A problem shared

In a frank assessment of the challenges facing European operators in deploying LTE networks, the chief technology officer of Orange Spain recently issued a rallying cry to the industry to collaborate on deep network sharing. Only by embracing this strategy, he told his peers, can operators hope to make LTE profitable.

July 9, 2012

Message management from vendors, trade associations and early moving operators usually ensures an air of optimism when a new network technology is introduced. And with LTE the industry has stayed true to form—‘onwards and upwards’ is the mantra. But at the LTE World Summit in Barcelona towards the end of May, the CTO of Orange Spain, Eduardo Duato, gave a keynote presentation that offered a dramatic contrast to the industry’s sunny default setting.

Unless operators are supported in a fundamental shift in deployment strategies, making LTE pay for itself could, for many of them, be impossible, he said. Only by embracing deep network sharing could operators in Europe—especially in the continent’s troubled economies—be sure of a meaningful return. Duato had little criticism for the technology itself, saying that it “holds the promises of the future,” and reporting that Orange Spain’s trials of LTE have yielded impressive results in terms of latency and throughput. LTE offers twice the spectral efficiency of HSPA, he added.

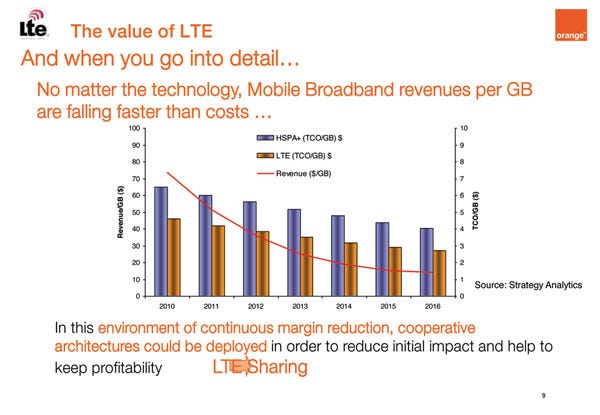

But none of that matters if it is not possible for operators to fund deployment based on projected revenues. While Orange’s calculations suggest that total cost of ownership should be 30 per cent lower for LTE than for 3G, Duato dismissed the suggestion that there are significant savings to be derived from simplicity of operation, arguing that this line had been spun to little avail with previous generations.

A new technology doesn’t change the fact that mobile broadband revenues are decreasing faster than the cost of network provision. This, he said, is the big problem. “Where is this taking us? Our marketing guys need to put together data tariffs— and these are extremely simple,” he said. “We calculate the cost per gigabyte in our network and add a fixed fee for the signalling traffic that smartphones introduce to the network— which is also growing very fast.

“But whatever we do, with the current scenarios that we are managing, [the results of the calculation] is that we always see a big drop in margins and revenues. Here in Spain we are unable to really come up with a solid business case for LTE; we only see erosion in the years to come.”

Duato may not be the only operator CTO thinking along these lines, but he’s the only one—so far—who has been prepared to stand up and voice his concerns in a public forum. LTE business cases are built on growth in demand for data services, and often on the idea that customers will be prepared to pay a premium for the improved performance the new technology offers. Duato acknowledged uptake forecasts from industry analysts but argued that the reality in much of Western Europe, and particularly in Southern Europe and in Spain, is that the revenue growth is not coming.

SPONSORED_GEMALTO

LTE is set to be the fastest technology yet in terms of customer uptake. But, Duato said: “Here in Spain it is not that good. In fact, it’s very bad. Despite the money that we have paid for the frequencies and the possibilities that we have to do re-farming, the growth forecast is not that good. It is still very limited.”

In July 2011, Spain’s leading three operators, Telefónica, Vodafone and Orange spent more than €e1.65bn collectively on spectrum in the 800MHz and 2.6GHz bands. The 800MHz band will become available after Spain’s analogue TV switch-off in 2014.

Against this backdrop, Duato’s assessment of the opportunities for LTE deployment was bleak. Unable to decommission their legacy networks “for a very long time”, established operators are going to be hit hard by the cost of managing three generations of network technology concurrently, he said.

At the same time, hotspot deployment of LTE is not going to be viable because customers are quick to become accustomed to the best performance the network has to offer. Easing into LTE deployment as a means of managing cost is not workable, he said.

“It will not be enough just to deliver LTE services in Madrid and Barcelona because people travel and we’re going to be asking them [to pay a premium] for LTE. If you are going to monetise LTE services it is unfortunate that you are going to have to make a massive investment.”

The Orange Spain CTO was clear about the best approach available to him and his peers: network sharing.

Duato compared Europe to the US. Roughly comparable in size, there is a huge disparity in the number of operators servicing each region. Europe has more than 100, while the US has just a handful of players offering nationwide coverage.

While there are well established passive sharing arrangements between European operators, some initiated at group level and some on a per-market basis, LTE can only be made a financial success if operators deepen their sharing to include key network elements like the radio access network and the backhaul network, Duato said.

“We think that, if we can get enough 50/50 active RAN sharing in LTE, we can save more than 25 per cent,” Duato said. “And this doesn’t need to be limited to two operators. We need to take a ‘family’ approach; there could be three or four operators in a market, really sharing in a more ambitious way. This can help us, in tough economical conditions, to roll out LTE extremely fast.”

Duato presented network sharing as the only option for Orange Spain—and, by implication, for the firm’s competitors. But he conceded that regulators, both national and regional, might not encourage the deployment model he was suggesting. With that in mind he called on his peers in the audience at the LTE Summit to lobby the authorities to make deep network sharing for LTE as easy as possible.

“My demand to this audience is that we get [national] administrations to help us with this rollout. They have to authorise this [approach] and we also need support from the EC and from equipment suppliers. We need help from everyone if we are to deliver on the promise of LTE. “It will not be the success that we want it to be if we are not able to change the way we roll out networks,” he said.

orange-slide

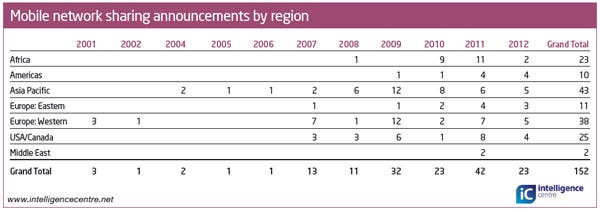

Network sharing has been on mobile operator discussion agendas for many years now, and there are some high profile and apparently successful executions. MBNL in the UK is jointly owned by Everything Everywhere and 3UK, and was formed to manage the shared 3G network of 3 and T-Mobile. Following the merger of TMobile and Orange in the UK, the Orange network is now in the process of being integrated. But examples such as this are far from numerous and there has been a lot less deep network sharing than many observers had anticipated.

Partly this is because integrating two mature networks is a phenomenally complicated task. When the integration of the 3 and T-Mobile networks was completed in the UK, Graham Payne, the man responsible for the project, described it as the biggest achievement of his career. He also said that, unless the companies embarking on a sharing project were fully committed from board level on down, the results could be disastrous. He told MCI at the time: “It’s an awfully big step and, when you take it, you’re absolutely locked to one another. Because unbundling it is more difficult than merging it together.”

So operators are wary of the almost irreversible nature of the strategy. There are also competitive concerns. The word at the time was that, when MBNL was created, the T-Mobile UK marketing department was seriously put out at the leg-up they perceived themselves giving to an upstart competitor with a far smaller subscriber base. Many operators also fear the leakage of sensitive data to a competitor over the shared network.

At the LTE World Summit, Duato argued that the small number of deep network sharing projects to date reflected the fact that there has so far been no serious pressure on operators to embrace the model. And because there are no large scale European deployments of LTE yet, he suggested that issues of balance around different size subscriber bases and perceived benefits to smaller players ought not to be an issue. “LTE has the advantage that nobody yet has a big rollout in Europe. Therefore we can start from scratch and roll out the network and distribute the costs between the operators in a sensible way from the outset.”

He even went as far as to suggest that Orange Spain would consider relinquishing certain spectrum assets if the right network sharing agreement could be drawn up. While Orange has no spare spectrum in urban centres, he said, “if we can have frequency pooling discussions we can release some spectrum, because in the rural areas we do not need all the spectrum we have.”

For the remainder of the LTE World Summit, delegates were musing on Duato’s presentation. It was the standout speech from the event and the one that sparked off the most conversations in the breaks. Now that Orange Spain has clearly stated its case it is difficult to see how it can do anything other than strive for collaboration with Vodafone and Telefónica. Orange is now publicly dependent on these two players for its success in Spain with LTE.

net-share-slide

Read more about:

DiscussionAbout the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)