ETNO says Europe's telco investment climate needs 'dramatic' improvement

European telcos are spending heavily on fibre and 5G but the financial health of the sector is suffering.

February 2, 2022

European telcos are spending heavily on fibre and 5G but the financial health of the sector is suffering, according to a report by European telco lobby group ETNO

Conducted by Analysys Mason, the state of the market found that the European telco sector spent a record €52.5 billion on capital expenditure in 2020, up from €51.7 billion in 2019. The proportion of revenues devoted to CapEx reached 19 percent, the highest in recent history and greater than the US, South Korea or Japan.

However, the study warns that despite all that effort, Europe still lags its global peers on several key metrics, namely: network coverage, take-up, usage, spending, and revenue.

“The increase of telecom investment and the resilience of the sector are desirable from a societal viewpoint and they are key to Europe’s ‘Open Strategic Autonomy’ plans. Therefore, the sustainability of the sector should encourage strong policy action to dramatically improve the investment climate,” said ETNO and Analysys Mason, in the report.

In 2021, 5G coverage in Europe reached 62 percent of the population, up significantly from 30 percent a year earlier. However, that doesn’t compare very favourably to the US, and South Korea, which in 2021 saw 5G population coverage reach 93.1 percent and 93.9 percent respectively. Indeed, despite the record high network investment, when it comes to spending per capita, European CapEx comes in at €96.3, as opposed to €191.9 in the US and €115.4 in South Korea.

As for 5G uptake, the technology accounts for only 2.8 percent of total mobile connections in Europe, compared to 13.4 percent in the US and 29.3 percent in South Korea. As a result, monthly data usage per capita in Europe is slightly lower at 8.52 GB, whereas in the US it is 10.62 GB, and in South Korea it is 12.52 GB.

Europeans spend less on telecoms services too. According to Analysys Mason, average monthly spend per capita in Europe is €33.8. In the US it is €71.1, and in South Korea €36.1. On a related note, mobile ARPU is considerably lower in Europe at €14.4. In comparison, the US stands at €37.9, and South Korea at €25.

There are other indicators that all is not well in European telecoms, the study warns. For example, the ratio of enterprise value to EBITDA (EV/EBITDA) has fallen compared to pre-pandemic levels.

“On one side of the equation, these multiples tell of improving EBITDA margins for the operators, but on the other side they also reflect what is increasingly being considered to be poor revenue growth prospects and a concern that the sum of the parts of the European telecoms industry is worth more than the whole,” the study explains. “While this might be desirable for some financial players, it is unclear whether it can serve the broader purpose of accelerating network roll-out and fostering innovation in digital services, as well as [the] EU’s digital autonomy.”

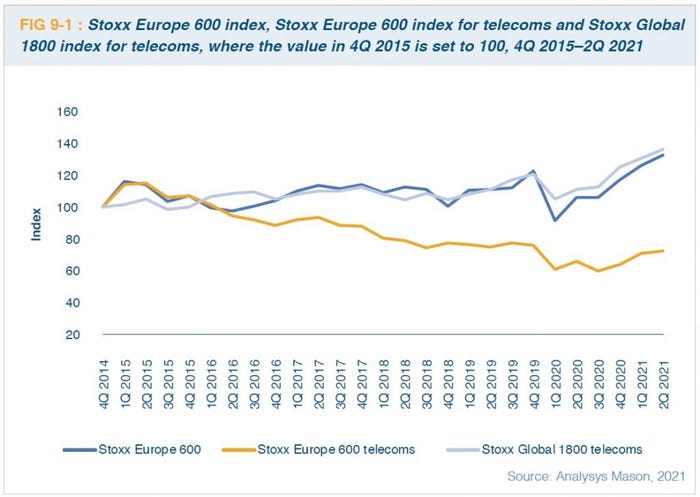

In addition, the report warns that net debt/EBITDA ratios have increased, and European telecom stocks have consistently underperformed both the Stoxx Europe 600 index and the Stoxx Global 1800 telecoms index since Q1 2016.

There are no prizes for guessing the changes ETNO considers necessary in order to improve the overall financial health of the sector.

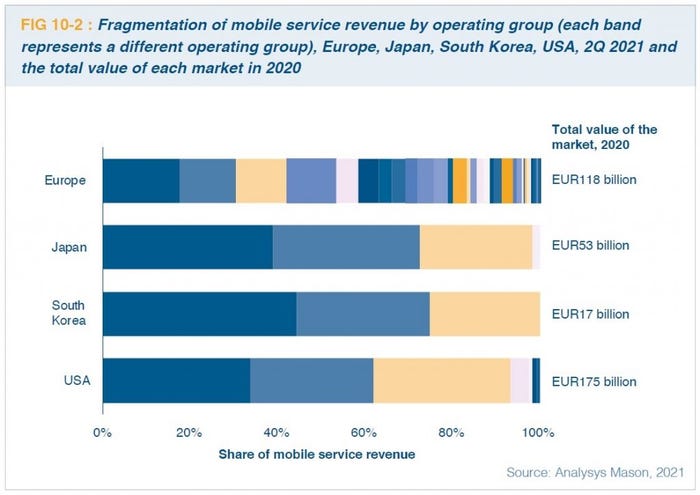

“European telecoms, by way of regulation and lack of a single market, remains highly fragmented, with Europe counting 38 operating telecom groups with over 500,000 subscribers, compared to seven in the US, four in Japan and three in South Korea,” said ETNO, in a statement.

The study also notes that telcos are subject to much stricter M&A rules compared to adjacent sectors, such as the hyperscaler market.

“Operators, similarly to players in other sectors, have to operate in contestable markets, and those players that have enjoyed great success over the past two decades in the online space (the current hyperscalers) should also bear the same kinds of responsibilities that historical incumbent operators (that is, ETNO members) have had to shoulder,” the report said.

It is the same well-trodden argument then that online players and cloud providers have had an easier ride than telcos when it comes to regulation, and that fragmentation is stifling growth. But with a gap opening up between Europe and its global peers, it is an argument that bears repeating if Europe wants to regain the initiative.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)