Three UK has a great 5G opportunity but needs to do some growing up first

Three is positioning itself to fully exploit the 5G opportunity, but you have to wonder whether it can deliver the high standards it is setting itself by just repeating what it has always done.

July 2, 2019

Three is positioning itself to fully exploit the 5G opportunity, but you have to wonder whether it can deliver the high standards it is setting itself by just repeating what it has always done.

“We are going to take 5G by storm, we believe it is ours to own,” said Shadi Halliwell, CMO of Three UK, at a London briefing this week.

There is certainly an element of truth to this statement; the UK connectivity market has pleasantly evolved into the environment which will allow Three to flourish. Data is king as we head towards 5G and with the on-going challenges in delivering broadband which meets consumer expectations, the conditions are ripe for disruption.

Three has always sold itself as a brand designed for the data-intensive consumer and this is the promise of 5G for the moment. Without Release 16 from the 3GPP, 5G is little more than upgraded 4G, but this won’t matter for Three. The brand proposition is already well established and 5G allows the team to double-down on this position.

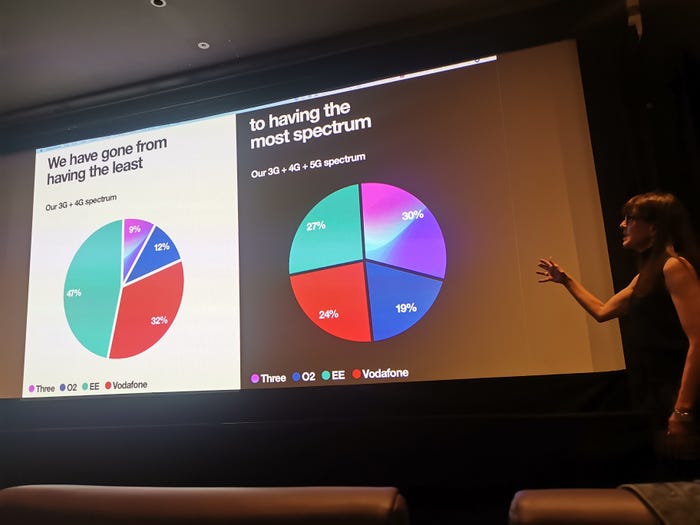

There are a lot of other factors which will help the team here also. The telcos has never been shy about hyping its contiguous 100 MHz of spectrum, or that it is has a greater horde of assets than its competitors. Being late to market also might help, taking a bigger picture approach than rivals seeking to win the ‘first’ tagline.

But if Three is going to be a serious competitor, it has to evolve its image.

Chasing after the data-intensive consumers is all well and good, but this is only one segment. Presenting itself as a challenger to the status quo is all well and good, but it doesn’t create a sense of robustness and heritage. Colourful marketing campaigns and undermining competitors with cheeky messaging is all well and good, but it doesn’t appeal to more conservative consumers.

If Three wants to compete with the big boys of the UK telco industry it has to present itself as a brand which is robust, dependable, reliable, competitive, consistent, mature and creative. It might be ticking a few of these boxes at the moment, but not all of them. And until it ticks more, it will remain a brand with a niche appeal.

In the UK, we like quirky, we like imagination and we like the underdog, but only to a certain degree. We also like brands we can trust and rely upon, especially when we are going to be paying for a service which is increasingly dominating more aspects of our lives. We’re conservative, especially when dealing with money.

At the moment, Three is like that mate you like going to the pub with. He’s fun, adventurous and there will never be a dull moment as you set the world to right. However, the other telcos are dependable friends which you can go to with real-world problems. When it comes to spending money, most UK consumers will want to side with the dependable friend.

This is evident in the market share statistics over the last couple of years, which have remained largely static. Using Ovum’s WCIS, O2 leads the UK for mobile subscriptions with 36%, EE sits in second with 33% and Vodafone holds 20%. Three is in a distant fourth with 11% market share of mobile subscriptions in the UK.

Three has created an interesting brand identity, and it has worked in attracting some customers, but this is a niche. If Three wants to steal subscriptions from its competitors, it has to be more than a plucky outsider, it has to grow up and evolve its offering.

This is not to say Three does not have an excellent opportunity.

As mentioned above, 5G is going to encourage consumers to use more data than ever before. This will be the case over the coming months, and these trends will gather momentum as designed-for-5G services and applications emerge. Three is in a good position here, both in terms of the brand heritage and the spectrum assets it controls.

What is also worth noting is the focus is not only on 5G. Three is refarming huge swathes of 3G spectrum into 4G and a £2 billion investment in the network will also help 4G speeds improve across the country. However, with this article focusing on 5G, you can see from the image below the telco is certainly creating a more stable foundation to grow in the future.

The constant issues with broadband has created an environment which is ripe for disruption. Just look at the progress alt-nets are making in the fixed world. With its UK Broadband acquisition, Three can offer FWA solutions to broaden the portfolio of services it can offer customers.

Looking at the FWA offering, there is a great opportunity for Three to enter the world of convergence. If priced correctly and the right data allowances offered, bundled FWA and mobile contracts could challenge BT in its pursuit of providing a seamless connectivity experience everywhere and anywhere.

Perhaps the most interesting aspect of this product is the plug-and-play nature. In theory, customers should be able to open the box, plug in the router and away it goes. No more waiting for engineers, it’s the simplicity which will sell it. A beta test is underway in Camden to ensure the reality of plug-and-play lives up to the promise, but this is a very interesting approach.

And finally, onto pricing. Being last to market offers Three a chance to see what rivals are going to charge. Yes, the rivals might be able to attract early adopters, but undercutting competitors on price could work very well, especially as 5G enters the mainstream. Both EE and Vodafone have unveiled very expensive tariffs, so it will be interesting to see how Three approaches this dilemma.

The new text-to-switch initiative from Ofcom will also help here. No-longer will customers have to endure the painful process of hopping around a call centre to cancel a contract, it is now (theoretically) a simple SMS.

Three does have a genuine opportunity to make substantial headway in the 5G era, but it needs to evolve its image and offering. Albert Einstein once said ‘the definition of insanity is doing the same thing over and over again but expecting different results’; if Three’s approach to 5G is the same as 4G, it might make gains, but it would not be a surprise to see the competitive landscape in the UK remain the same.

We would not like Three to ditch the image which has created, it clearly works with some demographics, but it needs to have more than one string to the bow if it is going to improve on an 11% market share.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)