Softbank to acquire 70 per cent in Sprint

Japanese carrier Softbank has announced its intention to acquire a 70 per cent stake in US operator Sprint. Softbank will invest $20.1bn into Sprint; $12.1bn of which will be paid to its shareholders and $8bn will be used as new capital.

October 15, 2012

Japanese carrier Softbank has announced its intention to acquire a 70 per cent stake in US operator Sprint. Softbank will invest $20.1bn into Sprint; $12.1bn of which will be paid to its shareholders and $8bn will be used as new capital.

The transaction has been approved by the boards of directors of both operators but is subject to approval from regulators and Sprint shareholders. The companies expect the transaction to close in mid-2013.

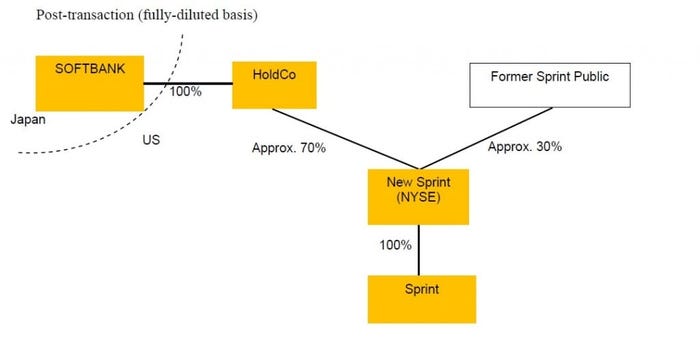

The US operator will take a new ownership structure; ‘New Sprint’ will be established as the parent company of Sprint. Softbank will set up a US holding firm, HoldCo, which after the transaction, will own 70 per cent of New Sprint. The existing shareholders of Sprint will own the remaining 30 per cent of New Sprint, which will be listed on the NYSE (see below).

Source: Softbank

Softbank said that the acquisition will rank it third among global operators in terms of combined mobile telecom service revenue. Sprint’s current CEO Dan Hesse will be the CEO of New Sprint

“This is a transformative transaction for Sprint that creates immediate value for our stockholders, while providing an opportunity to participate in the future growth of a stronger, better capitalised Sprint going forward,” he said.

“Our management team is excited to work with Softbank to learn from their successful deployment of LTE in Japan as we build out our advanced LTE network, improve the customer experience and continue the turnaround of our operations.”

Masayoshi Son, chairman and CEO at Softbank added: “Our track record of innovation, combined with Sprint’s strong brand and local leadership, provides a constructive beginning toward creating a more competitive American mobile market.”

Under the terms drawn out, if the merger does not close because Softbank does not obtain financing, the Japanese firm must pay Sprint a termination fee of $600m. Sprint must pay Softbank $600m if the merger does not close because Sprint accepts a superior offer by a third party; and Sprint must pay up to $75m of Softbank’s expenses if Sprint’s shareholders do not approve the transaction at their shareholder meeting.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)