now accounts for 39.2% of all IT infrastructure spending in Q3, up from 34.7% in 2015. Revenues from private cloud grew 8.2% to $3.3 billion and 8% to $5.1 billion for public cloud. By way of comparison, revenues for non-cloud IT infrastructure decreased 10.8% y-o-y.

“New cloud datacentres have begun to launch, but in the third quarter the effect on the cloud IT infrastructure market was minimal,” said Kuba Stolarski, Research Director for Computing Platforms at IDC. “As network upgrades continue to prop up cloud growth overall, the hyperscale cloud datacentres are coming and they will drive new server and storage deployments over the next few quarters.

“Recently, there has been renewed strength in emerging markets and among smaller cloud service providers. As OpenStack has become easier to implement and maintain by a growing population of capable system administrators, private cloud options are becoming more viable in an increasing set of use cases and with a wider set of deployment parameters.”

When looking more specifically at the individual winners and losers, another trend begins to emerge. Traditional IT players, such as Dell Technologies and HPE, demonstrated decline over the period (or very minimal growth), whereas those who would be more associated with the networking segments, the likes of Cisco and Huawei, posted impressive numbers for the quarter. Huawei in particular had a strong period, with IDC estimating a 68.4% y-o-y lift, taking its market share from 2.1% in the third quarter of 2015 to 3.3% in 2016.

Taking figures from one quarter alone does not necessarily indicate a definitive turn in the tides though it could indicate the networking players have better adapted their propositions for the cloud mass market.

A 5% decline for Dell Technologies might be seen as a slight worry considering CEO Michael Dell has a $60 billion bill to pay following his acquisition of EMC last year. That said, it isn’t clear what impact the sale of Perot Systems to NTT Data has had on the sales figures, though that is slightly irrelevant considering the progress of the likes of Huawei and Cisco.

Another worrying sign for the American companies will be the rise of Inspur. Although it would generally be considered a relatively unknown entity outside of its domestic Chinese market, the company grew sales in Q3 by 36.5% increasing its global market share by 2.6%. The majority of these are likely to be in domestic market though it does spell danger for American countries looking to expand into the lucrative Chinese IT sector.

Back in July, it was reported the Chinese government was looking to reduce its reliance on international products, amidst cyber security concerns between China and the US. While this report dates back to 2014, several Chinese industries stated they would consider using Inspur’s Tiansuo K1 as their preferred model of server for 216, as opposed to international suppliers.

While conflict between the Chinese and US governments is nothing new, trading terms have been relatively benign, with businesses on both sides benefiting from globalization trends. The introduction of President-elect Trump and his potentially protectionist policies could add a spanner into the works.

Although the protectionist rhetoric seemingly hit the sweet-spot for American voters, it hasn’t gone unnoticed by the Chinese authorities. In November, Chinese authorities commented that any tariff imposed by the US would be met in return in China, and it would be fair to assume many other countries would have the same position.

Considering growth is mainly coming from the Middle-East and Asia, perhaps a more diplomatic approach would be recommended here. IDC estimate cloud IT infrastructure sales grew fastest in Middle East & Africa at 36.7% y-o-y in Q3, with Japan rising 29.9%, the rest of Asia-Pacific 11.9% and Latin America at 21.7%, which compared to 2.9% growth in the US. Essentially, everyone who Trump has had a pop at is looking like a great opportunity for tech businesses.

Whether this has any material impact on the status-quo of the infrastructure industry remains to be seen, however the Chinese businesses are making a march on the segment. Watch this space.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)