Turkey now has just one privately-owned operator

The stage is set for a dramatic reshaping of Turkey's telecoms market.

March 15, 2022

The stage is set for a dramatic reshaping of Turkey’s telecoms market.

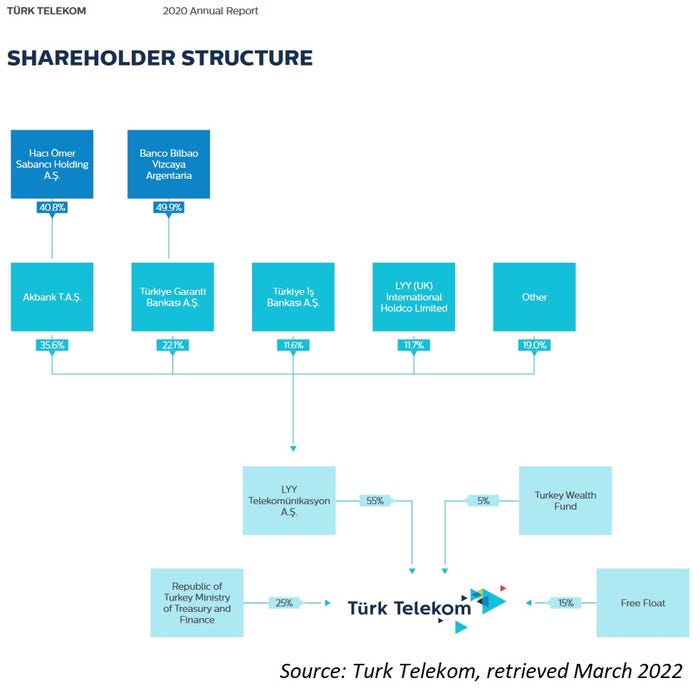

Turkey’s sovereign wealth fund TWF late last week struck a deal to buy out LYY Telekomünikasyon – the group of Turkish banks that owns 55% of Turk Telekom – for $1.65 billion. TWF, which already owns 6.68 percent of the operator, had been negotiating the acquisition since December.

TWF said the acquisition demonstrates its trust in the long-term outlook of Turkey’s telecommunication industry, and the sustainability of Turk Telekom.

“As TWF we focus on creating value in line with our mission as an asset-based development fund. Our primary goals include maximising the value of our assets and supporting the emergence of regional and global leading companies from Turkey,” said TWF CEO and board member Arda Ermut, in a statement. “Turk Telekom is such a company that aligns with our strategies and objectives with its potential and brand value. In this regard, we have signed a SPA (share purchase agreement) to acquire 55 percent of the total capital of Turk Telekom, a brand not only renowned in Turkey but also globally.”

The acquisition raises questions about the future composition and direction of Turkey’s telecoms sector. In 2020, TWF became the controlling shareholder of Turk Telekom rival Turkcell, when it acquired a 26.2% stake in the company, 24.02% of which was held by Sweden’s Telia. The deal gave TWF the power to appoint five of Turkcell’s nine directors. Therefore unless some ring-fencing takes place to create clear daylight between TWF’s stakes in these operators, there is an obvious conflict of interest here that is almost tantamount to a renationalisation.

Where does that leave Vodafone? The UK-based telco group is under pressure from activist shareholder Cevian Capital to consolidate in some of its markets, but Turkey isn’t one of them. In its most recent quarterly financials, Vodafone reported “good commercial momentum, with 332,000 mobile contract net additions”. Postpaid churn improved by 2.5% points year-on-year and service revenue increased thanks to growth in roaming and wholesale revenue, and ARPU.

For now, Turkey is home to three mobile operators, all of which have a healthy share of the market. Recent figures published by Turkey’s regulator BTK show there were 86.95 million mobile subscribers at the end of Q3 last year. Market leader Turkcell accounted for 35.66 million; second-placed Vodafone had 27.43 million; and Turk Telekom had 23.86 million. Competitive pressure is significantly lower compared to some of Voda’s other markets like Spain, Italy and the UK, for instance.

However, that could all change depending what TWF does with Turk Telekom and Turkcell. Should those two begin to coordinate against Vodafone, or if TWF merges them, then Vodafone might come under the kind of pressure that would force it to consider its position. Or, TWF might be planning to carry out a full renationalisation of the telecoms market. If that sounds like too much of a stretch, it’s worth remembering that the chairman of TWF happens to be one Recep Tayyip Erdoğan, president of Turkey. Ultimately then, whatever Vodafone has planned for its Turkish operation might prove to be a moot point.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)