SingTel saw Q4 profit drop by 14%

SingTel reported almost flat revenues and 14% decline in net profit in the quarter ending 31 December 2018, blaming negative influence from its investments in Australia and India.

February 14, 2019

SingTel reported almost flat revenues and 14% decline in net profit in the quarter ending 31 December 2018, blaming negative influence from its investments in Australia and India.

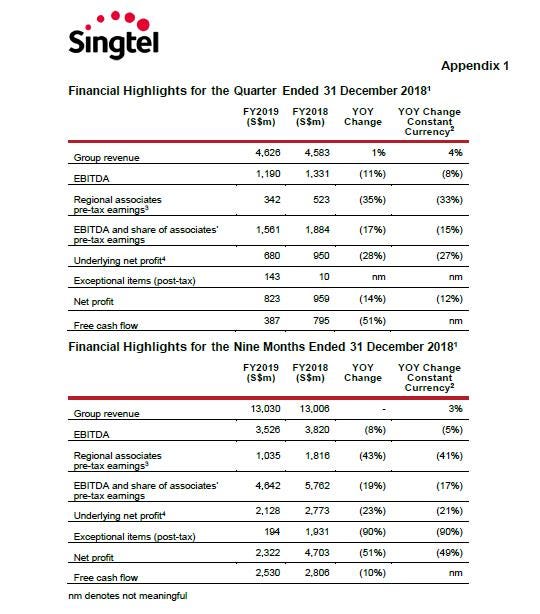

In its quarterly results announcement, SingTel reported a 1% year-on-year growth in revenues to S$ 4.626 billion (1 Singapore $ = 0.74 US$), or 4% in constant currency, but 11% decline in EBITDA, and 14% decline in net profit. The first nine months of FY2019 saw revenues almost unchanged (up by 0.2%) of the same period the previous year, EBITDA down by 8%, and net profit down by 51%. The total free cash flow is still solid at S$2.5 billion although it went down by 10% from a year ago.

“We have stayed the course despite heightened competition and challenging market and economic conditions. We’ve continued to add postpaid mobile customers across our core business in both Singapore and Australia while making positive strides in the ICT and digital space,” said Chua Sock Koong, Singtel Group CEO. “We remain focused on investing in networks and building our digital capabilities – areas that are important to our customers and our future success. We will also step up on managing costs, growing revenues and driving efficiencies through increased digitalisation efforts.”

The key factor that impacted the results was the return on its investment in regional associates. The total profit before tax (PBT) in its regional associate portfolio went down by 35% to S$342 million. The worst hit was Airtel, which suffered a S$167 million decline in PBT and registered a pre-tax loss of S$129 million. When broken down to different markets, Airtel fared better in Africa but came under “continued pricing pressures” (from Jio)

In Australia, SingTel’s subsidiary Optus has delivered a healthy growth of 16% in total revenues to A$1.64 billion (1 Australian $ = 0.71 US$). The mobile operator also switched on Australis’s first commercial 5G network in January. The slower than expected migration to NBN by broadband users, however, has brought in a 9% decline in mass market fixed revenue.

Despite lowering its outlook for the full financial year (ending 31 March) from stable EBITDA to single digital decline, SingTel was still confident in its long-term prospective. “Our long-term view on our regional associates remains positive as they continue to ride the growth in data and execute well against the challenges and competition,” added Chua, the CEO. “We expect the regional markets to revert to more sustainable market structures and deliver long-term profitable growth. Meanwhile, we are working closely with them to build a regional ecosystem of digital services that leverages the Group’s strengths and unlocks the value of our joint mobile customer base of over 675 million.”

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)