Nokia laments a weak first quarter

Finnish telecom vendor Nokia reported a disappointing Q1 of flat revenue and expanding loss. The company blamed competition and slow ramp-up of 5G.

April 25, 2019

Finnish telecom vendor Nokia reported a disappointing Q1 of flat revenue and expanding loss. The company blamed competition and slow ramp-up of 5G.

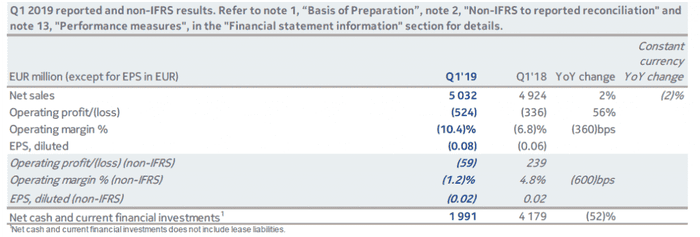

Nokia reported a modest 2% net sales growth to reach €5.032 billion over €4.924 billion of Q1 2018, which would be down by 2% on constant currency basis. The gross margin was at 31.3%, down from 36.7% a year ago. The operating loss increased from €336 million (or -6.8% of net sales) to €524 million (-10.4%). Net cash was depleted by more than half from €4.179 billion to €1.991 billion. Earnings per share went from positive €0.02 to negative €0.02.

Rajeev Suri, the President and CEO of Nokia, conceded that “Q1 was a weak quarter for Nokia.” Meanwhile, the company believes that its fortunes will improve in the rest of the year, especially in the second half. “As the year progresses, we expect meaningful topline and margin improvements. 5G revenues are expected to grow sharply, particularly in the second half of the year, driven by our 36 commercial wins to date.”

In addition to the slow start of the year, Suri also saw risks in intensified competition and customers reassessing their investment. He said in the statement that “competitive intensity has slightly increased in certain accounts as some competitors seek to be more commercially aggressive in the early stages of 5G and as some customers reassess their vendors in light of security concerns, creating near-term pressure but longer-term opportunity.”

When looking at the results by business lines, Networks, by far the biggest segment of Nokia’s business, grew by 4%, both Software and Nokia Technologies kept flat, while sales from the Group Common and Other unit (including Alcatel Submarine, Bell Labs, Radio Frequency Systems, etc.) went down by 13%. Geographically, North America, which overtook Europe to become Nokia’s biggest market in the last quarter, fell back to below Europe in Q1 despite registering an impressive 9% year-on-year growth. Europe was largely flat with the sales keeping at €1.5 billion level. Asia Pacific grew by a decent 6% to get closer to the €1 billion mark, but the biggest loss was in Greater China, where the sales plunged by 10%, now only marginally bigger than Middle East & Africa.

To say things have not been going smoothly for Nokia recently would be an understatement. In late March, the company first announced that it had discovered certain “compliance issues” in the Alcatel-Lucent business it acquired years ago which might have “material adverse effect” on its business, causing a rush sell in the financial market, only to retract a couple of hours later to declare those issues would not have materials impact. More recently it was reported that the company has been struggling to fulfil its business contracts in Korea.

This must be a painful moment for the Nokia management and shareholders (it’s shares were down around 9% at time of writing), who have to watch its two major competitors reporting strong results while sitting on its own disappointments. Ericsson has just delivered an encouraging quarter, and Huawei, despite all the headwind, has reported a particularly impressive Q1. As Light Reading, our sister publication, said earlier, Huawei’s woes may not necessarily mean good fortunes for its two main competitors. So far they have not translated into good fortunes for at least one of them.

Comparing the numbers with Ericsson we could see that despite Ericsson’s total sales in Q1 was about 10% smaller than Nokia’s, it was considerably more profitable (gross margin at 38.4% vs. Nokia’s 31.3%), and its operation more efficient (€1.3 billion operating cost vs. Nokia’s €2.1 billion).

These are also the two key aspects the Nokia management are focusing on to turn things around. On the profitability side, Suri said “we will continue to take a balanced view, and are prepared to invest prudently in cases where there is the right longer-term profitability profile.” On the efficiency side, the company is “also progressing well with our previously announced EUR 700 million cost savings program,” Suri said in his statement.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)