Nokia Q1 2024 earnings – Ericsson, but even more soNokia Q1 2024 earnings – Ericsson, but even more so

Finnish kit vendor Nokia’s Q1 numbers and messaging were very reminiscent of those of its great rival Ericsson earlier this week.

April 18, 2024

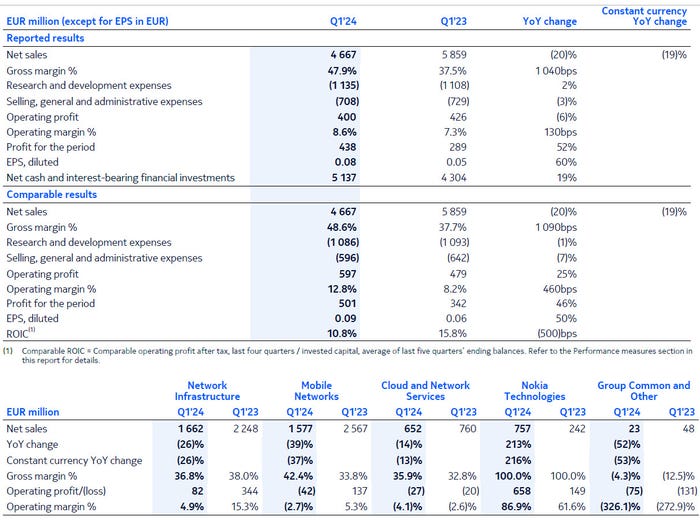

Nokia’s sales were down 19% year-on-year but its gross margin improved by a remarkable ten percentage points, resulting in a 52% year-on-year profit increase. This compares with Ericsson’s sales fall of 14%, margin improvement of three percentage points and profit increase of 66%. It should be noted, however, that Nokia’s numbers were flattered by an exceptional quarter from its technology licensing division, for which gross margin is 100%, as the smartphone licensing renewal cycle concluded. Opinion was divided about profit expectations.

“As expected, the ongoing market weakness drove a 19% year-on-year constant currency decline in net sales in the first quarter,” said Nokia CEO Pekka Lundmark. “However, we have seen continued improvement in order intake, meaning we remain confident in a stronger second half and achieving our full year outlook. Driven by the patent licensing deals signed in Nokia Technologies, we achieved a comparable operating margin of 12.8% in Q1, compared to 8.2% the year before. We also generated almost EUR 1 billion in free cash flow in the quarter, which is a very strong performance.”

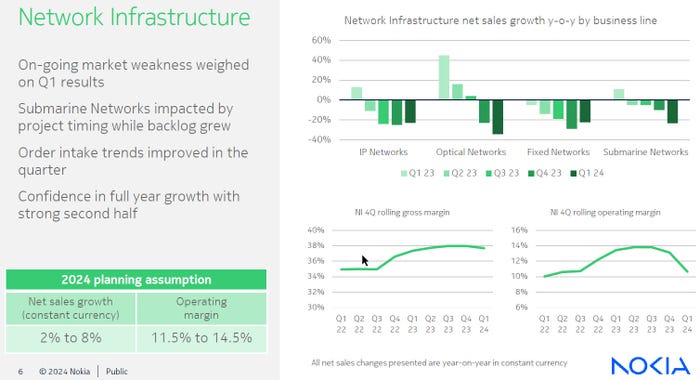

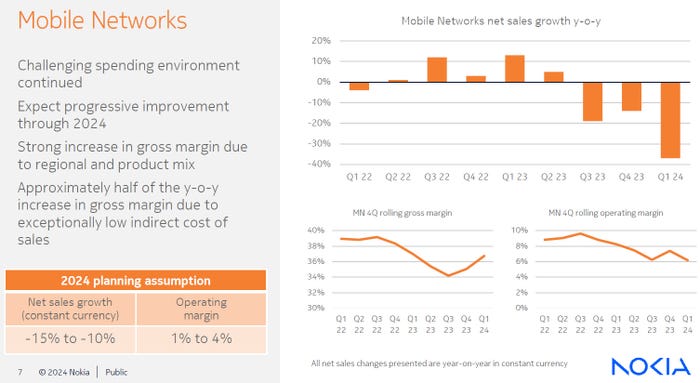

That H2 optimism also echoed Ericsson’s sentiments, both of which were apparently based on the amount of kit they reckon operators need versus how much they’re currently buying. They have to run out of inventory eventually, goes the reasoning. If anything, Nokia is even more dependent on this late-year rebound, since it’s sticking with its full-year outlook despite the weak quarter.

“We have been executing quickly on the operating model changes we announced back in October along with our cost savings roadmap,” concluded Lundmark. “These actions, combined with our expectation for improved net sales growth in the second half of the year, supported by our order backlog, mean we are solidly on track to achieve our full year comparable operating profit outlook of EUR 2.3 to 2.9 billion and free cash flow conversion of 30% to 60%.”

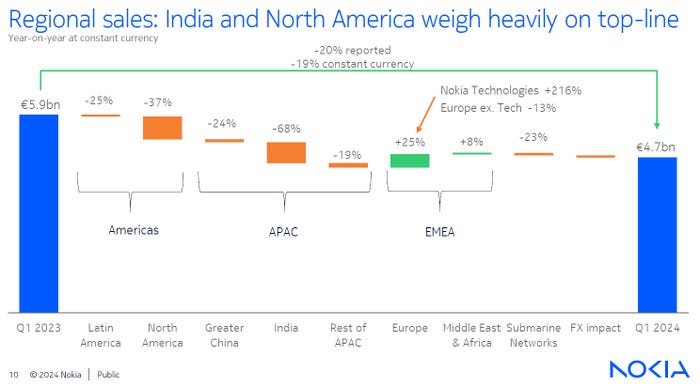

Both companies’ dependence on the US and India is illustrated by Nokia’s regional split, where the drop off from those two countries after an initial 5G-fulled spending spree is conspicuous. Nokia’s business is more diversified than Ericsson’s but its fixed-line unit still seems to track the mobile market quite closely, with both likely dependent on growing data traffic for demand.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)