5G growth isn’t enough to compensate Chinese operators’ subs loss5G growth isn’t enough to compensate Chinese operators’ subs loss

The total recent decline in mobile subscriptions reported by China’s mobile operators totaled 20 million and the ongoing Covid-19 pandemic isn’t the only reason.

March 24, 2020

The total recent decline in mobile subscriptions reported by China’s mobile operators totaled 20 million and the ongoing Covid-19 pandemic isn’t the only reason.

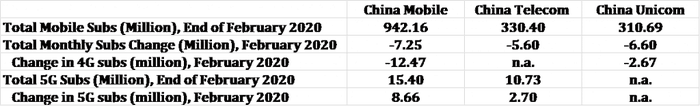

China’s three incumbent mobile operators have reported their latest results in the last few days. The numbers do not make happy reading. Put together, the three operators lost a total of 19.5 million mobile subs in February. Here is the breakdown:

Source: company reports, Telecoms.com summary

If the trend is nothing new, as the total subs have been going down for a while, the magnitude may be a surprise. A number of factors have contributed to the fall and the size of it.

The elephant in the room is apparently the coronavirus pandemic. Since late January China’s economy, and society as a whole, has been under a hard brake. In addition to the lack of demand from migrant workers and consumers holding their purse strings more tightly in general, mobile operators, beware of their balance sheet, have been controlling their subscriber acquisition cost and have largely scaled back their marketing investment. Another possible factor related to the pandemic is that, facing weak earning prospects, operators can be more active in clearing the inactive accounts on their networks, as a means to shore up ARPU by reducing the denominator. This is a normal “trick” used by operators everywhere.

A positive angle to read the numbers is to realised that the operators’ focus of investment has shifted to 5G. This has reflected in both strong 5G growth: China Mobile has clocked up over 15 million 5G subscribers four months after launch, including 8.7 million in February alone. China Telecom has signed up 10.7 million 5G subs, including close to 3 million in February. Such shift of focus has also reflected in fast reduction of subs on legacy networks. China Mobile lost 12.5 million 4G subs and close to 11 million 2G subs. China Telecom has stopped reporting its 4G subs numbers altogether.

Another recent contributing factor to the fast reduction and slow increase of subscriptions could be related to a new policy that came into effect on 1 December 2019. Facial recognition was added on top of photo ID when a new mobile account is opened, to ensure that the one opening the account is the same person as the legal ID cardholder. Operators may have also been retrospectively taking those subs that do not meet the new requirement off their database.

In general, we can expect to see continued reduction of total subs numbers reported by the Chinese mobile operators in the near future but the size of the reduction may become less drastic, as the effect of the new policy as well as investment focus shift will become normal business operations in the months and quarters to come.

Short-term improvement is expected when the worst of the Covid-19 impact in China is coming to an end. This may come less from the expected increase in migrant workers – since domestic roaming charge was done away with in 2018, there has been a marked reduction in demand for multiple local numbers – than from economic life gradually coming back to normal. The Financial Timesreported that China is going to relax the restrictions on movement in Hubei, the earlier epicentre of the pandemic.

However, there may still be some caveat. On one hand, China’s economy relies heavily on export. While Europe and North America are in the thick of battling the coronavirus with lockdown measures expanding to more places by the day, there is little prospect for China’s export-oriented enterprises to resume active business any time soon.

On the other hand, there is a question mark over how credible to official line of “zero new cases” is. Caixin, a business media outlet that prides itself for independent reporting, and is speculated to have backing from high places, reported that, Wuhan, where the virus originated, has kept finding new asymptomatic Covid-19 cases but is not recording or reporting them. Information like this may well dampen consumer confidence, however upbeat the official narrative may be.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)