LTE : Will faster = richer?

A recent study by Arthur D. Little sought to discover what the industry really believes about the impact of LTE European on operator revenue trajectories.

July 7, 2013

2012 was one of the worst years for European telecom operators with revenues down by 3.8 per cent compared to 2011. Will 4G reverse the trend? We analyzed this question in our 12th joint Arthur D. Little and Exane BNP Paribas report and concluded that although 4G will quickly become essential, it will not revive the sector’s revenues. In fact we expect that, despite 4G, revenues will continue to decline in Europe: -1.8 per cent per year on average by 2016.

The sector could return to growth if LTE smartphones generated data ARPU of e17/ month by 2016—e7 higher than today’s data ARPU on 3G smartphones—although this is a stretch. Nevertheless this demonstrates the high importance of a successful move to 4G for European telecom operators.

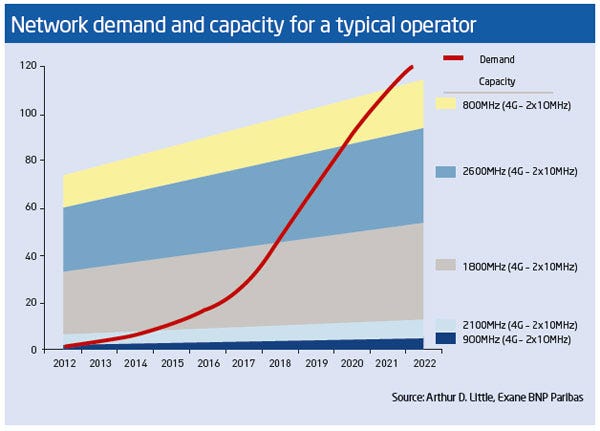

European operators’ 3G networks will soon hit a “capacity wall” and 4G LTE is a great tool to surmount this. Indeed, with the latest spectrum auctions in 800MHz and 2.6GHz bands, operators’ total spectrum assets will increase by 55 per cent.

Moreover 4G LTE is a better technology than 3G; the amount of traffic that can be carried on a given amount of spectrum is almost 70 per cent higher on 4G than it is on HSPA+, the latest version of 3G. Based on our traffic and capacity modelling, we found that thanks to 4G spectrum, operators will not face capacity issues for an average of a decade – specifically not before early 2022 for operators with 800MHz spectrum, and some time in 2020 for those without 800MHz spectrum European countries are in different stages of rolling out LTE but overall there is progress. Operators target coverage of between c.50 per cent and 99 per cent of their country’s population by 2014-2016. This requires slightly higher capex budgets but the cost is very reasonable: our benchmark points to e16-17 per inhabitant covered (compared to e1,000 per home for Fibre to the home).

Commercial launches of 4G services are gathering pace. Operators can count on a good line-up of devices, including high-end smartphones and tablets from the market leaders (Samsung, Apple) and from challenger handset vendors.

The US, Japanese and Korean markets, where 4G rapidly became successful, benefited from specific circumstances not shared by Europe. For Verizon Wireless customers, LTE represented a revolution compared to CDMAEvDO. For European customers already surfing on HSPA+ (the latest 3G), LTE will rather be an evolution.

Still we believe that 4G will be a commercial success in Europe. Customers are growing increasingly frustrated with the 3G experience, a problem that will only get worse as usage increases. LTE will bring a better service, with download speeds 3-5 times faster (15-20Mbps versus 4-6Mbps) and response times five times shorter.

The take-up of LTE should accelerate in the second half of 2013 and throughout 2014. We expect 100 per cent of new smartphones and tablets to be LTE-enabled from 2015, leading to 54 per cent penetration of 4G-enabled devices in the population by 2016e. Theoretically 4G should enable operators to better monetize mobile data and thus generate more revenues.

Indeed we expect 4G to significantly boost mobile data traffic. Experience in the US, South Korea and Japan has shown that traffic per device is higher on 4G than on 3G, driven by faster speeds, lower latency and datahungrier devices. In addition US operators have shown that ‘shared data’ plans (enabling a monthly data allowance to be used across multiple devices) could accelerate the connection of more devices to networks.

Higher traffic should then lead to higher revenues – assuming price levels stop declining. However our analysis shows that the move to 4G is unlikely to restore pricing power in the industry. We find that, in many cases, price levels keep declining due to operators offering higher data plans for the same price. Thus, the transformation of traffic growth into revenue growth is not apparent.

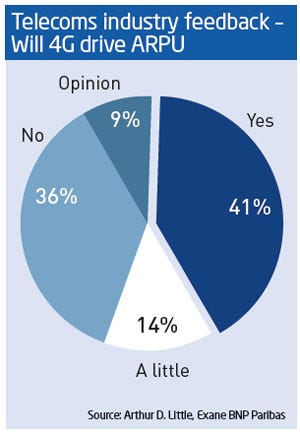

At this stage operators and other industry players are split on whether 4G will enable a better ARPU trend, as shown in the chart on this page.

We believe that, unlike Verizon Wireless and AT&T, leading European mobile operators will struggle to sustainably differentiate themselves from challengers for the following reasons:

Spectrum differentiation? Challengers’ spectrum assets are far in excess of their revenue market shares, giving them room for growth; conversely, leaders have lower spectrum share than revenue market share and are hence more constrained. 800MHz ownership is a plus but those without it have alternatives.

Cost differentiation? Costs will be lower under 4G than 3G, but the decline will take time to materialise and we expect all parties to benefit eventually (4G is affordable for challengers, especially if helped by network sharing, which is gaining momentum). With 4G, network costs will become a smaller part of the total cost base over the long term; correspondingly, “other opex” will become an increasingly important factor to monitor—this is good for the leanest, not for the largest.

Differentiation from owning fixed networks? Fixed-line networks will be an increasingly essential part of mobile networks, with wifi offload and small cells being a key part of future architecture. However, for mobile operators, there are alternatives to owning fixed-line assets.

Quad-play differentiation? It is too early to say whether customers will prefer to bundle tablets with smartphones in shared data plans as is seen in the US or with fixed broadband in quad-play bundles as in some European markets. However, mobile-only players certainly have one less option compared with their integrated competitors.

So what can operators do? Overall mobile operators will continue to suffer from a tough market environment – there is a lot they can do to improve their revenue and cash-flow outlook. We have identified five main levers for operators to improve their situation.

1. Monetising data – Tariff structures can help The transformation of traffic growth into revenue growth depends on how operators price their mobile data bundles. Tariff structures are an important element. The good news is that fully unlimited mobile data offers have in many cases been replaced by more sophisticated pricing, with operators charging either for volume, for speed or for a combination of the two. We believe that the most attractive structures are usage caps, which are already common practice in Europe and shared data plans, which have developed in the US and are starting to be seen in Europe e.g.at Telia Sweden, SFR in France and O2 Ireland. These shared plans are a great way to encourage users to connect more devices to cellular networks—and hence to generate more traffic revenues over time.

2. Innovating in services through partnerships With their mobile operating systems (Apple iOS, Google Android) and application stores (Apple’s Appstore, Google Play, etc.), tech giants and content providers are in tight control of the mobile services ecosystems. Most of the value of additional services such as maps, music, etc. is likely to continue going to these tech giants, and more generally to over-the-top players rather than to mobile operators. However, with the move to LTE, we see several opportunities for mobile operators to generate value in additional services— focusing on content heavy applications (cloud storage, on-demand media, video conferencing…), with potential benefits either directly (generating revenues) or indirectly (stimulating mobile data traffic and/or acting as customer retention tools).

3. Continuing cost reduction programmes With a further decline in revenue trends ahead, reducing costs will remain of paramount importance for European mobile operators. Indeed, the cost of capacity is a small component of the overall cost structure today (c.e3/month per customer, i.e. c.20 per cent of the total cost base) and will further decline in the coming years, despite exponential growth in data traffic (e2/month per customer in 2020e). Being the lowest-cost provider will become even more important in the future – and those most likely to benefit from a cost differentiation in the long term are not those which will be ahead of the pack in 4G, but rather those achieving better efficiencies on their “other opex”. For a typical operator, achieving a 10 per cent efficiency gain on the mass of “other opex” is equivalent to achieving a 25-30 per cent gain on the capacity-related costs in 2013e, and to a c.50 per cent gain in 2020e.

The key opportunities in this respect relate to transformation towards an “online centric” business model—with opportunities to save on commercial costs (direct online sales versus indirect physical distribution), customer management (self care versus call centres), billing (e-billing and direct debit), marketing (simplification of offers; use of targeted online tools rather than expensive TV advertising), etc.

4. Optimising network utilisation via small cells and wifi offload Offloading mobile data traffic on fixed-line networks via wifi, femtocells, etc. is (and will increasingly be) a key element of mobile network strategies, with two key benefits:

• Spectrum optimisation: wifi is operating on a different spectrum to 3G and 4G, so offloading traffic to wifi helps enable to save on spectrum utilization. In our core scenario, we assume that the share of traffic which will be offloaded onto wifi will increase by 25 per cent (of the total traffic) by 2017e. In this scenario, the operator’s spectrum assets are modelled to be fully used by 2022, whilst in an alternative scenario assuming no incremental offload, the spectrum would get saturated more than two years earlier.

• Cost optimisation: small cell solutions are significantly cheaper than large outdoor macro-cell antennas. However, because the incremental cost of capacity is small anyway, we estimate that the cost gain enabled by offloading an additional 25 per cent of traffic onto wifi reaches less than 1 per cent of the total cost base of a typical operator.

Integrated fixed-mobile players can certainly leverage the fact that they own both fixed and mobile network assets. However, mobile operators do not need to own fixedline assets themselves to benefit from this. There are many other options available today or which will develop over the coming years, in particular wholesale options.

5. Consolidation or network sharing European mobile operators have thought about in-market consolidation for many years. There would be significant synergies in terms of costs and potentially of ‘market repair’:

• Costs: our benchmarking of recent in-market consolidation deals in mobile points to potential merger synergies worth 25-55 per cent of the combined value of the merged entities, with an average of c.35 per cent.

Savings relate notably to the network (similar savings as in the case of a nationwide network sharing deal) but also to commercial costs (optimisation of distribution, etc.);

• ‘Market repair’: consolidation leads to a more concentrated market (e.g. market moving from four to three operators). This could mean less competitive pressure, with a potential positive impact in terms of pricing and/or in terms of commercial spending. Consolidation in Austria was recently approved by the relevant competition authorities, including the European Commission, but we believe that this is a specific case in many ways and this green light is not indicative of what could happen in other markets.

In such a context mobile network sharing appears as an alternative to consolidation, as it can generate a significant part of the network synergies with a lower level of regulatory scrutiny. Potential savings from network sharing range from ten per cent to 30 per cent on network capex and opex. The roll-out of LTE networks is a good occasion to look at network sharing with a new eye as it is easier to generate synergies when rolling out a new network than when trying to consolidate two existing networks. However, financial benefits have to be weighed against the potential strategic consequences e.g. enabling smaller players to access scale benefits that would otherwise be reserved for leading players or reducing the opportunity to create significant network differentiation.

4G represents a key opportunity for telecom operators to address customers’ growing usages and to provide ten years additional capacity to European mobile networks. As a result, 4G will quickly spread across Europe and will experience commercial success.

Will 4G be enough to put telecom operators on the path of growth again? Probably not as such, but operators will take advantage of this new technology to innovate in their offerings, their services and their networks. For customers, networks and operators, 4G will quickly become essential.

By Didier Levy, Director of Arthur D. Little’s Telecommunication, Information, Media and Electronics (TIME) practice, Antoine Pradayrol of Head of Telecom Operators Team, Equity Research at Exane BNP Paribas

This article is based on the 12th joint Arthur D. Little and Exane BNP Paribas report ‘4G – going faster but where?” for which we held 91 company meetings in the telecom-mediatechnology industry and beyond, across 15 countries.

Will LTE drive ARPU?

Yes - more than 3G (47%, 451 Votes)

Yes - around the same as 3G (26%, 251 Votes)

No - less than 3G (18%, 175 Votes)

Not sure (9%, 89 Votes)

Total Voters: 966

Read more about:

DiscussionAbout the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)