Microwave solutions are driving network evolution

Mobile subscriptions are expected to reach nearly 7 billion by the end of 2015, while mobile broadband subscribers will reach 2.3 billion. As mobile penetration reaches saturation in many regions and grows massively in others, operators across the globe need to face future network and business challenges learning how to adapt in a very dynamic and diverse IT environment.

March 5, 2015

Telecoms.com periodically invites expert third-party contributors to submit analysis on a key topic affecting the telco industry. In this article Elias Aravantinos, Leading Analyst of ExelixisNet Market Research, explores the current evolution of network technologies and some of the key players involved.

Mobile subscriptions are expected to reach nearly 7 billion by the end of 2015, while mobile broadband subscribers will reach 2.3 billion. As mobile penetration reaches saturation in many regions and grows massively in others, operators across the globe need to face future network and business challenges learning how to adapt in a very dynamic and diverse IT environment.

Market overview

It would be safe to mention that during 2014 the spending on small cell radio access networks was about 5% of the total spending on wireless infrastructure equipment. ExelixisNet Market Research estimates that microwave covers less than 50% of mobile backhaul equipment spending in 2014, anticipating the usual pressures mainly from fiber-based solutions. In 2015, operators will trial cloud RAN, and vendors will offer new fronthaul solutions but with limited deployments. New NLOS and E-Band solutions are forming highly competitive vendors with diversified toolkits ready to meet the current and future challenges.

India and the Middle East are expected to be among the key microwave backhaul regions where further network spending will benefit the microwave market in 2015. In Q32014, microwave transmission equipment revenue increased more than 20% respectively in Asia Pacific and the Middle East. Traditional regions that rely on wireless backhaul such as EMEA will continue to lead the next years’ demand.

Intense market transformation is expected

Microwave industry is transforming as new buyouts transform existing players with fresh ideas and strategies. Exalt Wireless announced in 2014 that it had completed a successful management buyout of the assets of Exalt Communications from its previous investors.

Nokia Networks completed the acquisition of SAC Wireless, a wireless network equipment installation specialist. Prior to that, the company acquired Mesaplexx, which provides filter technology that can be used to reduce the size, weight and cost of active antenna or compact small-cell systems. Interesting enough, is the new LTE-Unlicensed (LTE-U) opportunity that is likely to develop into the 5GHz range allowing data speed increase, decreasing coverage range. Recently, Nokia has linked a deal with T-Mobile US to develop small cells that will use LTE over public, unlicensed spectrum, within the domain of WiFi. The deployment is expected to begin indoors in 2016, followed by outdoor deployments. Stephane Daeuble, Product Marketing Manager for Small Cells at Nokia Networks, commented “One of our guiding principles is to always put the needs of mobile broadband operators at the forefront of our small cells roadmap planning. With Flexi Zone, operators can add almost unlimited capacity and coverage to meet growing demand in outdoor urban areas and indoor locations”.

Ericsson appears to be increasing its focus on networks and software, moving away from devices and chips for the moment. Ericsson joins MWC 2015 with seven product mega launch across radio and media sectors. Ericsson’s shopping cart prefers acquisition of cloud management (Sentilla and Apcera acquisitions) and media (Fabrix acquisition) companies. Ericsson’s vision, as summarized by Arun Bansal, Head of Radio Business Unit, “microwave is a key element of current backhaul networks and will continue to evolve as part of the future 5G ecosystem in the 2020 time frame. An option in 5G is to use the same radio access technology for both the access and the backhaul links, with dynamic sharing of the spectrum resources. This can provide a complement to microwave backhaul especially in very dense deployments with a larger number of small radio nodes”.

Huawei on the other hand prefers to invest into the IoT future and the M2M communications, acquiring an internet-of-things networking firm Neul. Earlier this year, Huawei has acquired Australian company Fastwire, in an attempt to accelerate its capabilities in OSS.

During 2014, Alcatel-Lucent closed a deal for US$254 million selling its IP telephony and Ethernet switching equipment activities to technology investment company China Huaxin.Qualcomm (QCOM) had made a $130 million investment in Alcatel to develop products together for the small-cell base station market.

High capacity solutions boosted by LTE advanced

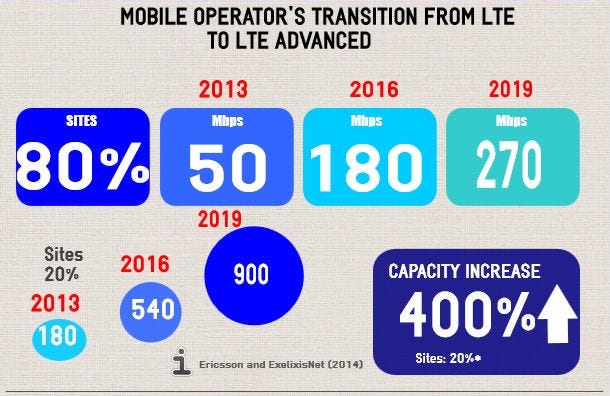

LTE Advanced with carrier aggregation will grow in importance for operators, making more efficient use of spectrum assets and delivering improved application coverage, with higher peak data rates and better performance across the entire cell. Operators are shifting their focus from the aggregation of 20 MHz carriers to 40 MHz and 60 MHz. In the near future, the most advanced operators with sufficient spectrum are expecting aggregation of up to 100 MHz of spectrum. This means that by 2019, high-capacity base stations in the more advanced mobile broadband networks will need backhaul capacity beyond 1 Gbps, while lower-capacity base stations will need backhaul capacity in the 100 Mbps range. That creates opportunities for millimeter wave solutions as well as PtmP technology that could satisfy Tier 2 operators and ISPs needs. Bluwan, CBNL and Intracom Telecom have been looking into this opportunity during 2014, preparing to capitalize their business proposals to enterprise access solutions and connected cities. North American market is also in the horizon during 2015, as new, high-capacity wireless solutions such as PtMP microwave could become more prevalent.

Small Cells to rise in H2 2015 forming new NLOS landscape?

Small cell adoption will become more prevalent in 2015, driven by the completion of LTE rollouts and “unlimited” data plans offered by Mobile Network Operators (MNOs). While 2014 has been a year for trials, 2015 will see small cell deployments begin to move from indoors to outdoors, and grow from coverage fill to capacity expansion. Greg Friesen, Vice President of Product Management at DragonWave, comments regarding Small Cell evolution, “we believe there will be a big push for small cell equipment integration. On the macro-cellular backhaul side, we expect there to be a greater global adoption of E-Band for macro backhaul as the equipment’s’ range increases. What’s more, we anticipate a large operator push for microwave scalability as service providers try and stay ahead of the rapidly increasing data demand curve”.

In traditional LOS solutions, high system gain is used to support the desired hop length and mitigate fading caused by rain. For short-distance solutions, such as those needed for small cell backhaul, this gain may be used instead to compensate for non-line-of sight (NLOS) propagation losses instead. Ericsson believes that in the near future, sub-6 GHz frequency bands may be used for small cell NLOS backhaul but microwave backhaul in bands above 20 GHz will outperform sub-6 GHz systems under most NLOS conditions. Due to lack of spectrum 3G, 4G and Wi-Fi will over time use these sub-6 GHz bands mainly for access. Hence there is a chance that NLOS deployments will over time be dominated by microwave bands above 20 GHz.

Closing that topic, new and existing NLOS vendors such as Fastback Networks and RADWIN respectively are coming to market with high capacity, low latency NLOS products even with sophisticated antenna designs aiming to deliver the NLOS performance operators require for LTE network densification. NLOS has gained traction and more acceptance during 2014, as even Alcatel-Lucent, among the leading small cell vendors, added recently, 9500 MPR Portfolio, including a sub-6Ghz wireless backhaul solution for NLOS small cell deployments in built-up, urban locations.

Future opportunities

Microwave solutions will continue to evolve, meeting the ever-increasing capacity needs with a high level of flexibility, innovation and cost-efficiency. That is possible by delivering an expanding range of capacity-enhancing technologies, higher modulation (beyond 2048 QAM), increased spectrum efficiency (across a wider range of frequency bands), support for efficient carrier aggregation and IP data transmission, and growing levels of optimization and automation.

Elias Aravantinos is the Leading Analyst of ExelixisNet Market Research, the global intelligence, information technology research and advisory boutique that since 2007 delivers the technology-related insight to senior IT leaders in corporations and government agencies, as well as wireless broadband research to telecom enterprises and investors.

Elias Aravantinos is the Leading Analyst of ExelixisNet Market Research, the global intelligence, information technology research and advisory boutique that since 2007 delivers the technology-related insight to senior IT leaders in corporations and government agencies, as well as wireless broadband research to telecom enterprises and investors.

Read more about:

DiscussionAbout the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)