Investing in Africa tip nine: Expect market consolidationInvesting in Africa tip nine: Expect market consolidation

It is inevitable that the African market will go through a period of consolidation. Governments have distributed new mobile licenses liberally and profited as a result. So too have the consumers in most markets. Competition has led to a greater choice of provider and lower pricing, although not necessarily high quality.

April 12, 2010

It is inevitable that the African market will go through a period of consolidation. Governments have distributed new mobile licenses liberally and profited as a result. So too have the consumers in most markets. Competition has led to a greater choice of provider and lower pricing, although not necessarily high quality. But the simple fact is that in many of Africa’s markets, there are simply too many mobile operators for all to be profitable. Even an investor with the size and scale of Zain has struggled and has only returned a profit in a few of its sub-Saharan African markets.

Any new operator entering Africa must accept that it does so shortly before a period of market consolidation. Rather than fear this, it should welcome it as an opportunity and see it as a chance to divest any legacy stakes that it might have picked up and does not find attractive, perhaps because the market is already too crowded, or because it does not have enough growth potential.

In the same vein, there may be acquisition opportunities. Taking those markets in which Zain currently has an interest, there is potential to take advantage of any future market consolidation. Could Warid be prepared to sell its stake in Uganda where it has a 16 per cent market share? Only recently Airtel acquired its Bangladeshi operation where as in Uganda, Warid was one of six players. In another crowded market, Tanzania, four operators between them have a 10 per cent share of the market – surely there is scope here for market consolidation from which one of the larger operators could build market share.

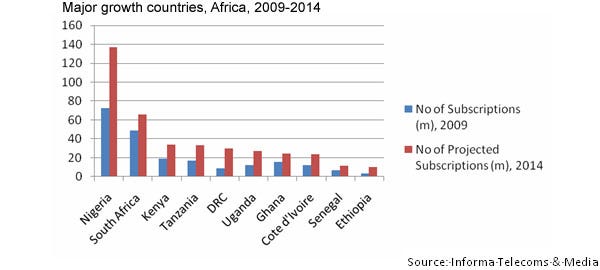

Taking a look at population sizes, the two most attractive markets south of the Sahara would seem to be Nigeria and South Africa. The latter is a saturated market and entering this market would involve competing head-on with Vodacom and MTN. There is little potential here for quick growth. Nigeria on the other hand remains under-penetrated, if not under-served by operators. Indeed, Nigeria is the market most likely to face a period of market consolidation. Despite the existence of 11 providers (four national GSM players and several alternative and former PTT players operating under the blanket of universal service licenses), only three have double-digit market shares – MTN, Globacom and Zain.

A SIM penetration in Nigeria of below 50 per cent (as of end-2009) suggests that there is strong growth potential in Nigeria, and Informa’s growth projections suggest that Nigeria will be catapulted into the elite group of countries that has more than 100 million SIMs by the end of 2011.

However, there are several other markets that will be attractive to a new investor, and especially the three leading east African markets – Kenya, Tanzania and Uganda – as well as DRC, even if this does involve a network sharing agreement.

intelligencentre

Source: Intelligence Centre

A positive M&A strategy will be paramount to success for a new investor. And whilst, the usual metrics of subscription numbers, ARPU and MoU should be fully taken into account, acquisition decisions must also take into account local demographics, macroeconomics, the regulatory climate, the current competitive landscape and an understanding of the type of services that might be attractive in a particular market. If the right decision is made on these factors, there is M&A potential across the region in a wide variety of markets.

growthcountriesafrica

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)