MTS delivers solid Q1 but provides cautious outlook

Russian operator MTS saw revenues grow 9% in Q1 but believes the whole-year performance is likely to be flat.

May 27, 2020

Russian operator MTS saw revenues grow 9% in Q1 but believes the whole-year performance is likely to be flat.

MTS has delivered a financially solid Q1 with a total revenue of RUB 119.6 billion ($1.7 billion), up by 8.9% year-on-year. The company’s OIBDA grew by 1.6% to RUB 51.5 billion ($730 million), while net profit improved 0.8% to RUB 17.7 billion ($250 million) compared to the same period of 2019. The strongest growth comes out of its mobile and fixed telecom services, but about half of the top line growth comes from the adjacent businesses, including fintech, digital services, and retail.

“…this is an unprecedented time that is impacting billions of people around the world, including millions of our customers and thousands of our employees,” Alexey Kornya, MTS President and CEO, said during the earnings call. “Connectivity has never been more critical and we are proud to be helping our customers stay in touch with their friends and family as well as colleagues and classmates.

“Overall, I am deeply proud of the MTS team and would like to express my appreciation for their professionalism in this challenging environment. Looking ahead, I am cautiously hopeful for the future, and our strategic focus is clear: supporting our customers today while not losing sight of our goals for tomorrow.”

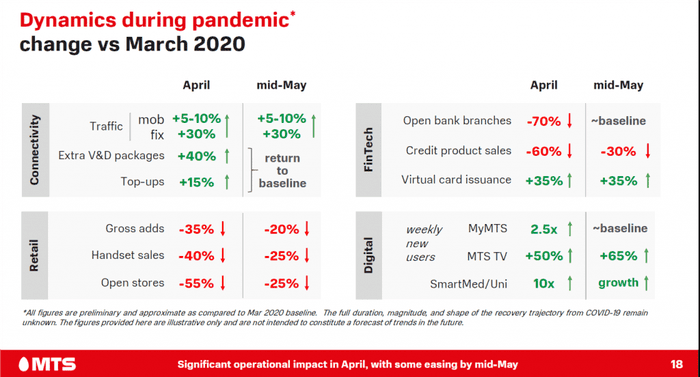

As Russia entered COVID-19 lockdown only at the end of March, its impact was not reflected in the Q1 results. However, MTS does provide a glimpse into the impact on April and the first half of May.

Similar to other operators that have witnessed during COVID-19, MTS has seen increased traffic but a big drop in retail with many shops are closed. Meanwhile, the operator has seen and expects increased digital activities, in communication, media, and in financial product consumption. In mobile, MTS has received the regulatory approval to implement self-registration SIM cards through an app.

“Looking ahead, we plan to prioritize this channel at the key level to lower subscriber acquisition cost,” said Inessa Galaktionova, First VP for Telecommunications. MTS is “also broadening our SIM-based infection tracking across all of our sales channels.”

“Now more than ever, consumers are shifting to digital-first banking from online customer service to virtual cards and contactless payments,” said Andrey Kamensky, VP for Finance, on the earnings call, suggesting there could be greater benefit for MTS.

Looking at the full-year expectations, MTS’s management is more cautious. Citing concerns including reduced number of retail outlets as well as the impact of lockdown on roaming income, the operator projects a 0% to 3% growth in total revenues and -2% to 0% OIBDA move, compared with 2019.

MTS is the latest of telecoms companies to show that the industry has withstood the uncertainties from COVID-19 well enough especially when it comes to coping with surging traffic, but it is certainly not immune to the impact. Factors ranging from reduced retail and roaming income due to lockdown to overall economic weakness are beyond the telecom operators’ control, but have or will have manifested on telecom operators’ quarterly and annual numbers.

Telecoms.com Daily Poll:

Can the sharing economy (ride-sharing, short-stay accommodation etc.) survive COVID-19?

Yes, but transformation is needed (31%, 37 Votes)

No, people will hate the idea of sharing post-coronavirus (21%, 26 Votes)

Yes, but there will be market consolidation (17%, 21 Votes)

Yes, people are still bought in (15%, 18 Votes)

No, regulation will make profits impossible (8%, 10 Votes)

Yes, but not for a very long time (7%, 9 Votes)

Total Voters: 121

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)