4G, mobile broadband and emerging devices: CTIA 20104G, mobile broadband and emerging devices: CTIA 2010

4G, mobile broadband and emerging devices were the key themes at CTIA Wireless 2010, held March 23-25 in Las Vegas, US.

March 29, 2010

By Mike Roberts

4G, mobile broadband and emerging devices were the key themes at CTIA Wireless 2010, held March 23-25 in Las Vegas, US.

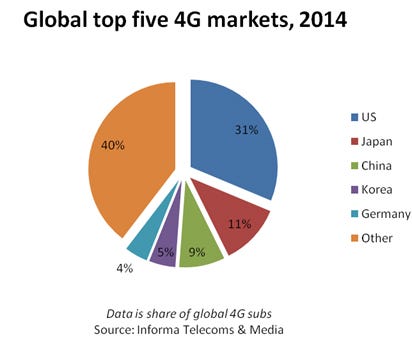

Although LTE and Mobile WiMAX may not be true 4G, as defined by the ITU, they are close enough as far as most in the mobile industry are concerned. In any case the US is leading the charge and will be the dominant 4G market through 2014, when it will account for 31 per cent of the world’s 4G subscribers, far ahead of the next-largest markets of Japan and China.

global-top-five-4g-markets

There were a number of 4G developments at CTIA, most notably when Sprint CEO Dan Hesse unveiled the HTC EVO 4G, which is set to be the first 3G/4G smartphone on the market in the US when it launches this summer. The Android device, which will run on Sprint’s CDMA network and Clearwire’s Mobile WiMAX network, has a 4.3 inch touchscreen display, can be a Wi-Fi hotspot for up to eight users, and supports 4G average download speeds of 3-6Mbps.Our view is that Sprint’s new 3G/4G handset is a milestone in the mobile industry, and could help Sprint slow and even stop its subscriber losses It’s a milestone because it’s the first dual-mode 3G/4G device launched in the US and one of the first in the world. It could also give Sprint an edge in attracting and retaining high-value smartphone customers, although every operator is targeting that segment, including AT&T with the iPhone. Sprint’s postpaid subscriber churn is twice as high as that of Verizon and AT&T, and devices like the HTC EVO 4G will be key to retaining and attracting customers. Of course Sprint’s new 4G device will only really come into its own when it has a variety of applications that take advantage of the faster speeds of 4G, and that will take time.

At the event Clearwire CEO Bill Morrow said the company’s Mobile WiMAX network currently covers a population of 30 million and will cover up to 120 million by end-2010. Morrow said Clearwire subscribers using portable devices have average data usage of 7GB per month, and that Clearwire can support this level of usage profitably. But Morrow, who previously headed Vodafone UK, argues that many cellular operators can only support usage of 3-4GB per month per subscriber, given prevailing tariffs. However cellular operators and vendors at CTIA disagreed with that assessment, arguing that HSPA and HSPA+ were competitive with Mobile WiMAX on cost per MB, and that LTE can undercut it.

Verizon Wireless used CTIA to confirm it is on track to launch LTE in 25-30 markets by end-2010, providing a population coverage of 100 million. The operator plans to double population coverage to 200 million by early 2012, and to have virtually nationwide coverage by end-2013, when 4 coverage will surpass that of its 3G network, partly due to the lower 700MHz frequency and greater cell range of the 4G network.

US regional operator MetroPCS is also on track to launch LTE by end-2010, according to its handset and network equipment vendor Samsung. Samsung says its SCH-r900 CDMA/Mobile WiMAX device will be launched by MetroPCS by end-2010 in markets including Las Vegas.

T-Mobile USA may not be planning 4G, but argues that it doesn’t need to since it is deploying HSPA+. The operator commercially launched its HSPA+ network earlier this year, and plans to have coverage in 100 markets with a population of 185 million by end-2010, which is the vast majority of its 3G footprint. The main constraint on the rollout is fiber backhaul for cell sites; the operator has 10,000 cell sites with fiber backhaul and plans to have 20,000 by end-2010. That is the vast majority of the operator’s 26,000 3G sites, and over half of its 46,000 total cell sites, which includes its GSM sites. The operator has commercially launched one HSPA+ device, a USB modem. During demonstrations on T-Mobile’s commercial network in Las Vegas the device was supporting download speeds of near 10Mbps.

At CTIA Informa also bumped into Rene Obermann, CEO of Deutshe Telekom, parent company of T-Mobile USA. When asked if the company was committed to T-Mobile USA, Obermann said “we got a little impatient before but now they [T-Mobile USA] have a good opportunity for differentiation, with HSPA+.”

Informa’s view is that the mobile broadband technology launches will provide better performance for subscribers but will not drive significant market share changes among US operators, since performance can be similar across Mobile WiMAX and HSPA+. However the new technologies should lead to lower costs per MB for operators, which in turn should lead to lower mobile broadband prices for US consumers. That will be welcome given that US mobile broadband prices are still relatively high in the US compared to other regions.

However operators argue that takeup would not be so strong if pricing was not competitive, and this is a fair point given that the US is the world’s largest mobile broadband market by far, with 91 million mobile broadband subscriptions at end-3Q09, ahead of Japan with 60 million and Korea with 31 million. Informa forecasts the number of US mobile broadband subscribers will top 100 million for the first time this year, grow 43 per cent to 118 million subscribers by the end of 2010.

Emerging devices was another key theme today at CTIA. AT&T announced that the OpenTablet by OpenPeak would launch in the US by end-2010 with embedded mobile broadband, and that the Zeebo gaming device would launch in the US in 2011 with embedded mobile broadband.

Informa’s view is that operators in the US and other developed markets are well aware that the classic mobile market is saturated, with penetration at 90 per cent of the population in the US at end-09 and expected to break through the 100 per cent barrier in 2013 to hit 105 per cent by the end-2013, according to Informa forecasts. The answer is to sell new types of devices, and to sell to machines as well as people – and operators are starting to see results.

For example AT&T reported that it added more than one million new emerging devices to its network in 4Q09, including devices such as Amazon’s Kindle. The mobile industry will focus more and more attention on the area to find growth as their traditional markets saturate. But these emerging devices can have very low ARPU for operators, so the challenge is to get many millions of them on their networks, so the total revenues start to become significant.

Read more about:

DiscussionYou May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)