Avaya reveals new turnaround strategy: go bankrupt

Struggling unified comms vendor Avaya has announced a cunning new business strategy consisting of filing for bankruptcy, then rising once more like a phoenix from the flames.

January 20, 2017

Struggling unified comms vendor Avaya has announced a cunning new business strategy consisting of filing for bankruptcy, then rising once more like a phoenix from the flames.

The stated reason for opting for Chapter 11 protection is to enable the company to restructure its balance sheet, which seems be another way of saying ‘do something about the crippling amount of debt we’re in’.

It is, of course, standard business practice to euphemise frantically when things go wrong, and one person’s restructuring is another’s corporate panic attack. But filing for bankruptcy must surely only ever me a last, desperate course of action taken when all other options have been exhausted.

“We have conducted an extensive review of alternatives to address Avaya’s capital structure, and we believe pursuing a restructuring through chapter 11 is the best path forward at this time,” said Kevin Kennedy, CEO of Avaya. “Reducing the company’s current debt through the chapter 11 process will best position all of Avaya’s businesses for future success.

“This is a critical step in our ongoing transformation to a successful software and services business. Avaya’s current capital structure is over 10 years old and was put in place to support our business model as a hardware-focused company, which has evolved significantly since that time. Now, as a result of the terms of Avaya’s debt obligations and the upcoming debt maturities, we need to recapitalize the company.

“Our business is performing well, and we are confident that we can emerge from this process stronger than ever, as this path is a reflection of our debt structure, not the strength of our operations or business model. Pursuing restructuring through chapter 11 will enable us to reduce Avaya’s debt and interest expense, while providing increased financial flexibility to further invest in innovation and growth to enhance our market-leading competitive position.”

So how the hell did Avaya get itself in so much debt? The answer would appear to lie in its acquisition by private equity firms TPG and Silver Lake back in 2007, prior to which it was a public company spun out of Lucent in 2000. Private equity buy-outs often involve a lot of debt and it seems this was no exception.

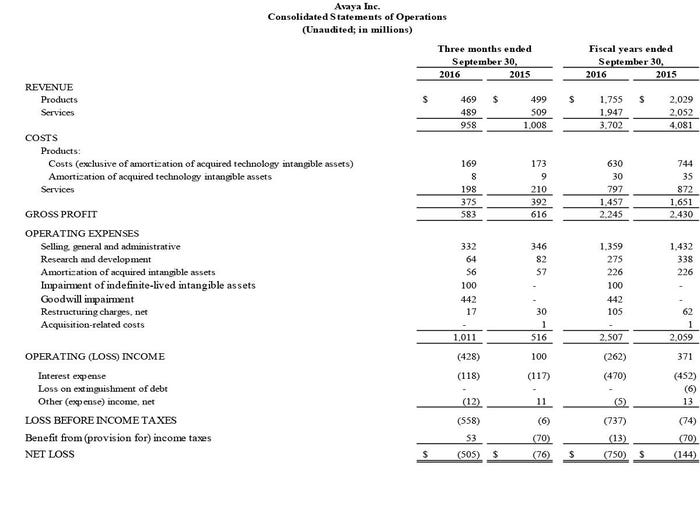

This announcement coincided with Avaya’s Q4/FY 2016 earnings and a look at the P&L below reveals Avaya spent $470 million last year just on servicing interest and it booked a similar amount for ‘goodwill impairment’, which seems to refer to its collapsing hardware business. Removing those two costs would have yielded a profit, rather than $750 million loss.

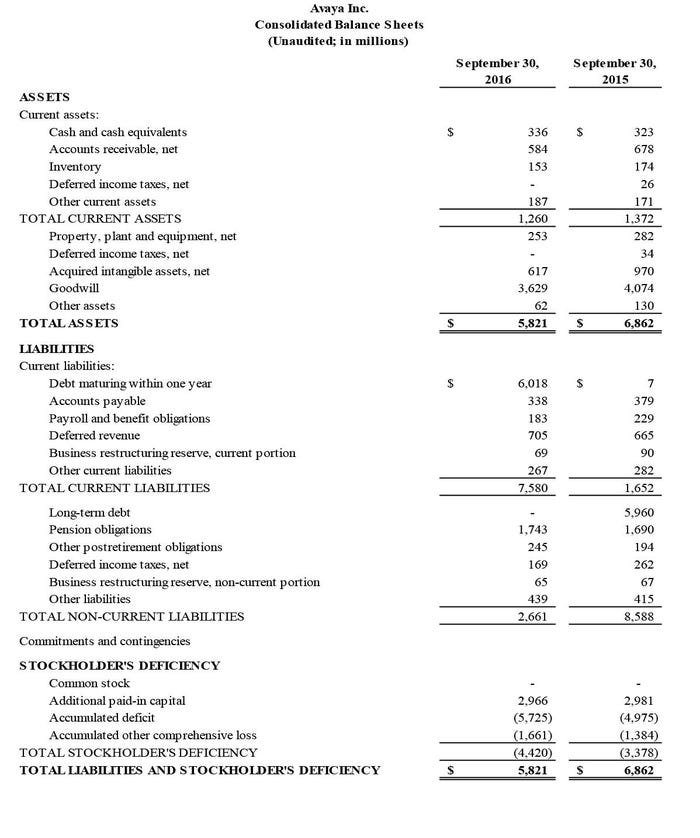

The balance sheet makes for even bleaker reading, revealing a total stockholder deficiency of $5.8 billion, including $6 billion of debt maturing this year and pension liabilities of around $2 billion. The movement of that debt from the long term to the short term column – ten years after the buy-out – seems to be the reason why it’s bankruptcy time.

This, presumably, is not how TPG and Silver Lake saw things going when they made their move. A combination of the banking crisis, strong competition from the likes of Cisco and Microsoft, and the decline in demand for UC hardware seem to have been among the unforeseen challenges. Focusing exclusively on software and services seems sensible but presumably even a Chapter 11 filing won’t just magic all that debt away.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)