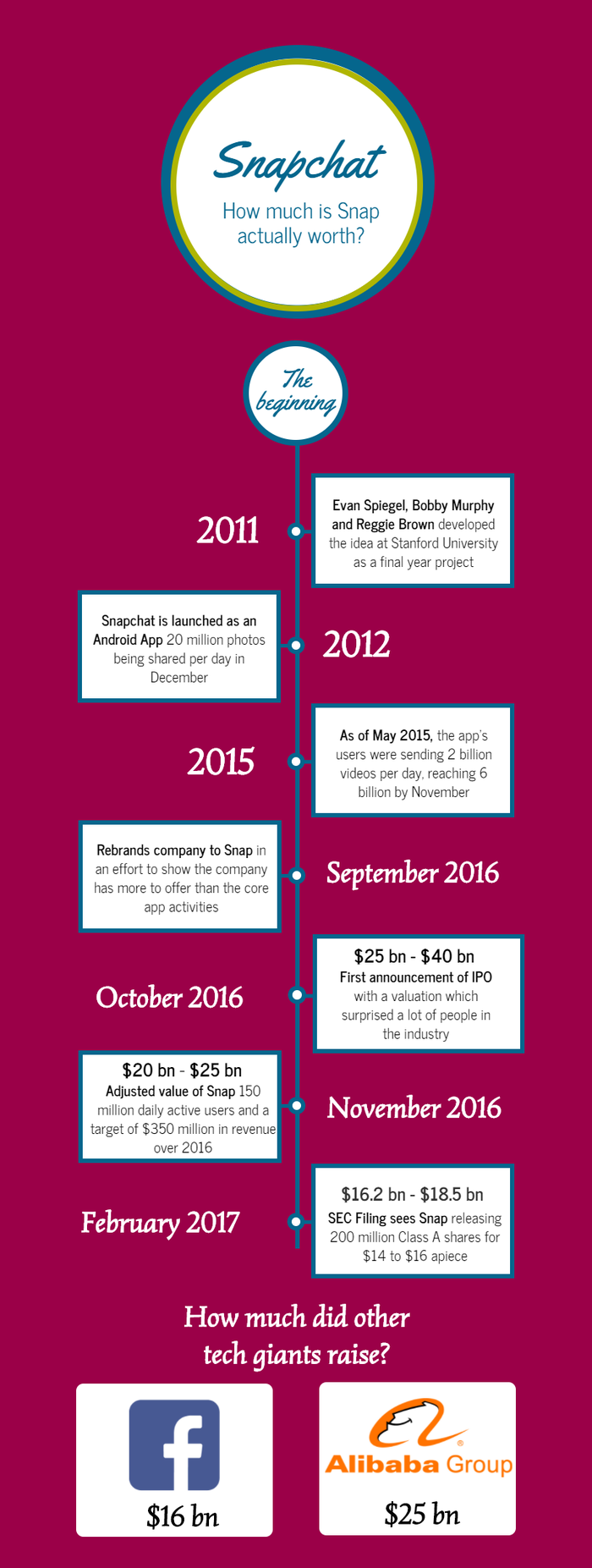

The Snapchat speculative bubble – an infographicThe Snapchat speculative bubble – an infographic

Snap’s most recent filing with the Securities and Exchange Commission, the team are chasing after an IPO which would value the business at $18.5 billion, less than half of its initial ambitions.

February 16, 2017

Snap’s most recent filing with the Securities and Exchange Commission, the team are chasing after an IPO which would value the business at $18.5 billion, roughly half of its initial ambitions.

According to Bloomberg, 200 million shares for $14 to $16 apiece will be made available during the IPO, valuing the organization between $16.2 billion and $18.5 billion. While this is certainly a promising valuation considering the limitations of an app which targets demographics with the attention span of a goldfish, it is less than half of the £40 billion which some sources believed was actually achievable in September.

The intentions to IPO were made clear just after the company rebranded to Snap, in an effort to demonstrate it is more than just a tiresome app with a range of offerings comparable to a wooden table. However, maybe the team now realize this.

The team initially put the IPO forward with the view to achieve an evaluation between $25 billion and $35 billion, though some believed it could be as much as $40 billion. This was then downgraded a couple of weeks later to a range of $20 billion to $25 billion, and its dipped to an ambitious $18.5 billion. We’ve included an infographic at the bottom of the story to help you out.

Let’s look at the facts, user growth was 17.2% in Q2 2016 and was 3.2% in Q4, its slowing down pretty rapidly. The core user demographic is teenagers, an audience which does not traditionally have a huge amount of cash; how attractive this audience will be to advertisers explains modest advertising numbers compared to competitors such as Facebook.

Snap does seem to appreciate its initial ambitions were ridiculous, hence the reduction as we get closer to the IPO date (March 2), but there is still a sneaking suspicion the team will be disappointed. Irrelevant of events over the next month, your correspondent has a suspicion this business may head the same direction as Twitter unless something is done quickly.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)