Global PC shipments slump 30% in Q4 2022Global PC shipments slump 30% in Q4 2022

The PC market had a downright dismal end to 2022, and there could be worse to come in 2023.

January 13, 2023

The PC market had a downright dismal end to 2022, and there could be worse to come in 2023.

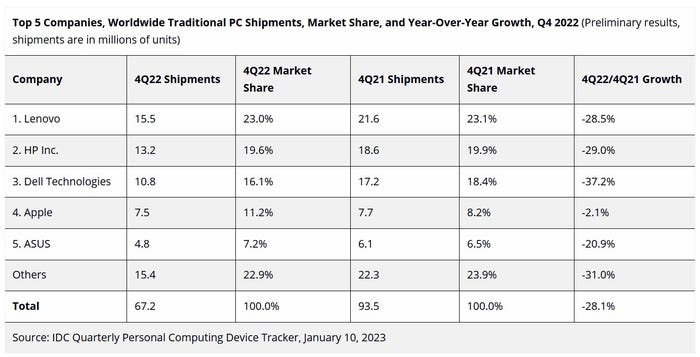

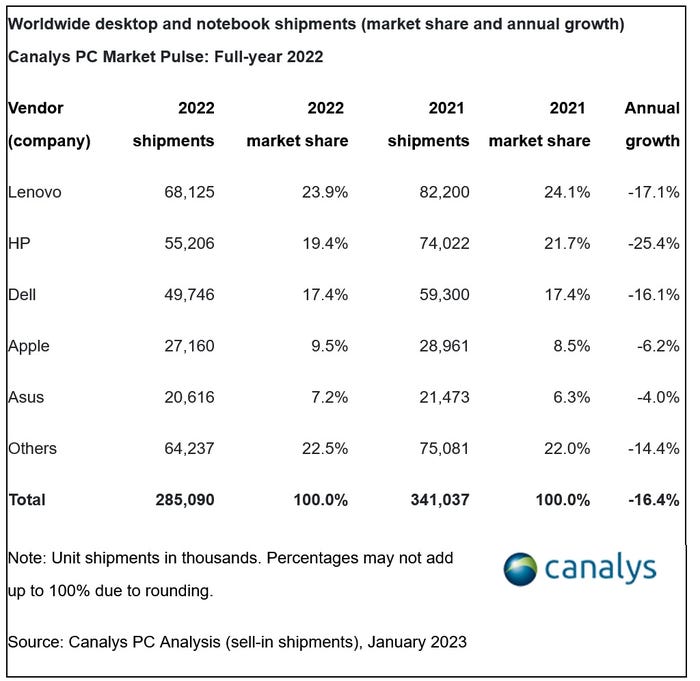

Three big analyst firms published stats this week that made for grim reading. The consensus from Gartner, IDC, and Canalys is that fourth quarter shipments came in at somewhere around 65-68 million units, down almost 30% compared to last year.

Dell had a particularly tough time of it, with shipments falling more than 30% year-on-year to 10.8 million units, according to IDC and Canalys.

Overall, Gartner said Q4 2022 marks the largest quarterly shipment decline since it began tracking the PC market almost 30 years ago, while Canalys pointed out that it marked the fourth consecutive quarter of declines.

The silver lining is that the PC market was due a comedown from its pandemic-induced high, when housebound consumers were prepared to blow their holiday money on some new tech to make lockdown life more bearable.

“Consecutive quarters of declines clearly paint a gloomy picture of the PC market, but this is really all about perception,” said Ryan Reith, group vice president of IDC’s worldwide mobility and consumer device trackers, in a statement on Tuesday. “2021 was near historic levels for PC shipments, so any comparison is going to be distorted.”

Gartner put full-year 2022 volume at 286.2 million units, broadly in line with 2019. Meanwhile, Canalys’ and IDC’s figures added up to 285.1 million and 292.3 million respectively, and both of them said this represents an increase on pre-pandemic shipments.

This barely qualifies as a crumb of comfort though, because the worsening economic outlook means fewer people are prepared to cough up for a new PC.

“The anticipation of a global recession, increased inflation and higher interest rates have had a major impact on PC demand,” said Mikako Kitagawa, director analyst at Gartner, in a statement on Wednesday. “Since many consumers already have relatively new PCs that were purchased during the pandemic, a lack of affordability is superseding any motivation to buy, causing consumer PC demand to drop to its lowest level in years.”

On the commercial side of the market, “both public and private sector budgets faced tightening amid rising interest rates, slowdowns in hiring, and expectations of a recession early this year,” noted Canalys senior analyst Ishan Dutt.

Canalys polled 250 channel partners last month and found that 60 percent of them expect their PC business revenue to remain flat or decline in 2023.

“This challenging environment for the PC industry is anticipated to last until the second half of this year,” Dutt said.

This tallies with Reith at IDC’s view that “the market has the potential to recover in 2024 and we also see pockets of opportunity throughout the remainder of 2023.”

Sectors of the economy where spending is viewed as discretionary can be viewed as the canary in the coal mine when it comes to the broader economy, so even though a slowdown in the PC market was in the forecast, the size of the slump is still troubling. It’s also worth remembering that the global smartphone market had a torrid time of it in Q3 and that Q4 figures have yet to be published, so there could yet be more bad news on the horizon.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)