Rakuten investigates LEO-based satellite IoT techRakuten investigates LEO-based satellite IoT tech

Japanese mobile upstart Rakuten has teamed up with the University of Tokyo to look into whether low Earth orbit (LEO) satellites can feasibly offer a direct connection to IoT devices.

November 29, 2021

Japanese mobile upstart Rakuten has teamed up with the University of Tokyo to look into whether low Earth orbit (LEO) satellites can feasibly offer a direct connection to IoT devices.

Rakuten has a vested interest here. It is working with US-based AST & Science, which has developed a solution that enables LEO satellites to offer 4G and 5G connectivity directly to unmodified smartphones. Rakuten, along with Vodafone, is helping to fund the development and deployment of AST’s LEO network, SpaceMobile. Voda and Rakuten have also previously been lead investors in AST funding rounds.

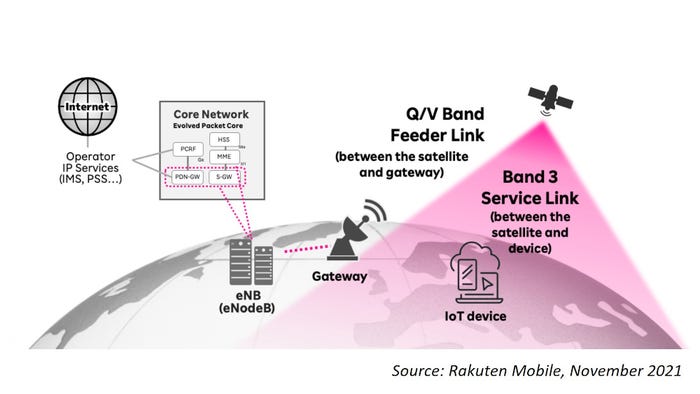

Normally with satellite-based communications, terminals either incorporate the antennas needed to connect to a satellite, or they connect to a terrestrial network which then hands off to a satellite via a gateway. What Rakuten and the University of Tokyo want to know is whether a cheap, off-the-shelf IoT device that uses LTE or NB-IoT can communicate directly with an LEO satellite.

“By building an NB-IoT and LTE network using satellites, it will become possible to provide low cost IoT services for various industries in locations that would typically be out of network coverage, such as mountainous areas, remote islands or on the sea,” Rakuten said, in a statement.

The R&D project kicks off this month and is due to run right through to March 2025. If all goes well, it represents another potential string to AST & Science’s bow, which could prove vitally important to its long-term prospects.

With just one test satellite in orbit, the company is still very much in the early phases of development. It planned to launch its second – BlueWalker 3 – before the end of this year, but that was pushed back to around next March. However, it emerged in its most recent quarterly financials that AST is considering delaying the launch again by a few months to allow more time for testing (see this recent Light Reading article for more on that).

Satellite networks – particularly LEO networks that require many, many satellites to deliver broad coverage – are a costly business, what with all the technical complexity and rocket fuel involved, and as such there have been one or two budding LEO providers that have fallen short. Most notable of these was LeoSat, which ran out of steam in late 2019. Then there is OneWeb, which needed a bailout from Bharti and the UK government in order to keep the lights on. Meanwhile, the geostationary satellite sector has seen some consolidation lately, with US-based Viasat earlier this month reaching a $7.3 billion deal to buy UK-based Inmarsat.

Despite AST having some big-name backers, it still needs to pull out all the stops to ensure it doesn’t become another also-ran in the current space-race.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)