What telcos may learn from banks when migrating to cloudWhat telcos may learn from banks when migrating to cloud

Findings from a recent Google survey of the financial institutions’ cloudification experience may serve as a mirror held up to the telecoms industry.

August 13, 2021

Findings from a recent Google survey of the financial institutions’ cloudification experience may serve as a mirror held up to the telecoms industry.

When it comes to embracing new technologies, the financial sector, banks, insurance companies, brokers, etc., is hardly the industry to benchmark against. However, occasionally, it does provide a good example of what not to do when adopting new technologies. Migration to public cloud could be such a case.

Google recently sponsored a survey on the financial services industry’s cloud migration experience and expectation. More than 1,300 what Google calls ““IT/compliance decision makers” from the US, Canada, France, Germany, the UK, Hong Kong, Japan, Singapore, and Australia participated in the survey. Thanks to the nature of their job these people are involved first-hand with their institutions’ cloudification decision making and implementation processes.

Firms represented in the survey are put into four categories when it comes their approach to cloud, defined by how the majority of their employees perform their tasks: “public cloud” means they rely on one public cloud (not much else to choose from other than Google Cloud, AWS, or Azure); “multicloud” refers to those firms using more than one public cloud provider; “hybrid cloud” are those firms that mix public cloud with on-premises infrastructure; and “on-premises”, which is self-explanatory.

In a blogpost about the findings from the survey, Zac Maufe, Managing Director of Google Cloud for Financial Services, drew five major conclusions:

Most financial services companies (83% of total) are already using some form of public cloud, with the biggest majority using a hybrid solution (public cloud and on-premises)

North America sees the highest cloud adoption rates, Japan the lowest among the surveyed markets

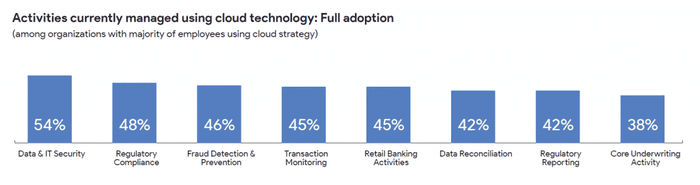

Many core functions are being migrated to public cloud, with IT security, regulatory reporting, and fraud detection and prevention rank high, and data reconciliation and core underwriting activity ranked the lowest

Source: “The Financial Services Industry Sees Increasing Public Cloud Adoption as Driving Innovation and Compliance”, Google Cloud, August 2021, p.6

Firms have a strong positive perception of the potential for cloud technology in improving both business operation and regulatory compliance

Regulatory complexity and uncertainty create hurdles to broader cloud adoption

There is much in common between what the financial industry has told Google and what we have observed in the telecoms industry when it comes to cloudification. Going “cloud native” has been in vogue in recent years. Some telcos have tried building their own private cloud, but many have given up, selling their datacentres, and embracing public cloud suppliers. More and more telcos are moving more and more of their non-core (and increasingly core) functions to the public cloud, which is dominated by Microsoft, Amazon, and Google.

It is ironic to note that while telcos and regulators are so concerned with the dominance of Huawei, Ericsson, and Nokia in the telecoms infrastructure market, not much a fuss is being made about the concentration of much bigger power in the hands of the small number of public cloud providers. Telecoms.com is one of the few voices that have repeatedly expressed this concern.

In comparison those sitting at the top of the financial industry have at least noted the risk. In July, Andrew Bailey, Governor of the Bank of England, pointedly said the “concentrated power on terms can manifest itself in the form of secrecy, opacity, not providing customers with the sort of information they need to monitor the risk in the service.” He also added that “in terms of the standards of resilience and the testing of those standards of resilience, frankly we will have to roll some of that back, that secrecy that goes with it. It’s not consistent with our objectives.”

The financial industry practitioners have also recognised the risk. Though not highlighted in Zac Maufe’s blog, the full report does stress that 88% of the firms that are not using multicloud “are considering adopting a multicloud strategy in the next 12 months. This is likely due to a need for financial services firms to enhance resiliency and reduce vendor lock-in, a concern called out by 26% of respondents.”

The financial industry is not entirely trusting the cloud platforms to carry their most important tasks. Despite the positive spin Google gives it and the attempt to blame regulators for holding the industry back, the low level of cloud migration of core underwriting activity is an indication that the financial sector is cautious when entrusting their most valuable assets to care by others.

These are concerns that the telecoms industry may very well take heed of. As the old sayings go, “don’t put all your eggs in one basket” and “protect the family silver”.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)