Will the spectrum goal posts move in operators’ favour?Will the spectrum goal posts move in operators’ favour?

The competition in wireless service provision is as fierce as ever. To make matters worse, it looks like the rules of engagement might soon change. With Dell, Microsoft and Google’s recent interest in the use of TV white spaces for broadband access, the cellular operator’s competitive advantage of a high-value spectrum licence may not last.

November 17, 2010

The competition in wireless service provision is as fierce as ever. To make matters worse, it looks like the rules of engagement might soon change. With Dell, Microsoft and Google’s recent interest in the use of TV white spaces for broadband access, the cellular operator’s competitive advantage of a high-value spectrum licence may not last.

The challenge for cellular operators is to stay ahead of this new group of competitors. If there are benefits to be had from changes in the regulatory environment and from the dynamic spectrum access technologies this encourages, cellular operators need to ensure that they rather than their new competition are the first to benefit.

How do cellular operators remain competitive in a changing spectrum environment?

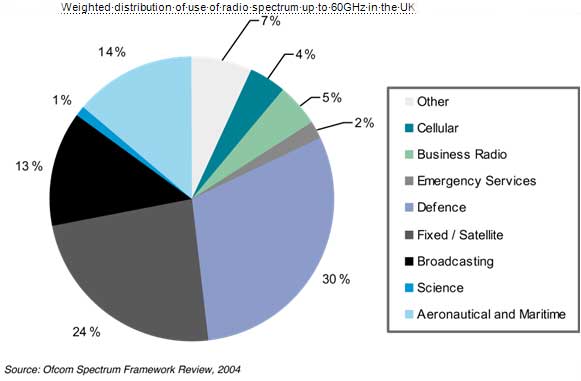

Cellular operators have paid a high price for the relatively small amount of spectrum made available to their industry. Only a small proportion of spectrum is assigned to cellular services and as a result competition for it is high. The £22bn paid, collectively, for the UK’s 3G licences in 2000 illustrates the level of competition for this limited spectrum resource and was justified through some careful planning, and based on a payback period measured in decades.

The high value placed on cellular spectrum was justified based on the following two assumptions:

• Spectrum has international importance and network equipment will be cost-effective. The harmonisation of spectrum across multiple countries has meant a truly global service can be offered, and significant economies of scale can be made by equipment vendors providing products built around a common set of frequencies suitable for all territories.

• Cellular spectrum is scarce and available to just a few. The bids made by cellular operators for 3G spectrum assumed that a limited number of licences were available and so there would be a limited number of competitors able to exploit this scarce resource of spectrum.

spectrum-uk

The regulatory landscape is changing – operators need to ensure that these changes reflect their interests

Changes in both wireless access technologies and in the wireless regulatory environment mean that this second assumption is now being challenged. New opportunities are opening up for other wireless service providers to acquire spectrum. In a bid to make more efficient usage of spectrum, communications regulators are keen to apply more flexible, technology neutral regulation, enabling spectrum allocation to be driven by market mechanisms rather than by traditional fixed allocation. In some countries this has included considering spectrum sharing and spectrum trading in particular bands and locations.

These changes in regulation are opening up cheaper alternatives for spectrum in the wireless services market which in turn is breeding new competition. For example, the 3.5GHz WiMAX regional licence for Greater London in the UK is reported to have been sold for up to 500 times less than 3G licences when compared on a price per MHz per head of population basis.

For cellular operators these changes are a risk. The spectrum goal posts around which they have built their business models are changing.

As the demand for high data rate wireless services continues to increase so too does the incentive to make better use of available spectrum. The Frequency Allocation Tables for many countries might give the impression that the RF spectrum is over-used and congested. But measurements of actual spectrum usage show that depending on location, frequency, and time of day, large amounts of spectrum are being underutilized. This waste is caused by inefficiencies in the fixed legacy approach to spectrum licensing where a single licensee is allocated a specific frequency band, and is bound by particular technology constraints within that band. This licencing approach overlooks the fact that the licensee may not be using that spectrum all of the time or in all locations.

To resolve these inefficiencies, regulators have looked at more flexible and dynamic ways of licensing spectrum. One technology that is increasingly being considered to support this is Cognitive Radio (CR). CR builds on the flexibility of Software Defined Radio (SDR) by adding the intelligence to sense and adapt to the operating environment. CR makes it possible to make use of temporarily unused pieces of spectrum, resulting in significant improvements in efficiency.

Regulators in the US and UK have shown particular interest in CR over the past five years, as summarized in figure 2. A major milestone came in the US in November 2008 when the FCC voted to allow wireless devices to operate as secondary users in the so called “TV white spaces”. These white spaces are the parts of the TV broadcast spectrum that are unused in particular locations due to some channels not being available on a nationwide basis. This move came after much lobbying by Google, Dell, Microsoft and others, and was followed in October 2009 by the roll out, in Virginia, of the first wireless broadband network to use TV white spaces.

In the UK CR was first highlighted by the communications regulator Ofcom in their Spectrum Framework Review in 2004. This set out Ofcom’s ambition to change the way they manage spectrum in the UK to a more flexible “market mechanisms” driven approach with the aim of improving spectrum efficiency. CR was mentioned as a technology that might enable more efficient sharing of spectrum.

Ofcom’s active interest in CR continues. Most recently they have been consulting on its potential usage in the interleaved Digital Terrestrial Television (DTT) spectrum being made available as part of the Digital Switchover (DSO). As with the US TV white spaces, the interleaved DTT spectrum is the portion of the DTT spectrum that won’t be used in all locations across the UK.

There is further motivation to adopt CR within the UK. The recently published Cave audit identified inefficient usage of public sector spectrum. As a result of this audit, the Ministry of Defence (MOD) in the UK initiated a spectrum reform program which is working to implement suggestions such as the release of spectrum around 3.4GHz into the public market.

All these changes are making CR a reality, and this is changing the regulatory landscape across which cellular operators must navigate.

But if these changes are a threat to incumbent operators, then they are at the same time an opportunity. The techniques of CR, and the spectrum within which these techniques can be exploited, can complement an operator’s existing assets. Improved efficiencies in existing service provision, and new complementary services are both possible. Although the commercial realization of such services may be some way off, it is now – as the regulatory framework gets established and new entrants vie to establish a foothold – that network operators must plan their approach.

Your competition is already putting significant effort into dynamic spectrum access technologies and you need to keep pace

Cognitive Radio has traditionally been viewed as principally an area for academic research with only limited use in the “real world”. However, in recent years significant interest and development effort is being put into this technology by both industry and academia.

The formation of the White Space Coalition, in late 2006, gave CR a firm commercial footing. This coalition, which includes Dell, Microsoft, Intel, Google and Philips, aims to provide wireless broadband access via TV white spaces. October 2009 saw the first trial of wireless broadband services provided via TV white spaces in Claudville Virginia. The trial used CR techniques to provide broadband access to rural communities at a low spectrum cost.

It is not only new entrants that are interested in CR. Based on our monitoring of newly declared patents related to the technology, PA has observed activity in this area from well known cellular companies such as Nokia, Samsung, AT&T and Motorola.

These patents have fallen generally into the following two CR approaches:

• sensing spectrum gaps and opportunistically making use of available spectrum. As an example Nokia has patented a technique for finding frequency slots over which a cognitive radio could send an opportunistic transmission; and

• geolocation and database assisted spectrum reuse. As an example Samsung has patented a method of operating a database for storing spectrum condition information about a licensed system in a Cognitive Radio system.

Along with the fundamental technologies that underlay CR there is a need to have flexible licensing of radio spectrum. This need is being addressed by an emerging industry segment. Enter the spectrum broker. Spectrum Bridge is an early example of a spectrum broker, providing an online spectrum marketplace. Through this marketplace, potential spectrum users can search for available bands in a particular area and make offers to acquire spectrum for a fixed period of time, and for a particular purpose. Spectrum has become a tradable commodity. It is no longer tied to a single licensee, and the geographic, time-based, and application-based restrictions to spectrum need no longer apply.

What role must an incumbent network operator play in this emerging market? With new entrants, new business models, and new applications their traditional position of strength may be under threat.

Exploited correctly, however, spectrum brokerage may be a commercial opportunity for the incumbent network operator – the licensee could become licensor. Equally spectrum brokerage may be seen as an opportunity to acquire cheaper spectrum outside the high value cellular spectrum and offload traffic bottlenecks onto complementary technologies. In addition, CR technologies may prove essential components of the incumbent network operator’s next network.

As we discuss below, CR technologies may prove essential to the success of emerging high bandwidth wireless standards.

Dynamic spectrum access techniques are more relevant to the cellular industry than you might first think

Early commercial exploitation of dynamic spectrum access techniques, and in particular CR, came in defence and public safety markets. Here, a relatively high terminal price was justified in return for the benefits of rapid deployment, reduced spectrum management overhead, adaptability and re-configurability.

However, CR is certainly not the exclusive domain of these markets. Various forms of CR are already widely adopted in commercial cellular systems, and are set to become more relevant in forthcoming standards.

For example, in LTE Self Organising Networks (SON) the technique of dynamically allocating data channels to different mobiles based on interference coordination information exchanged via a so-called “X2” link between basestations, as illustrated in figure 3, can be described as a CR technique.

In addition we have already seen CR techniques assisting in the femtocell industry. Here, such techniques are used to solve the problems of overlaying the smaller femtocells onto the macrocellular network without causing interference. The “network listen” feature already widely used in 3G femtocells can be viewed as a form of CR – adapting to the environment by listening for the presence of nearby macrocells and adapting behaviour so as to minimise interference.

The move to LTE, and the increasing dependence on small cell sizes to deliver the best user experience, will most likely further call upon the techniques of CR. Important interference mitigation techniques used in 3G networks to deploy femtocells will not translate directly to LTE due to differences in the underlying protocols – OFDM versus CDMA. But LTE must still solve these problems. It is most likely that they will be solved using an extension to the SON techniques, once again drawing on the benefits of CR. As illustrated in figure 3, LTE femtocells will struggle to implement SON as used at a macrocellular level due to the lack of an X2 interface into the main network. But techniques very similar to these will be required, and the LTE community are looking to the CR community to support this important further evolution of SON.

Indeed, the problems inherent in extending SON techniques to minimise interference from LTE femtocells share many of the challenges that the CR community has been considering for some time in the context of sharing spectrum between primary and secondary users. A common set of challenges will likely be met by a common set of solutions.

So, CR techniques are already deployed in cellular networks today, and look set to play an increasingly important role in next generation mobile broadband networks. The core technologies underlying CR will be fundamental to a network operator’s infrastructure in the coming years. Investing now to understand the benefits, and drawbacks, of these techniques will be important to help ensure that they are used to their best advantage.

The technology is in place, the regulatory environment is changing, and a new breed of competition is appearing

As we have seen, the regulatory environment surrounding radio spectrum allocation is changing. With more flexible and novel approaches to spectrum access there are new opportunities to acquire spectrum at lower cost, and with fewer constraints than ever before. A new generation of wireless broadband service provider is emerging to take advantage of this change.

CR will play a fundamental role in this new landscape of flexible, traded spectrum. Already in use today, the techniques of CR are also set to become important components of even mainstream cellular networks.

Although the final realisation of both the new business models and the underlying technologies of CR may still be some years off, we believe that now is the time for network operators to assess their options, understand the benefits, and plan their own path to successful exploitation of these exciting developments.

Frazer Bennett is an analyst with PA Consulting Group

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)