Cellnex cheers organic growth as investor reshapes boardCellnex cheers organic growth as investor reshapes board

Cellnex's revenues are on the up, suggesting its new organic growth strategy is paying off, while its major shareholder is getting its feet under the table at board level.

April 27, 2023

Cellnex’s revenues are on the up, suggesting its new organic growth strategy is paying off, while its major shareholder is getting its feet under the table at board level.

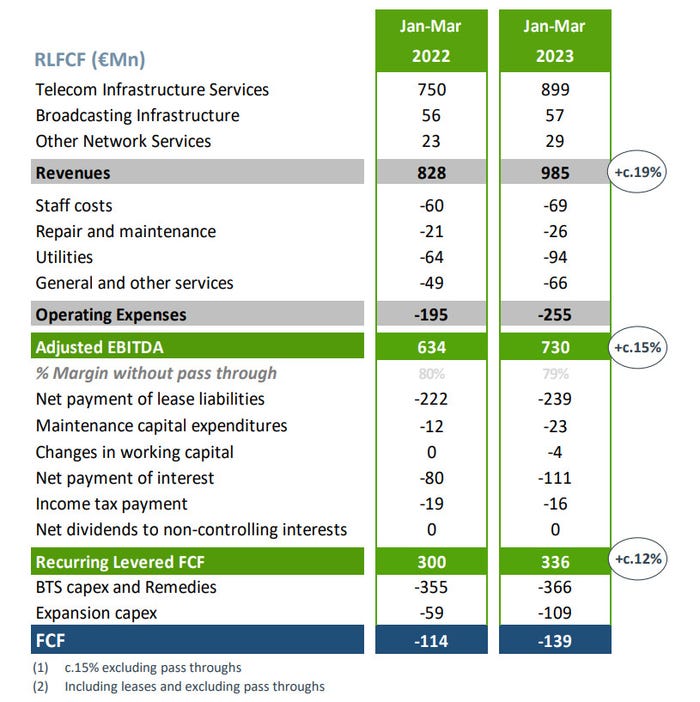

The Spanish passive infrastructure specialist posted revenues of close to €1 billion for the first quarter of this year and reported an increase in adjusted earnings, although its net loss continued to widen and debt crept up.

Specifically, the firm’s top line came in at €985 million for the three months to the end of March, an increase of €157 million on the year-ago quarter; €65 million – or just over 40 percent – of that growth came from organic sources, the company said.

It’s five months since Cellnex closed the acquisition of the final tranche of its €10 billion towers mega-buy from CK Hutchison and confirmed what it had been suggesting for some time: that its ambitious acquisition spree had come to an end and it would now focus on generating organic growth, with a view to securing an Investment Grade rating from S&P. Those first quarter numbers indicate that it is making progress on that score.

However, as we now know, the new strategy triggered a change in leadership, with outgoing CEO Tobias Martinez tendering his resignation at the start of this year; he remains in situ until his official departure date on 1 June.

“In the first quarter, we successfully met the group’s organic growth targets, which further reinforces the company’s alignment with the new strategic direction we announced last November,” Martinez said, in an understandably brief statement in which he also referenced the S&P goal once again.

But while Cellnex’s Q1 report shows it is heading in the right direction, the search for a new CEO to lead the charge is not happening quickly enough for some, particularly major shareholder TCI Fund Management.

In March the investor upped its stake in Cellnex to 9.38 percent and simultaneously published a letter to the board calling for the heads of three of its directors, including then-chairman Bertrand Kan, citing their lack of progress in appointing a new chief executive.

“We believe that the … hiring process for a new CEO has been mishandled by the board and resulted in insufficient progress to recruiting a suitable replacement. As a result we have lost confidence in Bertrand Kan, Peter Shore and Alexandra Reich as effective directors,” read the letter, signed by TCI Fund Management founder Christopher Hohn.

Days later Cellnex announced that former GSMA leader Anne Bouverot would step in as its new chair. Kan and Shore were out of the door within a couple of weeks, and just ahead of its results announcement Cellnex named their replacements.

Jonathan Amouyal represents TCI Fund Management on the Cellnex board – subject to ratification at the firm’s AGM – while María Teresa Ballester, founding partner of investment fund management company Nexxus Iberia, also steps into the board room. There has been nothing from Cellnex on TCI’s third target, Reich, who seems to be hanging on to her seat, at least for now.

With two new directors and a chairperson in place, and Martinez’s 1 June departure day fast approaching, we can reasonably expect an announcement from Cellnex on its next leader in the not-too-distant future. Whoever gets the nod, it’s certain to be more of the same from the company: organic growth above all.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)