Watershed moment: should mobile operators be worried we talk less?

A new report from Ofcom claims users in the UK spoke 2.5 billion minutes less on their mobile phones, down by 1.7% in 2017, the first such decline in history.

August 2, 2018

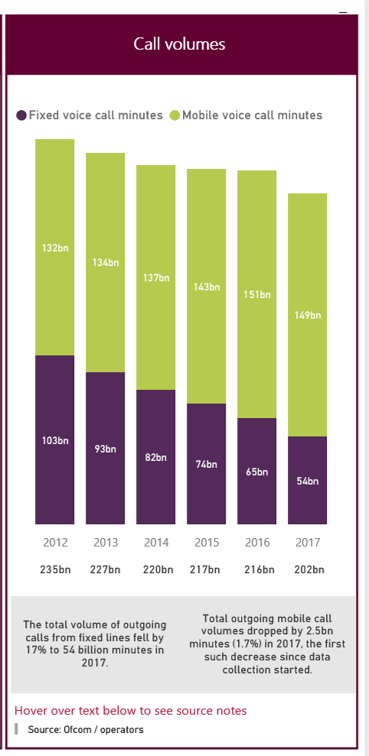

A new report from Ofcom claims users in the UK spoke 2.5 billion minutes less on their mobile phones, down by 1.7% in 2017, the first such decline in history.

This followed the trend total talking time by the UK population has been declining over several years, primarily mainly driven by the sharp drop in minutes spent on fixed line phones. The combined talking time also suffered the sharpest drop in years, at more than 6%. See the chart from Ofcom’s The Communications Market 2018 report (p.17) below.

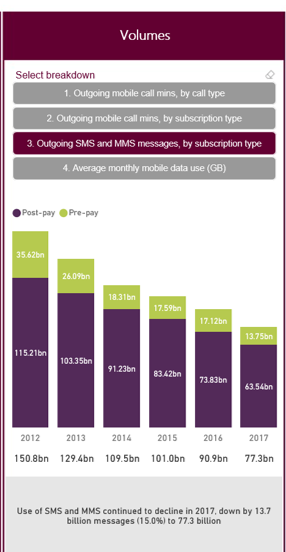

In some ways mobile operators should be concerned. After OTT messaging services (WhatsApp, Viber, WeChat, etc.) destroyed the text message cash cow, it looks they are also losing another revenue stream, the voice call.

However it does not necessarily mean we speak less. Some simply move the calls into other apps, especially when we need to speak to people overseas, more than one people at the same time, or when we like to combine video with audio. Group video call features from WhatsApp or Skype and others come handy.

Operators’ response is not too dissimilar to the one when they tried to fend off the OTT messaging services. After throwing in unlimited number of text messages to typical packages, they now often throw in unlimited minutes. However this does not look to have reverted the trend of fewer minutes spent on voice calls, just like the unlimited text message offers have not reverted the decline in SMS and MMS (p.20).

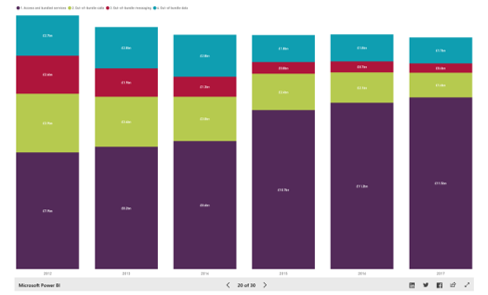

The experience of messaging apps may be superior when handling rich features, but it needs internet connection, and it consumes data, which is exactly what operators are working hard to monetise. Some choose to offer bigger data buckets at a higher price, while others bundled with value-added services, for example video streaming. The result shows people do pick up higher packages. The total mobile retail revenues dropped by 1.3% from 2016, but revenues from mobile packages grew by nearly 3%, while revenues from out-of-bundle data near held. The biggest drop occurred in out-of-bundle voice. It seems for most people the bundled voice was already more than enough.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)