A Week In Wireless – Who benefits from M&A?A Week In Wireless – Who benefits from M&A?

It has been another busy week on the corporate shopping front, with Telecoms.com publishing acquisition stories featuring BT, Orange, Altice and HP, but how many of these deals will end in tears?

May 22, 2015

By The Informer

It has been another busy week on the corporate shopping front, with Telecoms.com publishing M&A stories featuring BT, Orange, Altice and HP, but how many of these deals will end in tears?

When companies announce their thinking behind an ostentatious acquisition they often adopt a similar plaintive tone to someone trying to justify a self-indulgent purchase to their partner. There is the same exclusive focus on the potential benefits of the move and the same insistence that these make the alarming purchase price a bargain.

“Oh please let me buy ACME Widgets love, it’s so practical and fuel-economical it will virtually pay for itself. And besides, the neighbours bought Omnicorp last year and they’ve never looked back. We might get left behind if we don’t buy ACME and you bought that company the other day and I didn’t say anything. Why can’t you just let me have this one little acquisition? You hate to see me happy, that’s what it is, isn’t it? I want a divorce.”

There is a whole category of cliché associated with M&A activity, all designed to put the proposed move in the best possible light. Bloomberg recently decided to look into this phenomenon and track the incidence of certain key words in M&A press releases. The two clear leaders were ‘complementary’ and ‘synergy’, which effectively amount to the same thing in this context.

This rings alarm bells as there’s something almost apologetic about focusing on the how the two soon to be merged companies complement each other. You’d think it was implicit wouldn’t you? Why the hell would you want to make such a move if there wasn’t synergy, which incidentally is defined as “The interaction of elements that when combined produce a total effect that is greater than the sum of the individual elements.”

Such terms also mask other, slightly more sinister, corporate buzzwords such as ‘streamlining’, ‘downsizing’ and ‘asset-stripping’, which tend not to appear in these gushing, aspirational missives. If the two companies are complementary, you see, there should be no need to get rid of loads of people, and yet talk of synergies implies the merged companies will be more efficient than they were previously.

But this is shareholder capitalism we’re talking about here, not charity work, and we’re constantly it’s the fiduciary duty of those who run the company to look after their shareholders. So if, in the name of supporting its share price, a few people have to be let go, that’s right and proper.

The shareholder of the acquired company usually do benefit from the deal as a significant premium on the share price is usually paid. But the acquiring company, which is the one so keen to focus on all these lovely synergies, often leaves its shareholder short changed.

“The benefits of merger and acquisition to the shareholder of the buying company are usually not very tangible or clear,” says lexuniverse.com. “Rather evidence suggests that their gains are generally minimal. Fall in the value of stock in the post-merger period is a common phenomenon.”

How strange. This almost seems to imply the senior managers of public companies don’t always act in the best interests of their shareholders, which must surely be a mistake. Next they’ll be suggesting that such people place a higher value on maximizing their annual bonuses than they do on the health of their company.

Maybe CEOs just get bored. There’s nothing very exciting about long term organic growth and nothing beats the thrill of spending loads of cash, especially when it’s not yours. Or maybe there’s some kind of country club pissing contest going on, or just an outright possessiveness.

Whatever the reason, M&A activity often ends up producing far worse results than the initial PowerPoints suggest. The Informer has frequently written about corporate misadventure and once more turns to the Delphic internet for further evidence.

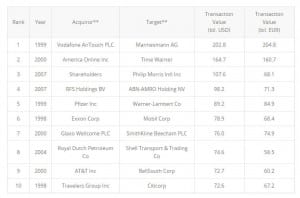

The Institute of Mergers, Acquisitions and Alliances was an obvious destination and it yielded the table below, summarizing the biggest M&A deals ever. Note the clear top two involve tech companies and that they happened just before the dotcom bubble burst, resulting in massive shareholder loss. As covered recently both the AOL Time Warner and Vodafone Mannesmann deals resulted in massive write-downs as the poor value of the deals became apparent.

There is a pattern merging here and the IMAA provided another chart tracking the volume and value of M&A deals every year since 1985. There was a clear spike in M&A value immediately before both the dotcom and the banking crises and there’s no reason to believe we’re not in line for another before long. To paraphrase Samuel Johnson the M&A game seems to be the triumph of hope over experience but, to quote another famous English wordsmith, hope springs eternal.

Read more about:

DiscussionYou May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)