Samsung smartphone recovery overshadowed by semiconductor gloom

Samsung's Q3 2019 numbers show improved performance in the smartphone business, but the semiconductor sector remains weak, which contributed to the 56% decrease in corporate level operating profit.

October 31, 2019

Samsung’s Q3 2019 numbers show improved performance in the smartphone business, but the semiconductor sector remains weak, which contributed to the 56% decrease in corporate level operating profit.

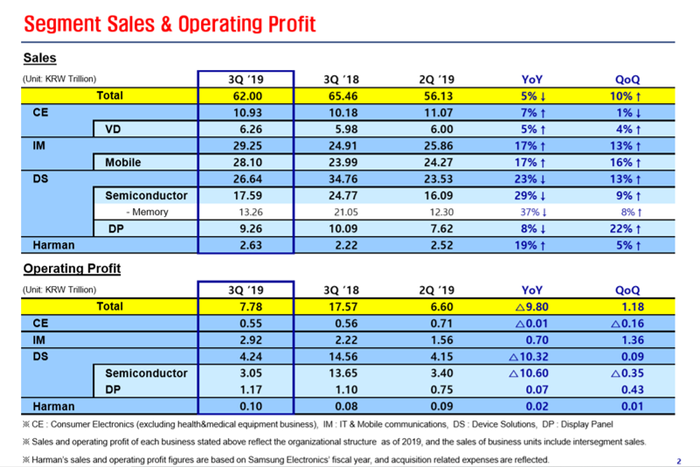

Overall the company has delivered sequential improvement over Q2. Total revenues stood at KRW 62 trillion ($53 billion), representing a 10% QoQ improvement despite being 5% lower than the same quarter a year ago. The corporate level operating profit of KRW 7.78 trillion ($6.7 billion) was 56% lower than a year ago, albeit registering a growth of 18% over the previous quarter.

The IT & Mobile communications group, which includes the smartphone and mobile network businesses, now the biggest revenue generator of the company, delivered the strongest recovery. Total income from mobile handsets, predominantly smartphones, amounted to KRW 28.1 trillion ($24 billion), a 17% increase over a year ago, and 16% over last quarter.

More impressive was the profit growth: operating profit at the business group level grew by 31.5% year-on-year, and 87% quarter-on-quarter. The company attributed the profit improvement to “a product mix improvement and cost reduction after a lineup transition” including contributing from the new phablet Note 10 as well as the entry level A series. The “extended technology leadership via launch of Galaxy Fold and additional 5G models” also helped. At the last IFA show in September Samsung announced it had already shipped 2 million 5G phones and expected the volume to exceed 4 million by the end of 2019. Samsung is believed to have increased its smartphone market share to 21%, retaining the global leadership.

In contrast to the smartphone business’s recovery was the continued depressed performance of the Device Solutions group, which includes the semiconductors and display panel businesses, and is by far Samsung’s biggest profit generator. To illustrate the importance of this group to Samsung’s overall performance, the group level revenue, KRW 26.64 trillion ($23 billion), represented 43% of the company’s total revenue, but the operating profit, KRW 4.24 trillion ($3.6 billion), accounted for 55% of the total operating profit of Samsung Electronics, at a 16% operating margin. In comparison, the IT & Mobile group’s operating margin was at less than 10%.

The memory chip sector was particularly weak, where the revenues went down by 37% from a year ago to reach $13.26 trillion ($11 billion) although it was an 8% improvement from last quarter. The operating profit collapsed to KRW 3.05 trillion ($2.6 billion), a mere 22% of the level a year ago, and also more than 10% drop from an already weak Q2. This indicated increased demand for shipment but at depressed price levels.

Looking at Q4 and 2020, Samsung believes 5G will have a big impact on the company’s performance. It foresees that the profitability of the smartphone business will continue to be a challenge in Q4 “due to weaker mix from dissipating new model effects of Note 10 and increased marketing cost under strong seasonality”. For 2020 this group will “enhance competitiveness throughout entire lineup and by addressing growing 5G demand; strengthen foundation for further sales growth, mainly driven by foldable; expand sales of premium models and optimize operations for low-end to mid-range models to improve profitability.”

For the semiconductor sector, Samsung expects the demand for memory chips to be solid in Q4 as clients are replenishing inventory again, although it does note “uncertainties likely to linger due to issues in the external environment.” The system large-scale integration (S.LSI) business expects growth in “shipments of 5G 1-Chip SoC and 64Mp & 108Mp high-resolution image sensors”.

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)