BT finally unveils its reimagined TV propositionBT finally unveils its reimagined TV proposition

The aggregator model has taken centre-stage at BT, leveraging its existing capabilities instead of trying to beat the content industry at its own game.

February 18, 2020

The aggregator model has taken centre-stage at BT, leveraging its existing capabilities instead of trying to beat the content industry at its own game.

Under Gavin Patterson, BT tried to do something which almost looked impossible. It attempted to disrupt the content industry by not only owning the delivery model for content, but the content itself. It attempted to muscle into an established segment and compete with companies which were built for the content world. It was expensive, complicated and messy, and it failed spectacularly.

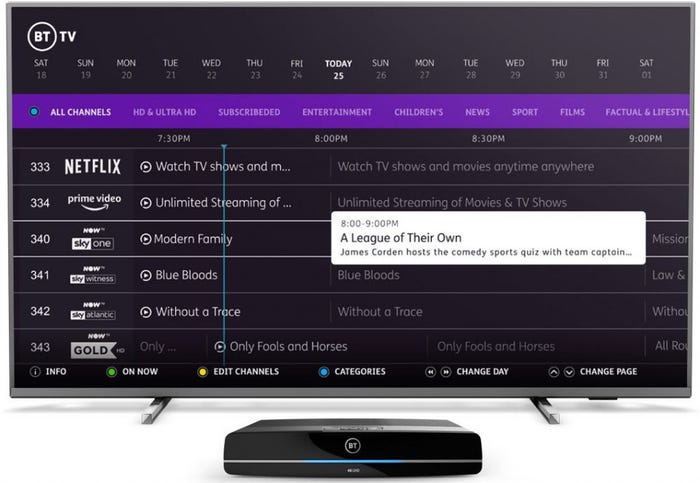

BT has not given up on content under new leadership, but it is taking a seemingly more pragmatic and strategic approach. Aside from its own content, Now TV will also be embedded in the BT interface, meaning that customers can now watch, pause, rewind and record premium Sky Entertainment and Sky Sports content. Customers will also be able to integrate Amazon Prime Video and Netflix onto their BT bill, while each element of the bundle can be scaled-up or -down month-by-month.

It is making best use of its assets, and it looks to be a comprehensive and sensible pillar of the convergence strategy.

“Life doesn’t stand still from month to month, so we don’t believe our customers’ TV should either. Our new range of TV packs bring together the best premium services, fully loaded with a wide range of award-winning shows, the best live sports in stunning 4K and the latest must-see films – all with the flexibility to change packs every month – with quick and easy search to find what you want to watch,” said Marc Allera, CEO of BT’s Consumer division.

BT will ‘own’ some content, it still has the UEFA Champions League broadcast rights after all, but it is picking its battles. The BT TV proposition failed in years gone because it tried to go it alone, but without the broad range of content genres, it looked like a poor attempt to compete with the likes of Sky. In reality, it didn’t need to.

The telcos have a significant advantage over many content companies around the world; they have an existing and trusted billing relationship with the customer. According to the Ovum World Information Series, EE has 30.6 million mobile subscribers and BT has 9.1 million broadband customers. These relationships can be leveraged through the partnership model to realise new profits in a low-risk manner.

BT is in a position of strength. The streaming wars are raging, and the service providers will do almost anything to gain the attention of the consumer, as well as build credibility in the brand. By bundling services into the BT, the OTTs are leveraging the trust which the customer has in the telco billing relationship and gaining eyeballs on the service itself. All they have to do is offer BT a small slice of the profits.

This is the symbiotic relationship in practice. The OTTs gain traction with customers, while BT can complete the convergence objective in a low-risk manner through the aggregator model.

That said, it is somewhat of a retreat from its previous content ambitions.

“This well long overdue move feels like a last-ditch effort to be successful in TV,” said Paolo Pescatore, founder of PP Foresight.

“Aggregation is the holy grail. BT has done a superb job of introducing some novel features and bringing together key services all in one place. This will strongly resonate with users. However, it is unlikely to pose a considerable threat to Sky who in turn will be able to bundle BT Sport into its own packages. In the future expect this new TV platform to be bundled with BT Halo which will further strengthen its premium convergent offering.”

Convergence is a strategy which should be fully embraced by the BT business. Not only has it been proven in other European markets, see Orange in France and Spain, but the depth and breadth of BT’s assets should position it as a clear market leader. With mobile, broadband, public wifi hotspots and content tied into a single bill, as well as partnerships to bolster the experience, BT is heading down the right path. If it can start to build service products on top, such as security, this could start to look like a very competent digital business.

The issue which remains is one of price. The Halo bundle is one few can compete with, but if it is not priced correctly it will not be a success. This does seem to be the issue with the BT consumer business right now, it is pricing itself out of the competition. Convergence is attractive to customers when it is convenient and makes financial sense, but right now it doesn’t seem to.

BT is slowly heading in the right direction. It might have taken years, but it is slowly creating a proposition for the consumer which few should theoretically be able to compete with. If it can merge the business into a single brand and sort out the pricing of its products, it should recapture the market leader position.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)