Comcast gazumps Murdoch/Disney with £22 billion bid for SkyComcast gazumps Murdoch/Disney with £22 billion bid for Sky

Giant US telco Comcast has upstaged Rupert Murdoch by offering £12.50 per share – around £22 billion – for Sky.

April 25, 2018

Giant US telco Comcast has upstaged Rupert Murdoch by offering £12.50 per share – around £22 billion – for Sky.

Murdoch’s 21st Century Fox bid £10.75 per share for Sky back in 2016 but the process has been bogged down by UK regulatory concerns that have called into question the prospect of it ever succeeding. Comcast seems to have taken advantage of this lull to swoop for the pay TV company and it wouldn’t be surprising to see Murdoch throw in the towel at this stage.

“We are delighted to be formalizing our offer for Sky today,” said Brian Roberts, Chairman and CEO of Comcast Corporation. “We have long believed Sky is an outstanding company and a great fit with Comcast. Sky has a strong business, excellent customer loyalty, and a valued brand. It is led by a terrific management team who we look forward to working with to build and grow this business.

“With its 23 million retail customers, leading positions in the UK, Italy, and Germany, and its history of strong financial performance, we see significant opportunities for growth by combining our businesses. Sky is a highly complementary business and will expand Comcast’s international footprint in the UK and Continental Europe.

“Sky will be our platform for growth across Europe. The combined customer base of approximately 52 million will allow us to invest more in original and acquired programming and more in innovation as we strive to deliver a truly differentiated customer experience. We look forward to receiving the necessary regulatory approvals.”

This is yet another example of a US telco looking to spend big on the content side of things. Comcast had already bought NBC Universal back in 2011 and now it clearly fancies expanding its operations internationally. Sky is arguably the most equivalent company to Comcast outside of the US.

The independent committee of Sky welcomes today’s announcement by Comcast of its firm intention to make a £12.50 per share pre-conditional cash offer for Sky, which follows its initial possible offer announcement on 27 February,” said the Sky announcement.

“The independent committee also welcomes the post-offer undertakings and commitments Comcast intends to give in relation to Sky’s existing business including Sky News, and believes that these voluntary commitments should comprehensively address any potential public interest concerns. In addition to Comcast and as required by the Takeover Panel, Sky also intends to give the same post-offer undertakings conditional upon the Comcast Offer becoming wholly unconditional.

“As a result of the announcement of this higher cash offer, the independent committee is withdrawing its recommendation of the offer announced by 21CF on 15 December 2016 and is now terminating the co-operation agreement entered into with 21CF on the same date.”

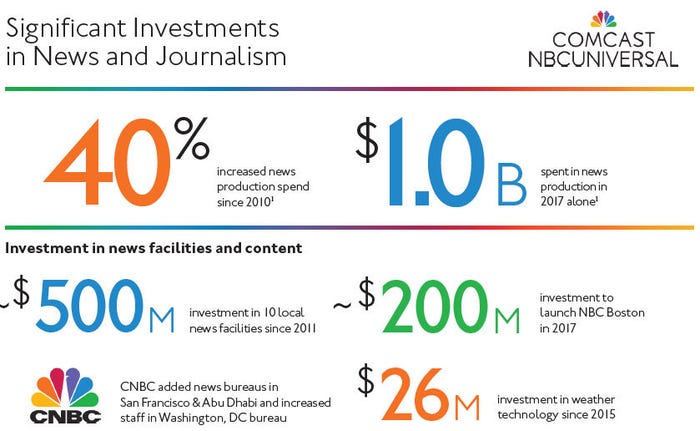

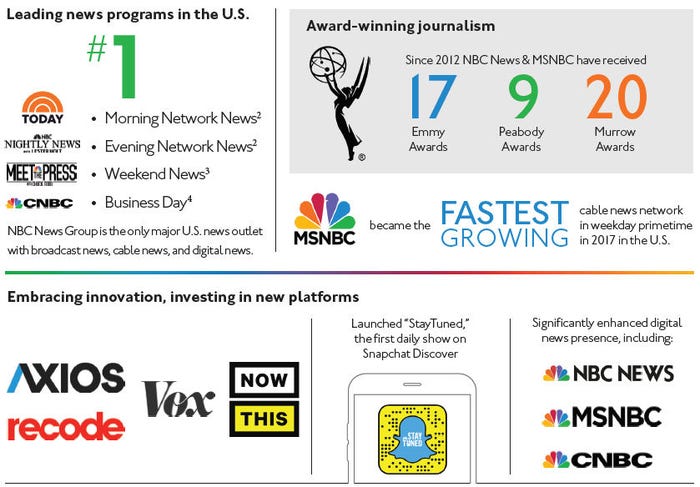

Since Fox has already accepted an acquisition bid from Disney, Comcast is effectively bidding against Disney on this one and may consider this to be an opportune time, while there is still uncertainty around the deal’s completion. Comcast has also gone to the trouble of publishing a presentation to show into news and journalism it is, presumably in anticipation of concerns about Sky News being closed down. Here it is.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)