A prolonged outbreak presents significant problems to telcos

While the telco industry might be getting well-deserved attention and praise today, the longer the coronavirus outbreak plagues society, the greater the risk of penalties for the telcos.

March 27, 2020

While the telco industry might be getting well-deserved attention and praise today, the longer the coronavirus outbreak plagues society, the greater the risk of penalties for the telcos.

In the short-term, the risks which have been presented to the telcos could well be mitigated by the delay of some spectrum auctions, as well as more residential customers upgraded services. There is likely to be an incremental gain from the residential business, while fewer spectrum auctions mean significant less outward investments.

These might seem like attractive numbers, though what is worth noting is that the residential upgrades are highly unlikely to result in a significant increase in revenues, as increases in internet traffic is not a linear relationship with cash rewards, especially with upper limits on contracts being relaxed.

“This increase in traffic will not lead to any significant increase in revenues for telecom operators as most consumer offers for consumers products are based on flat-rate fees for broadband, mobile data traffic as long as consumption caps are not reached,” said Jacques de Greling, an analyst for the Scope research group.

“The real question is more on the longevity and depth of this crisis. A deep and prolonged recession in Europe could nevertheless put some, if limited, pressure on telecom operators’ revenues.”

The enterprise customer revenues are the ones which are under immediate threat, though should a recession take hold of society, consumer markets could feel the pinch also. Right now, there does not seem to be an immediate need to panic, China reopening for business is a very encouraging sign, but with more people working from home the threat to enterprise revenues is very real.

On the most basic level, the less people in the office, the smaller the connectivity contract which can be won from the corporate customers. Moving up a level, this might force companies through a digital transformation project to encourage more flexible and remote working. And finally, ambitious projects are generally being put on hold. This will include the trials and initiatives to further embed connectivity in the business, a trend telcos were hoping would lead to increased revenues.

Alongside the potential dampening enthusiasm from enterprise customers, revenues derived from roaming traffic is also disappearing.

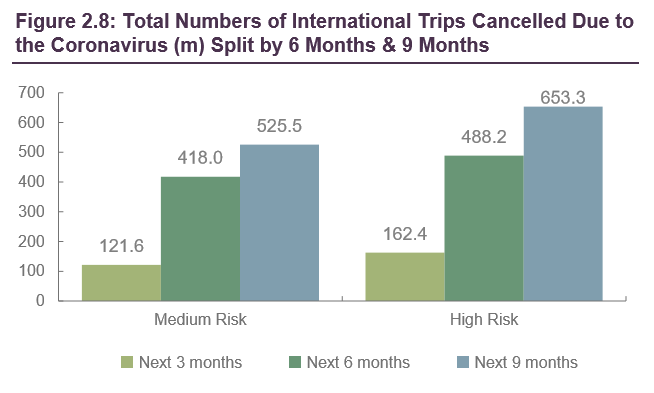

As you can see from the Juniper Research forecasts above, individuals are travelling less. Should governments be less successful than some would hope in combatting COVID-19, this could lead to 653 million trips being cancelled over the next nine months.

Although this challenge is primarily directed towards the travel industry, some telcos might feel the pinch also, most notably those who operate in nations which are popular tourist destinations. The UK, Spain, France, Italy and Portugal might suffer quite considerably, as you can see from the Juniper Research estimates below:

Cumulative loss telco roaming revenues

Next three months | Next six months | Next nine months | |

Medium impact | $4.807 billion | $16.529 billion | $20.779 billion |

High impact | $6.42 billion | $19.306 billion | $25.832 billion |

The medium impact scenario which has been outlined above is based on the assumption that travel plans would be materially impacted through to December. 65% of travel will be cancelled over the next nine months in this scenario, though in the high impact scenario, additional travel bans would be introduced, more trips cancelled, a longer period of impact and thus a much more notable impact.

Although these are only two of the areas which could see strain due to the COVID-19 pandemic, there are certainly many others. Supply chains will certainly be strained over the coming weeks and months, both for devices and network infrastructure equipment, while the closure of retail outlets will also see sales of existing stock plummet and new device launches could be delayed. All of these elements together could postpone the anticipated rewards from 5G embedding in society.

Should governments be able to combat the coronavirus, the impact to the telecoms industry is minor, but as the weeks turn into months, the consequences could compound to some serious damage for operators.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)