Three moans about spectrum allocationThree moans about spectrum allocation

Three UK CEO Dave Dyson has claimed the imbalanced distribution of spectrum is harming consumers and challenger mobile players alike.

September 6, 2016

Three UK CEO Dave Dyson has claimed the imbalanced distribution of spectrum is harming consumers and challenger mobile players alike.

In the telco’s half annual investor call, Dyson provided the standard rhetoric of a company lobbying for change by playing the role of consumer guardian, saying Ofcom needs to revise existing spectrum distribution policies.

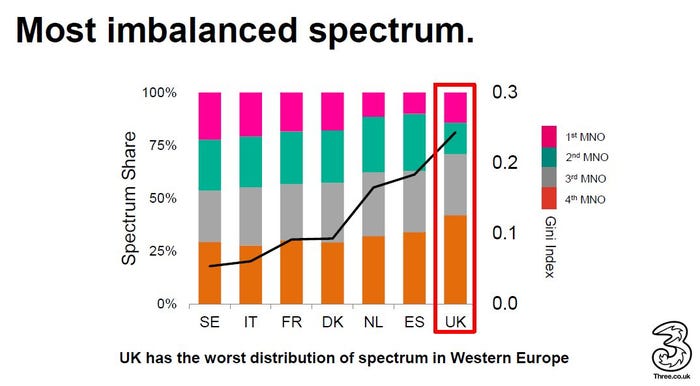

As it stands, BTEE holds 42% of available spectrum and Vodafone 29%; while Three and O2 lag behind with just 15% and 14% respectively. Three says this disproportionate distribution of spectrum is the worst in Europe harms consumers and says Ofcom should limit the allocation of spectrum to any one operator at 30%. The chart below illustrates the imbalance, with a questionably relevant reference to the Gini Coefficient, and appears to do little more than provide a jagged upwards line to help reinforce Three’s point.

Revising this policy, according to Three, means consumers will benefit from a greater choice of fast, reliable networks in their area.

“Three believes fair access to spectrum is critical for a better mobile market for everyone. It’s key for a thriving UK digital economy and for continued innovation in mobile,” the operator said in a statement. “Three is calling on Ofcom to put a cap in place so that no one network can own more than 30% of the airwaves post-auction.”

It went on to say that the upcoming spectrum auction in 2017 will be the ideal time to have a revised policy in place, allowing industry challengers to rival leaders EE and Vodafone.

“Three calls on Ofcom to deliver a better mobile market through the upcoming spectrum auction. In 2017 Ofcom, the industry regulator, will be auctioning off a further tranche of spectrum to be used for mobile phones. By selling more of these vital airwaves (190 MHz of high-capacity spectrum), networks will, in theory, be able to increase their capacity and help the UK mobile industry improve. This autumn, Ofcom will consult on the rules for the auction.”

In a presentation filled with talk along the lines of “look how much more decent we are than our competitors, despite their clear advantages”, Three’s UK revenues shrunk 2% year on year. The operator puts this down to declining handset revenues, a problem not unfamiliar to the rest of the industry. Encouragingly, however, net customer service margin looks to be on the rise, up 4% year on year.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)