Cellnex inks €971 million deal to sell out of IrelandCellnex inks €971 million deal to sell out of Ireland

Cellnex has announced its latest asset sale, brokering a deal to sell its Ireland business to Phoenix Tower International for around €971 million.

March 5, 2024

The deal comes as no surprise. Cellnex is on a very public mission to shore up its financial position, in part through asset sales, and late last year admitted that its business in Ireland was in line for the chop.

Details of the sale come alongside the publication of documentation to accompany the passive infrastructure specialist's Capital Markets Day, which is due to get underway later on Tuesday. Cellnex will there present a new strategic and financial plan as relatively new top leaders – chairperson Anne Bouverot and CEO Marco Patuano – seek to persuade disgruntled shareholders that they have things under control.

The divestment of the Ireland business forms part of this bigger picture for once expansionist Cellnex, which for a few years appeared to have bottomless pockets, as it picked up towers assets and significantly increased its footprint.

Cellnex acquired the bulk of its Irish assets as recently as three years ago, when it closed part of its €10 billion deal to pick up CK Hutchison's towers across a dozen European markets. That transaction gave it 1,150 of the approximately 2,000 sites it currently operates in Ireland.

Changes in the macro-economic climate and increased cost of capital encouraged Cellnex to put its chequebook away though, and instead focus on organic growth, debt reduction and securing an investment grade rating from S&P, a focus that only intensified after something of an investor revolt and change in personnel this time last year.

"The Company intends to use the proceeds from this transaction for deleveraging purposes and reiterates its unconditional commitment to become Investment Grade by S&P by end of 2024 the latest, as well as to maintain its Investment Grade status by Fitch," Cellnex said, announcing the Ireland deal.

"This transaction, along with additional strategic options for the portfolio of assets that could be assessed, will help Cellnex to crystalize value and accelerate said deleverage plan," it said.

We already know that Cellnex's business in Austria – also much increased as a result of the CK Hutchsion deal – is earmarked for sale and the company reiterated that point in its Capital Markets Day presentation, highlighting a possible disposal later this year. There could also be other divestments; Cellnex admits it will look at selling non-core assets, at the right price, if it helps to shore up its balance sheet.

The Ireland transaction represents an EBITDAaL ratio of around 24x based on projected 2024 numbers, Cellnex said. That's not a bad deal, particularly given the economic backdrop.

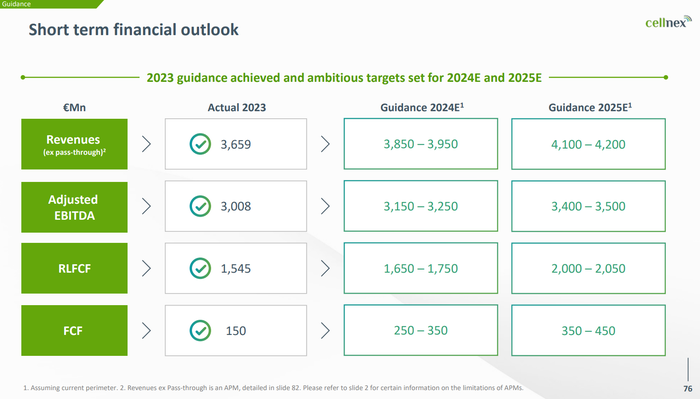

On a related note, Cellnex shared a new outlook for the current financial year and 2025 that shows, amongst other things, rapid growth in free cash flow; that figure could more than double this year compared with 2023, at the mid-range of Cellnex's estimates (see chart below). It also aims to exceed €4 billion in revenues in 2025 excluding re-billing from energy price pass-throughs. That's worth pointing out because Cellnex trumpeted reaching the €4 billion mark at its recent full-year 2023 results announcement, but that figure included pass-throughs.

Cellnex's Capital Markets Day is billed as the presentation of the next chapter of its strategy, including the simplification of its portfolio, changes to its reporting lines, and so forth. The company also discussed market changes, such as the fact that mobile operator consolidation in Europe could benefit, rather than challenge, its business, with merging operators in a stronger position to invest in their networks and the possibility of new market entrants providing new custom.

But underneath it all, Cellnex has one, clear goal: to make shareholders happy by improving returns.

After it hits its investment-grade target this year, Cellnex will shoot for a 5.0x-6.0x net debt/EBITDA ratio, freeing up resources for shareholder remuneration and/or industrial growth; it clarified that the latter would only happen under strict criteria. It expects to have €10 billion in available cash by 2030, a minimum of €3 billion of which will be paid out in dividends in the 2026-2030, the remainder going to share buybacks or to fund growth opportunities.

"Starting from 2026, shareholders can expect a minimum dividend payment of €500 million a year, with a minimum annual grow rate of 7.5% in the years to follow. Cellnex may consider earlier share buybacks and/or dividend payments contingent upon its leverage and rating," the company said.

There's clearly still an appetite for spending for growth at Cellnex, albeit in a more disciplined manner than in the past. But for now, it's all about organic growth and investor returns.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)