Active subscriber data suggests Reliance Jio is not Indian market leader

The Telecom Regulatory Authority of India (TRAI) has released subscription data for March, though with only 80% of Reliance Jio customers active, the numbers are not all they seem.

July 16, 2020

The Telecom Regulatory Authority of India (TRAI) has released subscription data for March, though with only 80% of Reliance Jio customers active, the numbers are not all they seem.

The monthly statistics from TRAI are always an interesting read, though certain details often get lost in the sheer volume of information which is provided. Interestingly enough, the total number of mobile subscriptions is decreasing year-on-year, though this might indicate duplicate or redundant SIMs as cheap or free offers have expired.

As you can see from the table below, Reliance Jio is certainly increasing year-on-year, while its rivals are losing subscribers, but the percentage of active customers is worth bearing in mind.

TRAI Subscription data, March 2020 (thousands)

Company | Subscribers | Market share | Active (%) | Total active |

|---|---|---|---|---|

Reliance Jio | 387,498 | 33.47% | 80.93% | 313,602 |

Bharti Airtel | 327,759 | 28.31% | 96.18% | 315,238 |

Vodafone Idea | 319,191 | 27.57% | 92.00% | 293,655 |

Across India, only 85.43% of the total wireless subscriber base were described as active by TRAI. This might indicate that just under 15% of the subscriptions are duplicate SIMs, ones which have been temporarily purchased to take advantage of an offer or a giveaway. This mobility is not something which many telecoms operators would be keen on as loyalty is king in the industry.

Reliance Jio subscriptions are certainly increasing, and it is the clear market leader, but it is worth paying attention to the active subscription base.

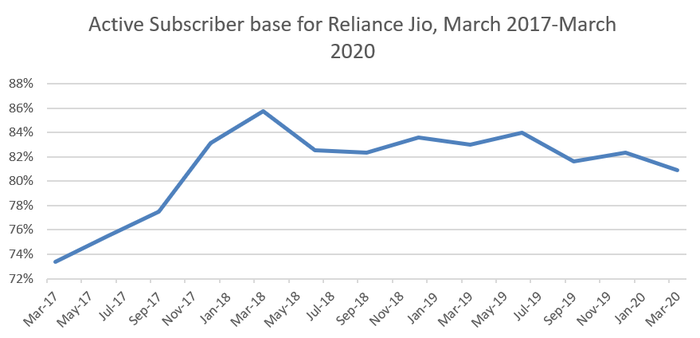

In 2017, Reliance Jio had a major problem with active users. This is perhaps due to the free offers which were being made to disrupt the market with some consumers playing the system with multiple SIMs, though it has appeared to have corrected this issue. That said, as you can see from the data, the percentage of active subscribers has started to drop again.

At the highest point, in June 2019, the active subscriber base was 84%, though this has been gradually falling to the 80.93% in March. This does not have to be a problem, as long as the company is still profitable it will not care how many duplicate SIMs there are out there, but it is always worth bearing in mind as some numbers can be misleading.

According to the March 2020 numbers, Reliance Jio had 313.6 million active subscribers, whereas Bharti Airtel’s active subscriber base was 315.2 million.

The total number of subscribers only goes so far in telling the story of how profitable a company actually is, as there is more value from monetising connectivity through services and apps than simply being a dumb pipe to deliver it. But when you consider the active subscriber base, Bharti Airtel is still India’s market leader, an interesting nuance to the story.

Active Subscriptions for Reliance Jio, March 2017-March 2020

Month | Active subscribers |

|---|---|

March 2020 | 80.93% |

December 2019 | 82.38% |

September 2019 | 81.61% |

June 2019 | 84.00% |

March 2019 | 82.99% |

December 2018 | 83.59% |

September 2018 | 82.33% |

June 2018 | 82.52% |

March 2018 | 85.75% |

December 2017 | 83.11% |

September 2017 | 77.49% |

June 2017 | 75.50% |

March 2017 | 73.38% |

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)