Investing in Africa tip eight: Build a distinct brandInvesting in Africa tip eight: Build a distinct brand

Mobile operators in Africa are fortunate. Unlike in some of the world’s more developed markets, trust and familiarity are associated with many operators. The very fact that in many cases the mobile handset has empowered individuals means that mobile consumers often have a great affinity with the mobile operator brand.

April 9, 2010

Mobile operators in Africa are fortunate. Unlike in some of the world’s more developed markets, trust and familiarity are associated with many operators. The very fact that in many cases the mobile handset has empowered individuals – be it by allowing consumers to transfer money, advertise their services to a wider audience, or allow them to source useful local information, such as crop prices – means that mobile consumers often have a great affinity with the mobile operator brand. A mobile phone is not a piece of technology, but a life-aid, something that is aspirational and heralds a bright future.

Whilst this provides a great opportunity, a brand is not just a logo or a tagline, but a portrait of an operator’s entire customer-facing performance, depicting network reliability, service portfolio, pricing, channels to market and customer support.

Any investor entering the market will have to work to build up its brand value but if it can show itself to be reliable in terms of network quality or innovative in providing a service that is relevant to end-users, it will be able to build a strong and distinctive brand. A local flavour will help, and this will require local market knowledge. Despite investing heavily in its brand, Zain suffered from its top-down approach of management with too much emphasis coming from its headquarters based in the Middle East. Being regionally headquartered in Africa would help a new operator group show that it is serious in creating management positions at a local level, and services that are relevant to specific markets. Certainly MTN has benefited from the fact that it is not too centralised an organisation, and has successfully transplanted many best practice business models from one market to another.

An area in which there is scope for a newcomer to offer something distinctive is in the enterprise space. MTN has been more successful in this area than many others, but most operators have failed to build any brand within the business enterprise segment, in providing broadband or managing networks. This gives an opportunity for an operator with that experience in its own domestic market, such as Airtel.

A new investor may be tempted to compete on price in reaching out to the mass market. Although possible to achieve, but only with a crafty cost management model and marketing muscle, this may not be the best way to build a new brand. Rather than this, network reliability, comprehensive coverage and a wide-ranging product portfolio would play out well in many African markets.

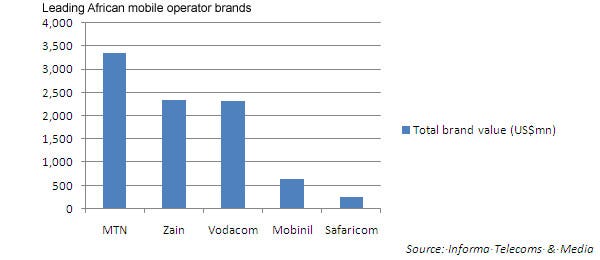

Whomever the investor and however it looks to build brand, it will have to compete with one of the largest brands across Africa, MTN. As a sponsor of the FIFA 2010 World Cup, the operator will surely succeed in building up its brand further, both internationally and across new consumer markets within Africa. To retain this momentum MTN has entered into a strategic alliance with arguably the world’s best supported football club, Manchester United. The deal will allow the African operator to provide exclusive mobile content and match highlights as well as customised ringtones, all of which will be downloadable via MTN’s Play entertainment portal.

intelligencentre

Source: Intelligence Centre

With regards brand, most important for any newcomer will be the ability to show that it is reliable in its service delivery and that it performs well from a customer care perspective. If it can appeal to the mass market by being competitive on pricing, so much the better, but only if this does not come at the expense of a deteriorating quality of service. Indeed, positioning oneself as the operator of choice for the growing enterprise market may, in fact, be a sounder strategy.

Once a sound financial footing has been established, the new investor should look to increase its African footprint through acquisition, and seek to compete with MTN directly on reliability, service offerings and tariffs. It is only by competing with the largest telecoms operator brand in the region that it can hope to build up its own distinctive regional brand.

africanbrands

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)